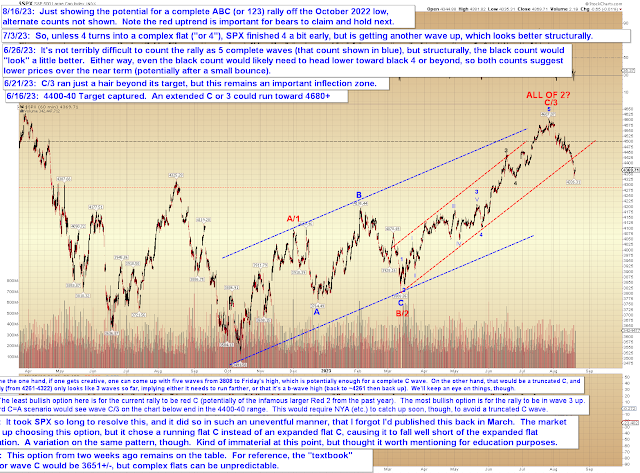

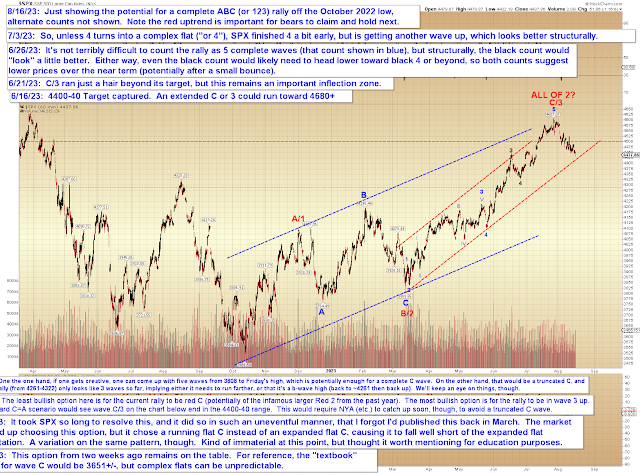

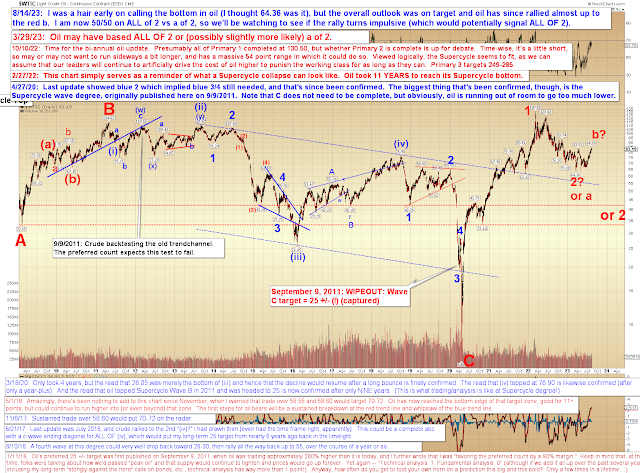

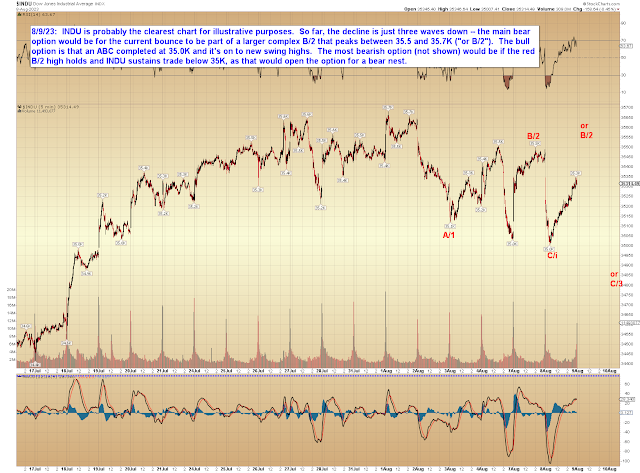

There are a million ways to count the decline from this year's high, but in my opinion, it's now three large waves down (recall that three large waves down means two smaller impulsive waves connected by a corrective wave) -- the question is whether those three waves are complete yet (and it's terribly unclear; they could be, or not. Neither would surprise me here.). If they are, then a larger bounce would be in the cards now (see chart below).

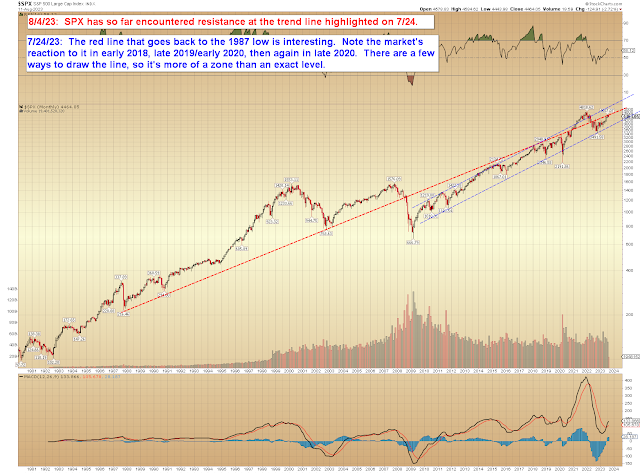

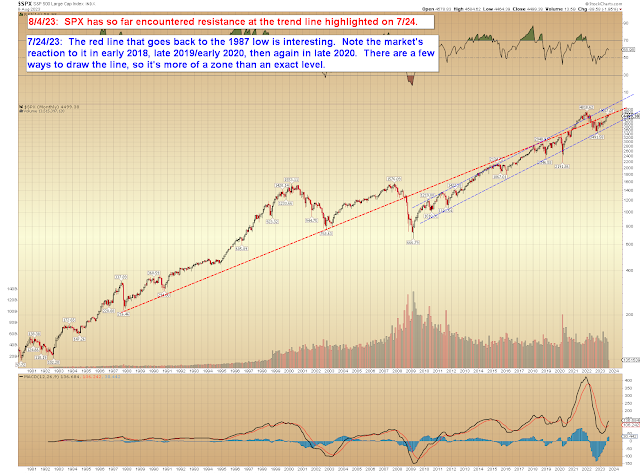

The next question will be whether those three waves can go on to form a still-larger impulse down, which would in turn more strongly suggest an intermediate decline. But let's not get too far ahead of things yet, as "the evil of the day" is sufficient to wrestle with for now. Accordingly, I've tried to create something of an "all in one" chart with a focus on clarity for SPX:

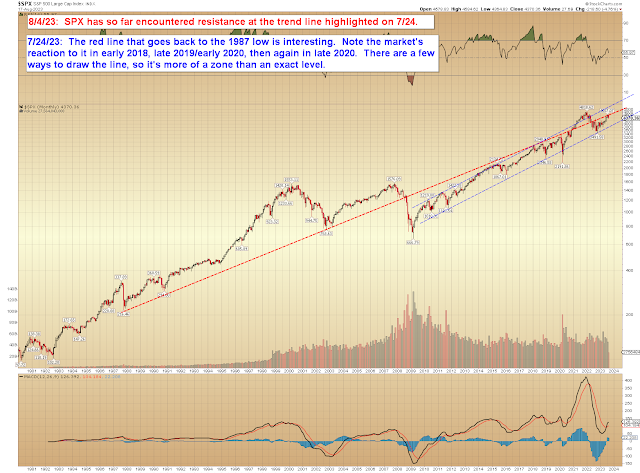

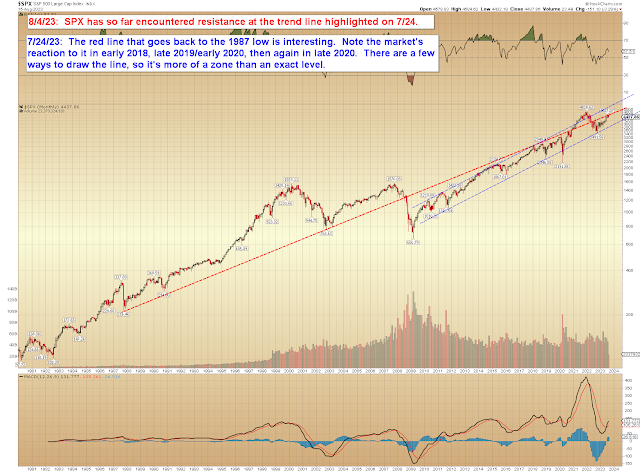

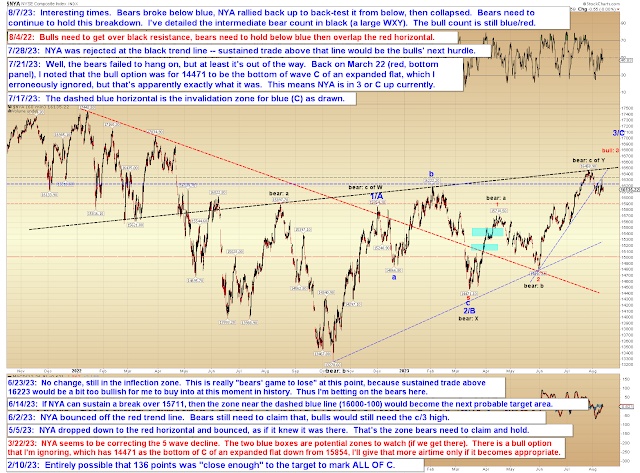

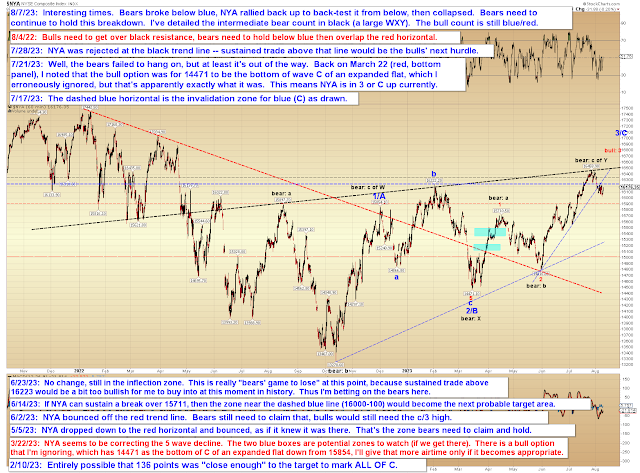

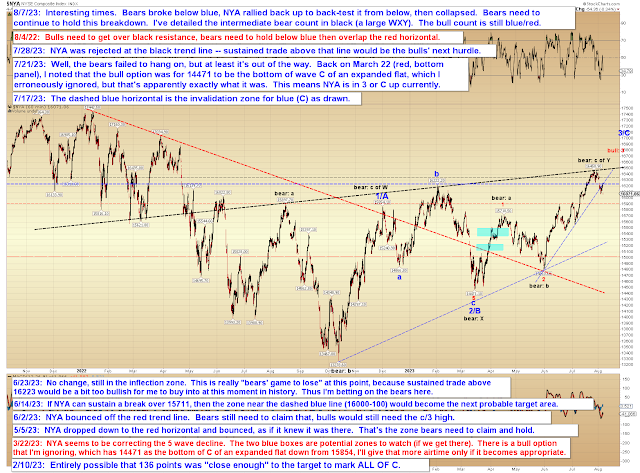

An interesting companion to that chart would be NYA. In the event NYA wanted to back test its broken red trend line, we can see how that would align nicely with a test of the confluence on the SPX chart above. Of course, that's not a "guarantee" that the market will go that route, just something that would display some consistency across markets if it did:

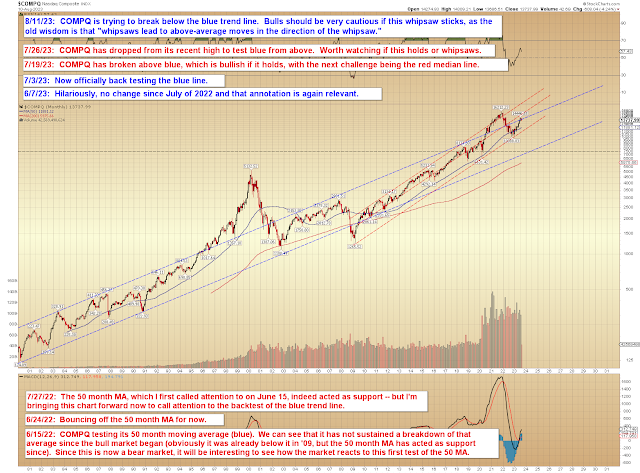

Finally, COMPQ dipped below support, but bulls can still salvage things if they act quickly:

In conclusion, we're into an inflection zone down toward the SPX 4300 (+/-) zone, so we'll see how the market reacts here. Again, in the event bulls can't pull things together soon, then things can get slippery to the downside. Trade safe.