Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Monday, January 31, 2022

INDU, COMPQ, SPX, and a Whole Bunch of Interesting Data

Friday, January 28, 2022

SPX Update: Other Than That

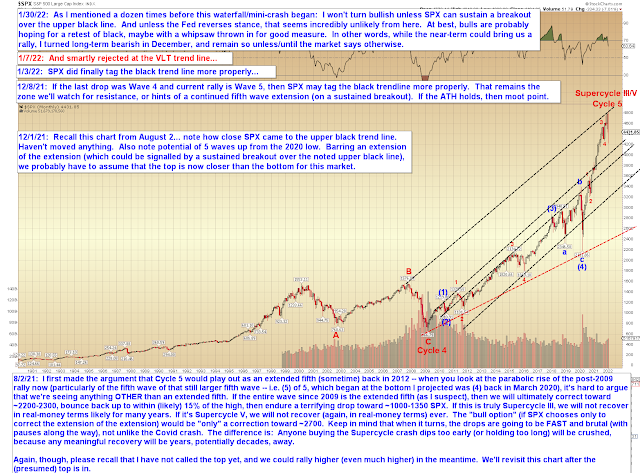

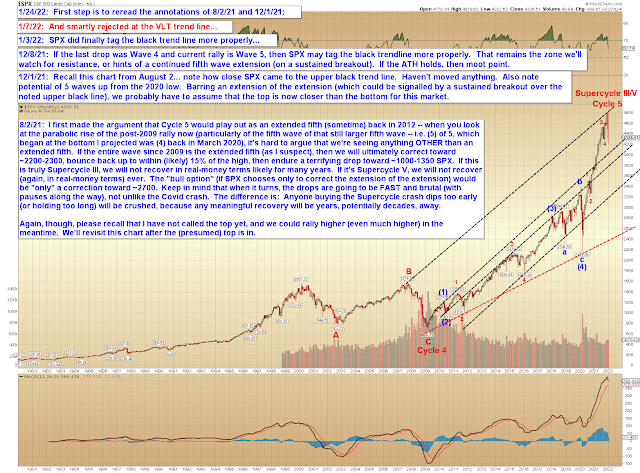

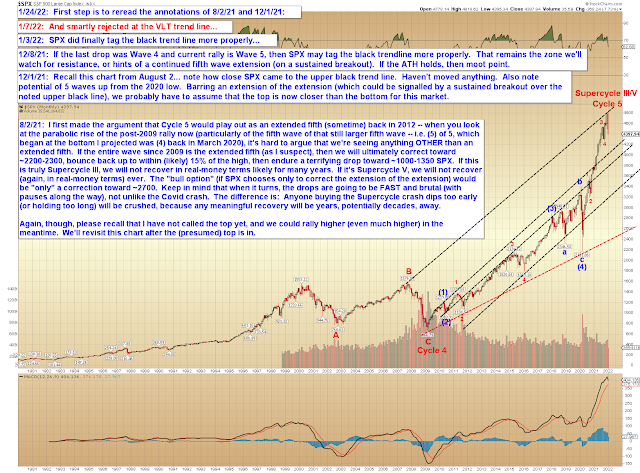

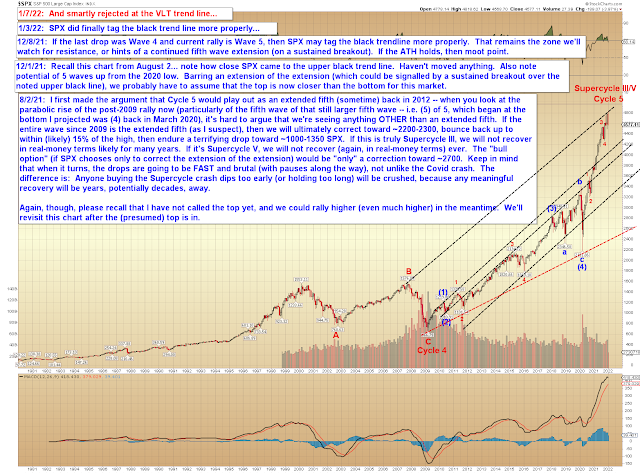

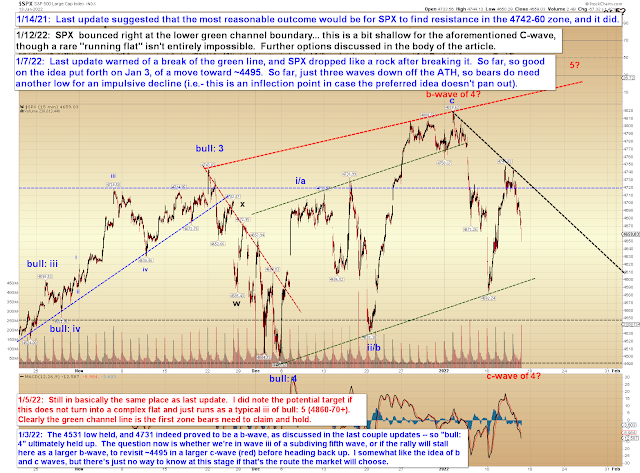

Now, here's the "market point": The Covid crash was a pretty clear fourth wave. That means we have almost-certainly been riding out the fifth wave ever since. And the fifth wave is the final wave of a move -- which, now that we're finally getting into a potentially-complete wave structure, means we're likely approaching the end of the 12+ year bull market.What we're currently trying to nail down is whether the fifth wave of the fifth wave of that larger fifth wave has completed or not.Read that again.As I mentioned last update:

Even if SPX manages to make a new high, that will probably be the fifth wave, and (barring an extension) is thus reasonably likely to be followed by a correction (or worse) anyway.

In other words, even if SPX manages to make a new all-time high, we are probably into territory where we should be considering selling the bounces. Let's look at the near-term chart first, with the emphasis that "bull 5," even if it shows up, could very well be the final high of this 12+ year bull market.

Wednesday, January 26, 2022

SPX, NYA, COMPQ: Big Fed Day

Monday, January 24, 2022

SPX Update: How Soon is Now?

I hold to my view that the top is closer than the bottom (long-term), unless there's a breakout at the very long-term trend line I've mentioned repeatedly over the past few weeks. That trend line will remain as the first litmus test where I might question my current thesis:

We then tagged that line a few weeks ago, failed to break out (and reversed), immediately began looking for a trip south of ~4495, and the rest has been history so far.

Friday, January 21, 2022

SPX Update: 4495 Target Captured: ~300 Points of Profit to Begin 2022

Tuesday, January 18, 2022

SPX Update: 100% on the Year

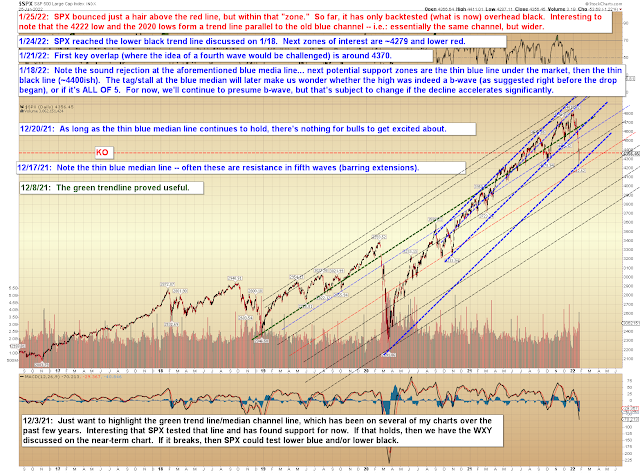

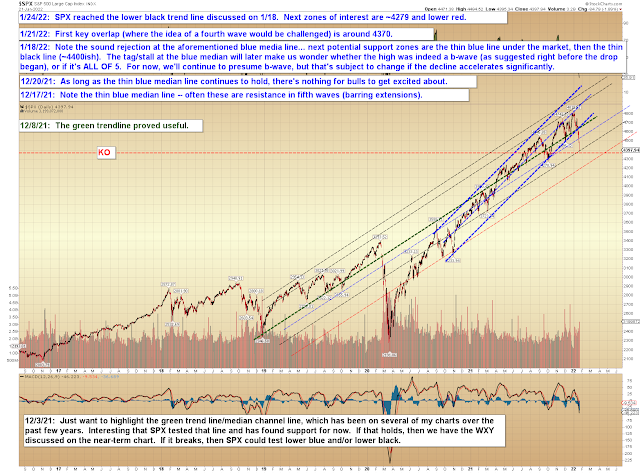

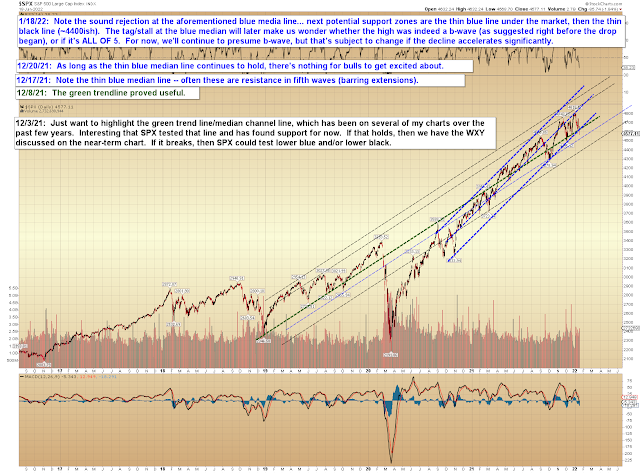

On January 3, I mentioned that I liked the idea of a nearly-immediate top, which would then lead to a c-wave decline below ~4495 -- and while that probably seemed a little crazy at the time, it doesn't seem so crazy anymore, as (at the time of this writing), futures are down at total of about 270 points from the January 4 high, getting very close to the ~4495 target zone.

More recently, the last two updates discussed the near-term count I was leaning toward, as follows:

The low is a micro b-wave, which could run toward SPX 4742-60 in a micro c-wave, before reversing back to break Monday's low [4582].

And this lean, too, was a hit, as SPX broke "Monday's low" of 4592 during yesterday's session.

Accordingly, there's not too much to add to this year's updates, except to note the following (discussion on the intermediate-term chart below):

Similar notes on the near-term chart:

And no update needed to the long-term chart:

In conclusion, SPX continues to be "so far, so good" on following the path I laid out on the first trading day of the year. The main question we'll face next is whether the decline will remain a c-wave at the discussed degree and thus find support (at least in the foreseeable future) and bounce to a new (potentially final) all-time high, or if it will instead turn into something more ominous. Trade safe.

Friday, January 14, 2022

SPX Update

I think if I had to pick one, I'd probably lean very, very SLIGHTLY toward option 2, as of this exact moment.

2. The low is a micro b-wave, which could run toward SPX 4742-60 in a micro c-wave, before reversing back to break Monday's low.

And again, "so far, so good." SPX found solid resistance in the noted zone, leading to a reversal and drop that will exceed 100 points.

Of course, bears will want to be cautious as we head lower into prior support (it is still three waves down from 4748), and of course would want to be extremely cautious were SPX to sustain a breakout over upper black and particularly over 4749.

Obviously, the 4742-60 resistance zone discussed in last update has at least been good for a solid trade, so other than that, not much to add. Trade safe.