Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, October 27, 2023

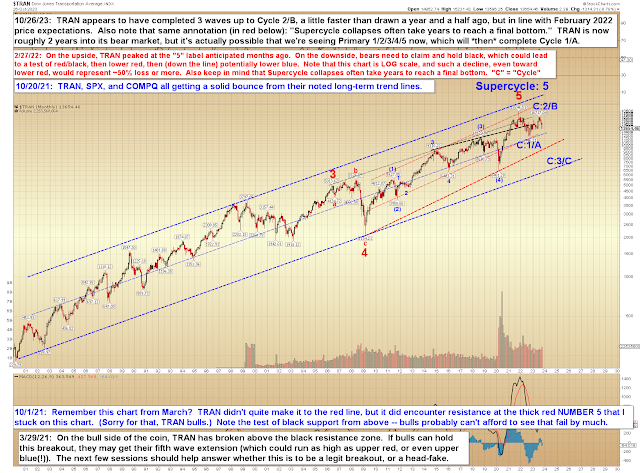

TRAN, SPX, COMPQ: Now Entering "Bounce or Break" Territory

Tuesday, October 24, 2023

SPX, NYA, COMPQ: Bears Still Getting Things Done

Sunday, October 22, 2023

SPX, COMPQ, Gold: Friday's Update was a Hit

Friday's update concluded with:

Incidentally, if today begins with a little bounce back up over 76, then there's a reasonable chance that the overnight low is a corrective b-wave -- meaning the overnight futures low would be revisited and broken soon after (the overnight low sits down near ~4253 cash equivalent, though this isn't an exact equivalent, so allow a little leeway).

Friday's market found support 3 minutes after the open and bounced up to 76.56, then reversed and dropped below 4253, fulfilling the prediction quoted above. It eventually dropped all the way down to 4223 near the close, so hopefully that was helpful to readers.

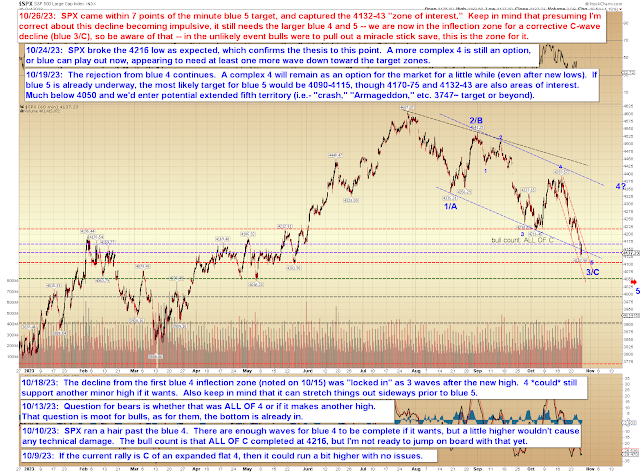

Friday's close is into the zone that constitutes a retest of the prior swing low ("retests" are never to the penny and are plus/minus zones above and below prior lows (or highs)), so we'll see if bulls can muster any sort of bounce from this zone. Keep in mind that the complex 4th wave discussed previously stays on the table plus and minus the current zone:

COMPQ is also testing its low:

I did want to mention that Gold did not sustain a breakdown at its key trend line, and as long as that continues, it will avoid the option of the blue path. The next step for gold bulls would be to attempt to decisively clear the zone around the last three highs.

Finally, the very-long-term chart of SPX remains interesting:

In conclusion, the market traveled, without incident, from the blue 4 inflection all the way down to the zone where it will enter the upper portion of the inflection for a more complex blue 4. I'm not crazy about the idea of a complex fourth, because I think it's too easy on bulls, who ideally should be trapped now -- but it's always possible. How the market behaves over the next week or so may determine if November 2023 becomes known as "Black November" in the future; if it goes directly into a fifth wave, there is potential here for an extended fifth (extended fifths become waterfalls). Trade safe.

Friday, October 20, 2023

SPX, NYA, COMPQ, TLT: On the Right Track

Wednesday, October 18, 2023

SPX and INDU: Blue Velvet

Monday, October 16, 2023

SPX, INDU, COMPQ: Legacy Charts and a Horn Toot

This means that as the music stops and mortgage rates rise, we have a much different dynamic in play this time. Rising rates do, of course, have an impact on future affordability -- but they have no impact on families already in a home (presuming these families have a fixed-rate mortgage, which, as we already covered, the vast majority do). If anything, rising rates might tend to inspire people to hang on to their homes longer instead of putting them up for sale, which would have a tightening effect on inventory. After all, if you're in a mortgage at ~3%, what possible incentive do you have to ever exit that loan with inflation running above or near 8%?As I mentioned earlier, inflation should provide a tailwind for housing -- in more ways than one. If my reasoning above is in the right ballpark, then rising rates may, perhaps counterintuitively, provide impetus for inventory to ultimately balance. Houses might spend more days on market due to fewer buyers, but if fewer homes are being brought to market in the first place because families are incentivized to stay put (or to turn their old 3% mortgage home into a long-term rental), those seemingly-opposed forces could tend to counteract each other.

And, of course, now that my initial prediction has become reality, everyone treats it like it was obvious all along. Below are CNBC's bullet points from a couple months ago; basically exactly what I'd speculated would happen, back in April 2022:

- The recent spike in mortgage rates has created a so-called golden handcuff effect.

- Nearly 82% of homeowners feel “locked-in” by their existing low-rate mortgage, according to data from Realtor.com.

- In the meantime, the shortage of homes for sale is pushing up prices.

Worth noting that in the event of sustained trade below Friday's low, and 4270-90 SPX would be the next meaningful support zone. Trade safe.