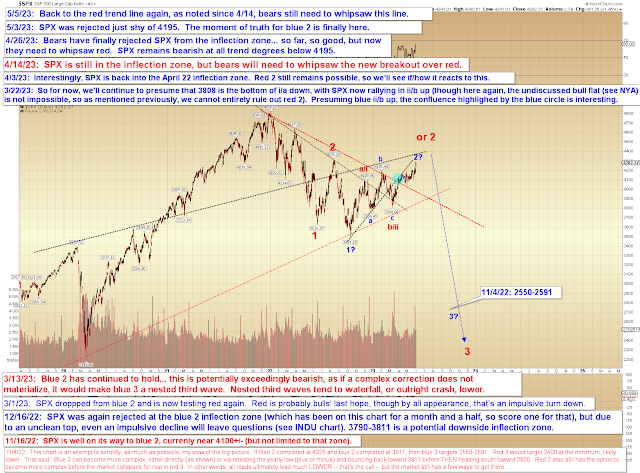

Last Friday, I wrote that SPX appeared to be on track to break resistance, which it has since done. It's now closing in on its next upside target zone:

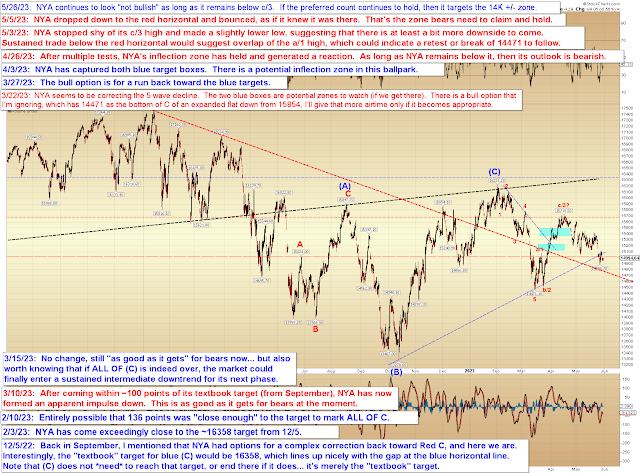

NYA is now right up against resistance -- if it sustains a breakout there, then the next probable resistance zone is represented by the blue line:

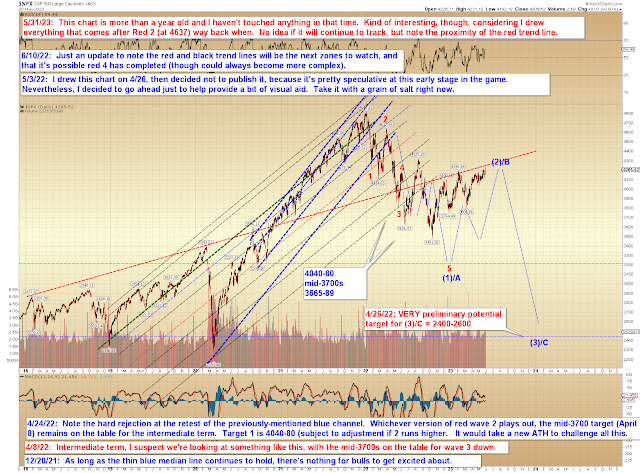

Finally, for the past few months, I've gone back and forth on whether to publish the potential longer term bullish count, but have been restraining myself. I'm very close to publishing it now (eighty percent of the time, "finally" publishing a bull count is the best way to create a bear move, so we'll see if the threat of publication is enough to cause the market to reverse, or if I actually need to publish the bull count to really force the market's hand), but have decided to hold off just a little longer. Trade safe.