Last update called out SPX 4100-11 as the next zone to watch, and SPX declined to 4103 and found support in that first target zone. As noted last update, if SPX can sustain a breakdown below the first zone, then 4040-51 becomes the next zone to watch.

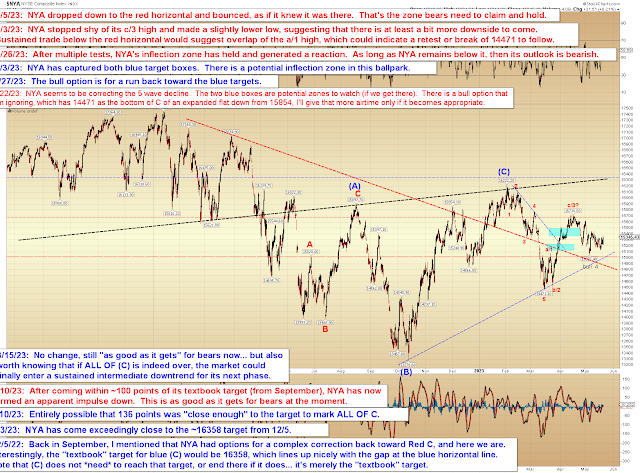

Since SPX is back into a congestion zone, NYA is far more interesting:

As we can see, NYA has now overlapped the 1/a high, which means that we are likely looking at a 3-wave rally on the heels of the long-presumed impulsive decline (the red 12345 back in March). As long as bears can hold that c/3 high, then things look promising for them.

Other than that, nothing to add to the past couple updates. Trade safe.