Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, July 5, 2023

SPX, NYA, COMPQ: Second Verse, Same as the First

Monday, July 3, 2023

SPX, NYA, COMPQ: Back Test

Friday, June 30, 2023

SPX and NYA Updates

Wednesday, June 28, 2023

SPX and NYA Updates

Monday, June 26, 2023

SPX and NYA: Big Picture and Near-term Counts for this Major Inflection Zone

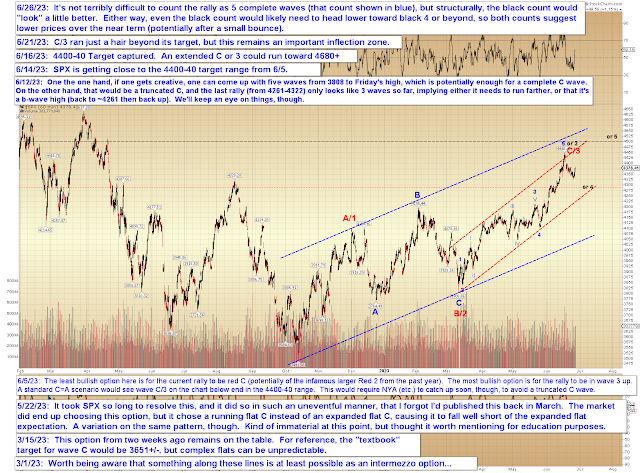

Last update I outlined some of the reasons I'm still betting on the bears for the bigger picture, so today we'll do a deeper dive into the near term.

Before we do that, though, let's look again at where we seem to be at the intermediate level, starting with NYA (no change from recent updates):

SPX:

And now, the near term. It doesn't require any creative counting to come up with five complete waves, but the overall structure would "look" a bit better with one more high:

In conclusion, SPX and NYA have both stalled at the lower edges of their respective inflection zones -- and again, these are not minor inflection zones, these are major inflections with significant downside potential if they generate a turn (which I am currently presuming they will). Both markets appear to need at least a bit more downside (potentially after a bounce in 2/B up), so we'll be watching that closely to see if it exceeds what might be expected for a fourth wave (black 4 on the final chart). If this is a fourth wave, then the market has some wiggle room to head a little higher afterwards, back into the higher edges of the inflection zone. If no fourth wave materializes, then the bear market may be gearing up to resume in the near future. Trade safe.

Friday, June 23, 2023

SPX and NYA: Still Betting on the Bears

Wednesday, June 21, 2023

SPX and NYA: Important Inflection Zone

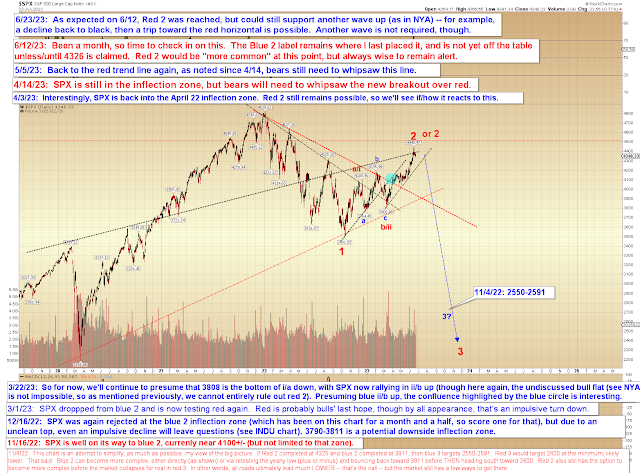

A week ago, I wrote:

I'm very close to publishing [the alternate intermediate bull count] now (eighty percent of the time, "finally" publishing a bull count is the best way to create a bear move, so we'll see if the threat of publication is enough to cause the market to reverse, or if I actually need to publish the bull count to really force the market's hand).

I then published that count on Friday, and lo and behold, after exceeding the SPX target/inflection zone by a hair, the market reversed that very session. Interestingly, NYA fell a hair short of its target/inflection, but also reversed. Let's start there:

As we can see, NYA could support one more smallish wave up, but if we are indeed on the cusp of a bear move, it would not be uncommon for such a wave to fail to materialize.

SPX is in a similar position:

As yet, we don't quite have a small impulse down, but a couple sets of slightly lower lows today might accomplish that.

In conclusion, this is -- quietly, for the masses -- a major inflection zone. The market does have a little leeway to run a little bit higher if it wants (and still remain in the inflection zone), but if there's a bear move to come, such moves often attempt to take "everyone" by surprise. Trade safe.