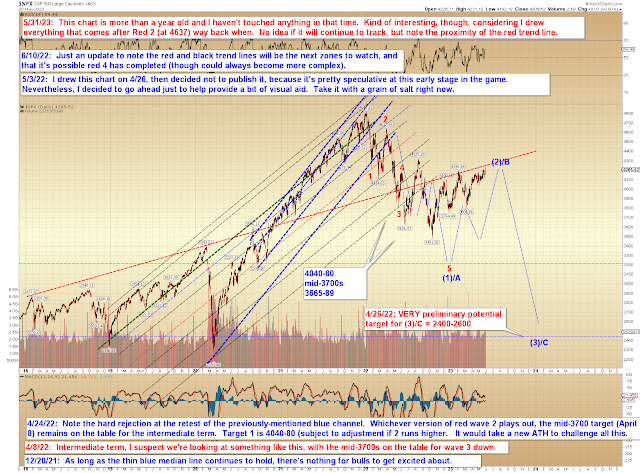

On Friday (and reiterated on Monday), I noted that INDU and NYA were both severely lagging SPX, and wrote:

This lag suggests two diametrically opposed possibilities: Either SPX only has a little more upside, and the rest of the market will drag it back down -- or SPX is headed toward at least Red 2 and that will drag the rest of the market up. NYA may become particularly germane here -- IF it can break above the red c/3 high, as it would then need to go on to form 5 waves from the 15055 low. Right now, because of the divergences across markets, it's a bit early to determine how significant SPX's breakout may or may not be, so how these markets collectively behave during the upcoming sessions will be important toward drawing firmer conclusions one way or the other about the larger time frames.

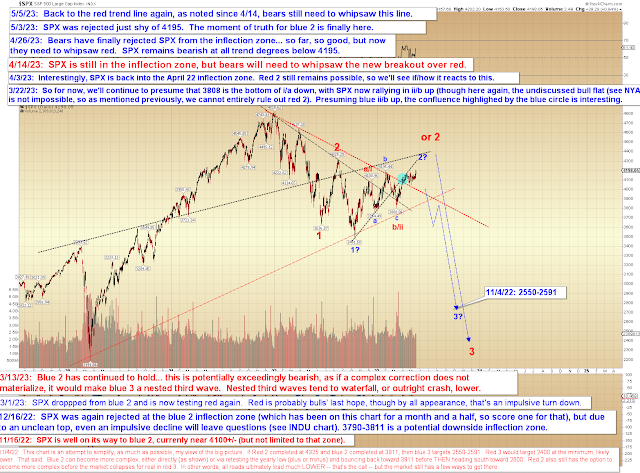

After Friday's update was published, SPX ran a little higher, then stalled, and it has since reversed lower. This is (so far) in keeping with the first possibility discussed on Friday (above).

The next zones to watch in SPX are 4100-11, and, if SPX sustains trade below the first zone, 4040-51.

We can see on INDU that a sustained breakdown would suggest some downside follow through:

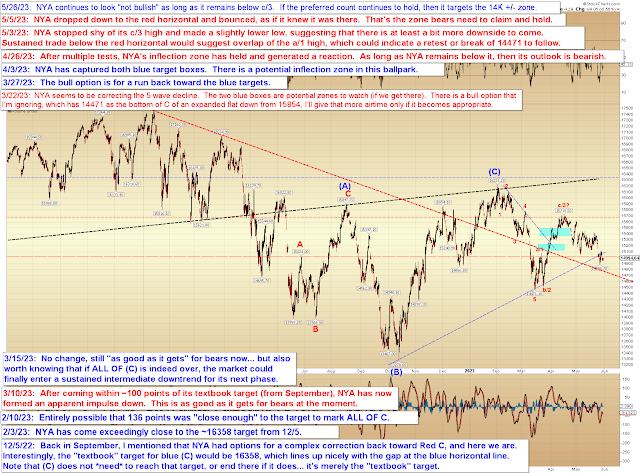

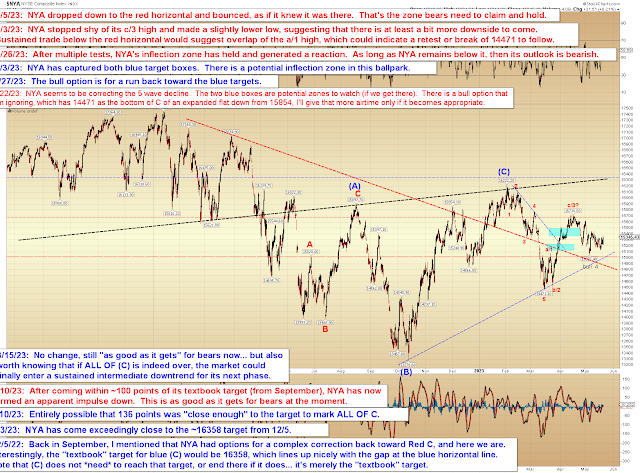

NYA is in a similar position:

NYA's bigger picture chart is still unchanged:

In conclusion, this is why I warned on Friday and Monday not to read too much into the breakout in SPX -- but by the same token, as of yet, we can't read too much into downward options, either. We're still range-bound, but based on INDU and NYA, it seems reasonably likely we'll see at least some near-term downside follow-through if there's a sustained breakdown of recent lows. And, if nothing else, this reversal is obviously preferrable for bears than the alternative. Trade safe.