Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, September 8, 2023

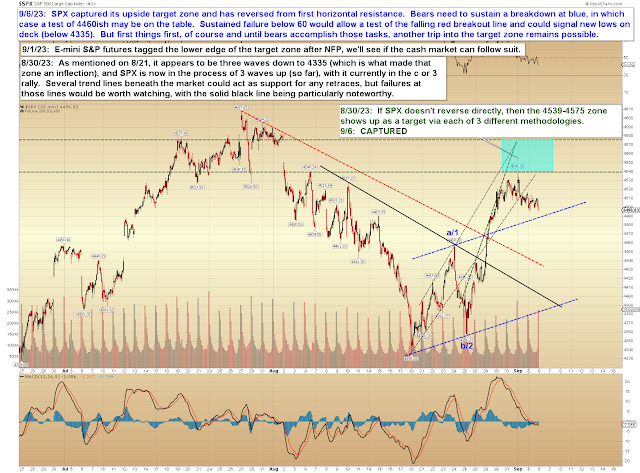

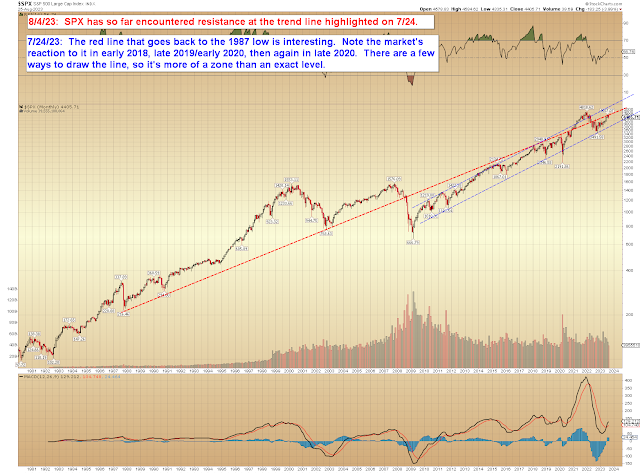

SPX Update: Next Downside Targets Captured

Wednesday, September 6, 2023

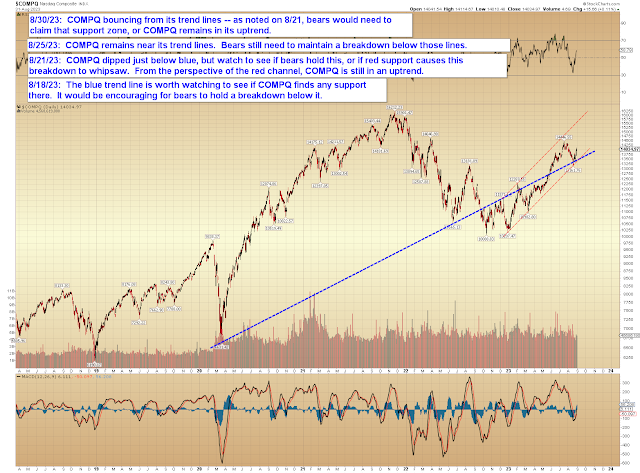

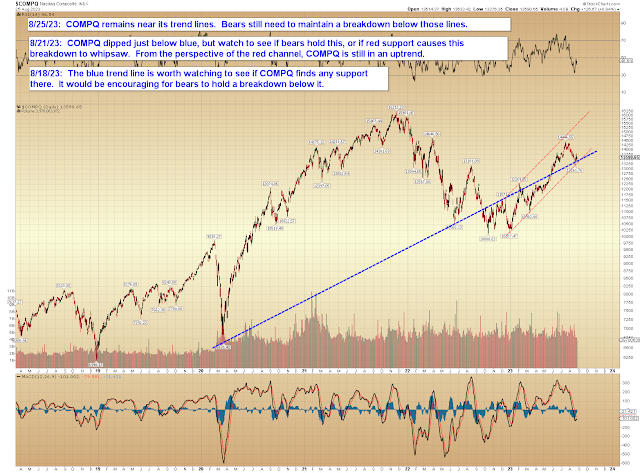

COMPQ and SPX: Upside Target Captured

Friday, September 1, 2023

SPX and COMPQ: Next Upside Target Just Overhead

Wednesday, August 30, 2023

SPX and COMPQ Updates

Monday, August 28, 2023

SPX and COMPQ: Support Still Holding

Friday, August 25, 2023

SPX and COMPQ: Monday's Upside Inflection Target Captured

On Monday, I posted a "keep it simple" chart of SPX (and literally just now realized I uploaded another SPX chart where I was trying to upload NYA -- ah well, irrelevant) and discussed an option for SPX to rally back up to test a confluence that had caught my eye. It did test that confluence, and was then strongly rejected:

COMPQ can also run into trouble if it sustains a breakdown below support and its recent low:

In conclusion, we can see that several major markets are implying the potential for big trouble on sustained breakdowns of support. Now it's really just up to bears to make it happen. And I suspect they ultimately will -- but as noted Monday, I do have to respect the potential inflection at the recent lows, which means that, despite my lean here, it's certainly not impossible for bulls to pull out a stick save and we should stay nimble accordingly. Trade safe.

Wednesday, August 23, 2023

SPX, COMPQ Updates

Monday's update suggested that the market had reached an inflection zone, which meant a larger bounce was possible. We did get some upside follow through, but then Tuesday retraced much of it. We can see SPX's low came at a very old trend line, so that's going to be the next zone bears need:

We discussed COMPQ's trend line on Monday, and while it's not as old, the implications are similar:

Finally, SPX's "keep it simple" chart below. SPX made it back into the red channel, but it's entirely possible that completed a three-wave rally, so bulls will need to clear Monday's high:

In conclusion, there are enough waves up from Friday's low to mark a complete corrective rally if the market wants, which means the upside level is fairly clear. On the downside, there are multiple trend lines crossing Friday's low, so that level is even more significant (though, if it fails, always watch out for whipsaws and sudden snap-backs on the first breakdown, before the "real" move begins). Trade safe.