Those of you with internet access may have noticed that today's title continues the long-running tradition (two days) of referencing classic 80s songs. Not sure if I'll try this again on Wednesday, but I Just Can't Get Enough, so I will be Right Here Waiting to see If This Is It or not.

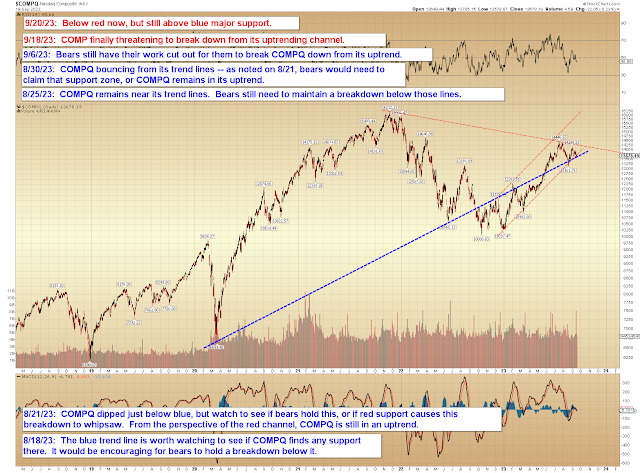

As the title implies, no change from last update, but I did want to bring forward the NYA chart, which I haven't updated in a while, because it's right at rising support. If bulls can't manage any kind of reactionary bounce, then a sustained breakdown here quite likely takes NYA down toward blue 3/C:

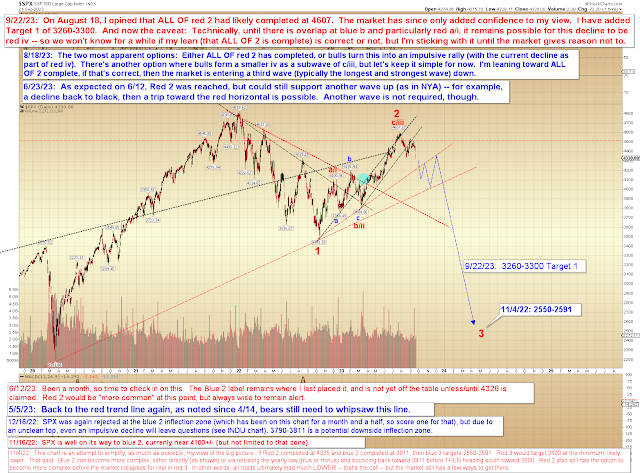

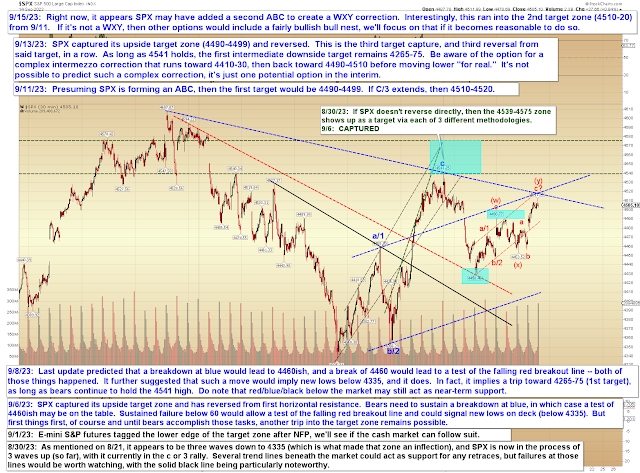

SPX is unchanged:

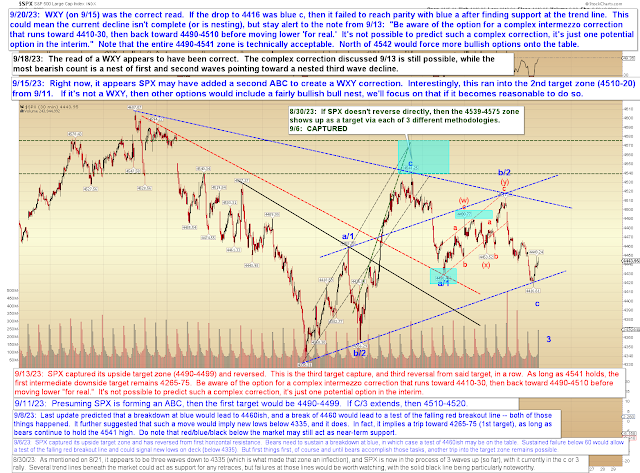

No change to the targets:

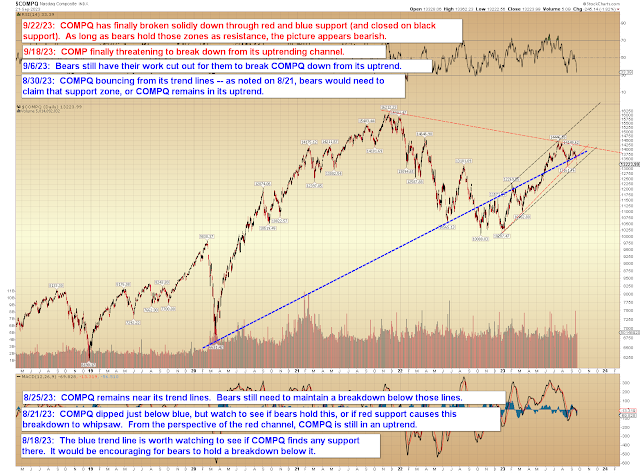

COMPQ still flirting with next support:

In conclusion, no real change to anything. Several market are still sitting at or near theoretical support zones -- if bulls can't manage any kind of reactionary bounce, then that tells us something about the strength (or lack thereof) of the market. Trade safe.