Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Tuesday, August 27, 2024

SPX and INDU: Getting Closer

Monday, August 26, 2024

SPX and INDU: From the Dark Depths of Jackson Hole

Thursday, August 22, 2024

SPX Update: Time for The BLS to Remove The "L"

So, the big news since last update is that the BLS (Bureau of Laughable Stupidity) "overestimated" the yearly jobs number by 818,000 jobs. So instead of yearly job creation being 2.9 million, it was 2.1 million -- an overestimation of nearly 40%, which would get the BLS fired from the private sector. This is the biggest yearly revision to the NFP number since the Great Recession, a time when everything was in complete chaos.

Many pundits believe this will give Jerome "the Gnome" Powell the reasons he needs to justify a discussion about cutting interest rates during his Jack's Son Whole speech today (10 a.m. sharp, coat and tie encouraged, but cut-off jeans and t-shirts okay). The only question pundits have is whether he'll decide to cut rates by 25 or 50 bps next month.

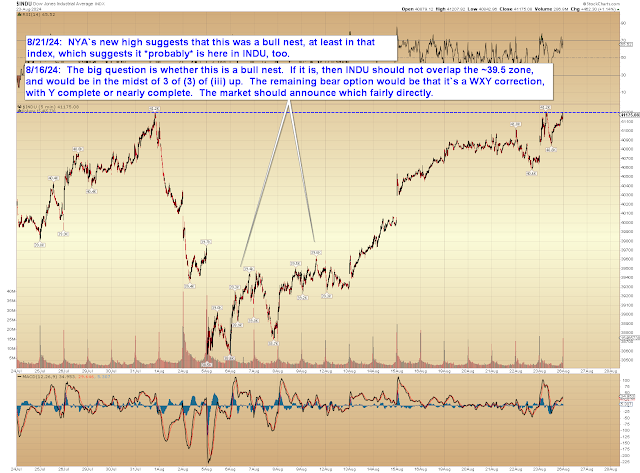

Chart-wise, still not a lot to add, but bears are back into a price zone where they do have an option (classic 3-3-5 flats of the "non-expanded" variety need to retrace 90% before they can work, so this wasn't an option at lower prices), even if it appears to be the underdog at the moment:

Not much else to add today, Powell's speech will probably set the tone for today's session. Trade safe.