Well, most of us made it past Friday the 13th without getting attacked by men in hockey masks, though it seems former President Trump had another close call. Considering that prior to July 13, America hadn't seen an assassination attempt on a President or former President for 43 years, it's pretty noteworthy that there have been two attempts on Trump in as many months. Let's hope people calm down.

The market has run back up to its prior resistance zone:

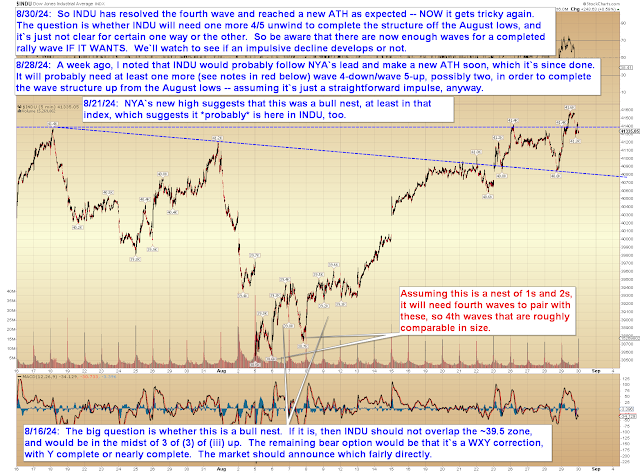

INDU is in a similar spot:

Not much else to add to recent updates. We'll see if bears offer any pushback here or not. Trade safe.