"No one will ever fix the problems in the system -- the overspending, the waste, the ever-increasing debt, the free money, the corruption, etc. -- because it will cause too much short-term pain to fix those problems. Consequently, politicians will always kick the can down the road, and nothing will ever change. At least, not until it all collapses in on itself."

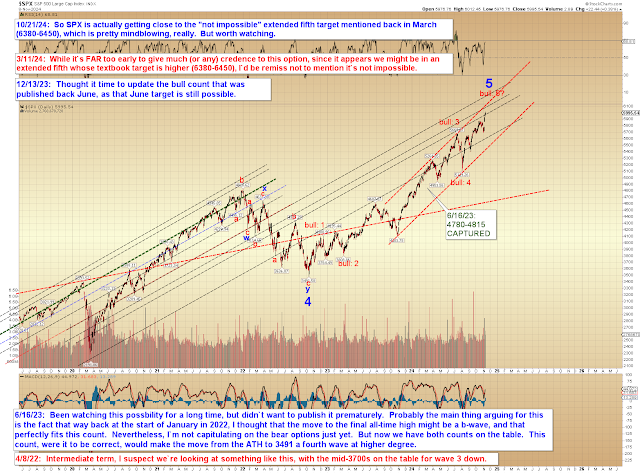

Anyway, I got to thinking about all this because my long-term count has us approaching the end of Cycle Wave 5 -- and the end of Cycle 5 marks the end of a higher degree Supercycle Wave. And the end of Supercycle rallies is a huge deal. It's world changing. By my count, even the Great Depression was only at Cycle degree. Imagine something an order of magnitude worse, and you have Supercycle degree. I don't think we're there yet (I actually have the year 2025+/- as the window).

The year 2025. Next year. When, as we now know, the first-ever genuine attempt to correct our past excesses seems set to begin.

If we make some assumptions, such as the assumption that a sizeable portion of the liquidity and "economic activity" supporting the current market is BS and the assumption that this will be eliminated: What happens if that goes away forever? How long might it take to get back to current levels in the market without all the BS driving it and/or bailing it out if it collapsed? Would it take long enough to call the peak of that hubris a Supercycle Top?

The final question is: Do VOTERS have the will to ride this out? Everyone's very excited now, of course, but how excited will they be if the elimination of The Government Department of Departmenting for the Government causes the National Highway System not to pave a road leading to nowhere, which causes the paving company not to need a large order of widgets, which causes Widget Wonderland not to generate the sales it had grown accustomed to (under the old wasteful system) and causes it to go under, which causes them (the ma and pop voters) to not get the job painting all the local Widget Wonderlands fluorescent pink, which causes their paint company to go under, drowning in 1,198 gallons of hot pink paint?

What happens in midterm elections if that's the state of the Union in 2026 and the economy is in recession? In that case, do midterm elections upset the power dynamic, leaving the job of fixing our excesses halfway done and permanently stuck in some weird state where things are both wasteful and useless?

Who knows? Point is: There are a lot of unknown variables here. Things could turn out spectacularly -- or not. Or, things could turn out spectacularly in the end, with a lot of pain in the middle (this seems like the most likely outcome). Or I guess (though it seems less likely) we could just sail through major changes with minor bumps along the way and the market could rally to a million. Or -- and this is probably the final possibility, though again, seems less likely given the rhetoric -- nothing much happens and it's just business as usual.

All of which means: This is a high variance situation with potential for high kurtosis, and the market doesn't seem to have given enough thought to any of it so far. Maybe it will soon. Trade safe.