Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, July 19, 2023

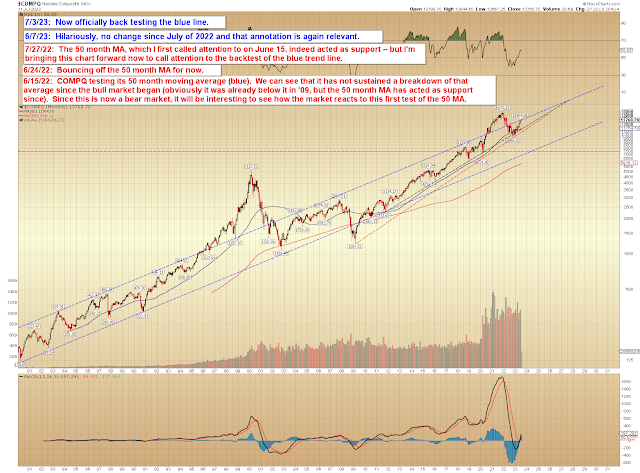

COMPQ, NYA, BKX Updates

Monday, July 17, 2023

NYA Update: How to Solve a Tropical Storm

Friday, July 14, 2023

SPX, NYA, BKX: It's a Mad Mad Mad Mad World (or whatever)

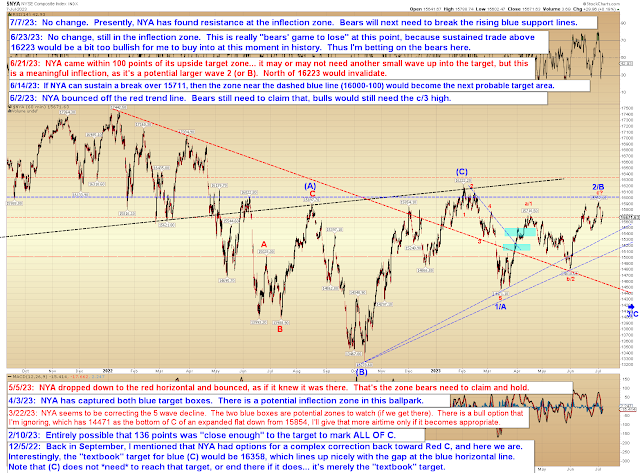

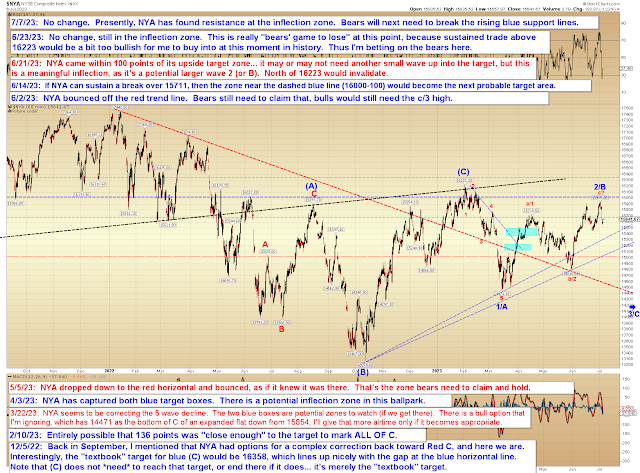

The market continues to defy bears (and reality) and head higher. Bears haven't run out of real estate just yet, but NYA is getting close, and bears need to show up soon if they want to prevent a breakout:

I haven't updated BKX in a few months, and this seems like a good time to do so:

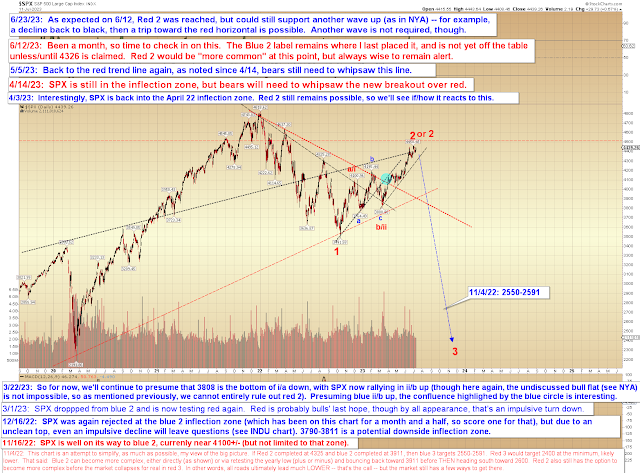

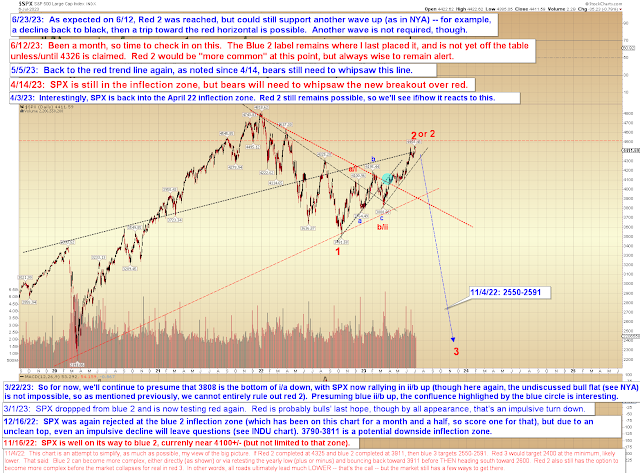

The SPX "immediate" bear count will come under fire if NYA breaks out:

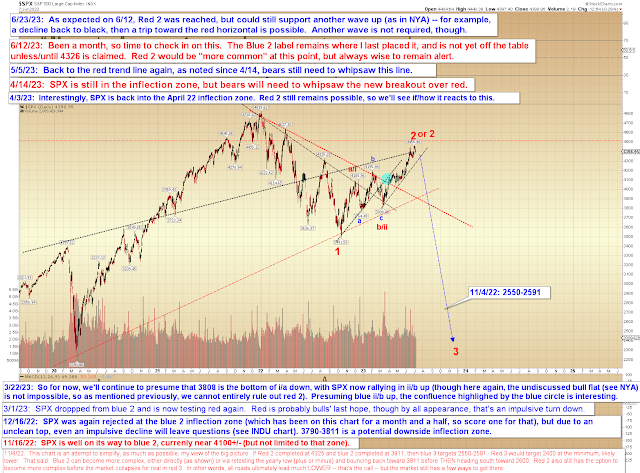

And the SPX bull count, which would also function as another version of the bear count (with both the bull and bear options being in agreement for a time; see annotation):

In conclusion, still waiting on NYA to either reverse or break out in order to clear the air. Trade safe.

Wednesday, July 12, 2023

SPX, COMPQ, NYA: Party Like It's 2020

Monday, July 10, 2023

SPX, NYA, COMPQ: The Eye of the Storm

[A]s I've stated previously, unless and until NYA breaks out over its blue (C) high, I'm continuing to give bears the benefit of the doubt. While there are several near-term options, if NYA is to hold its key high, then there's just not a lot of room for bulls to run much higher. If I'm wrong, then I'm wrong, but right now, this makes more sense to me than the bull alternative.