Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, May 10, 2023

SPX Update: Nothing Lasts Forever... or Does It?

Monday, May 8, 2023

SPX and NYA: Sorry, I Ran Out of Titles Six Months Ago

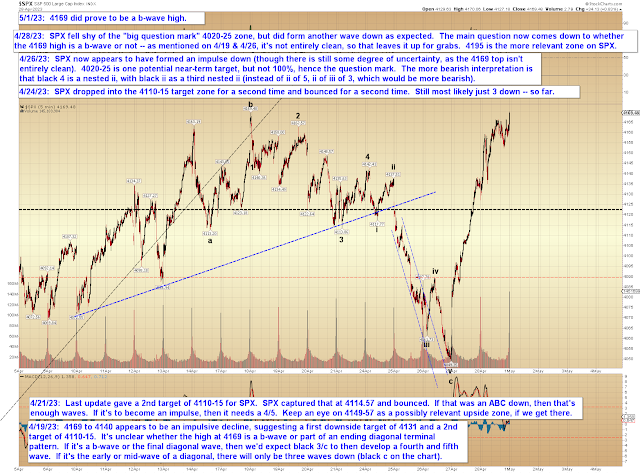

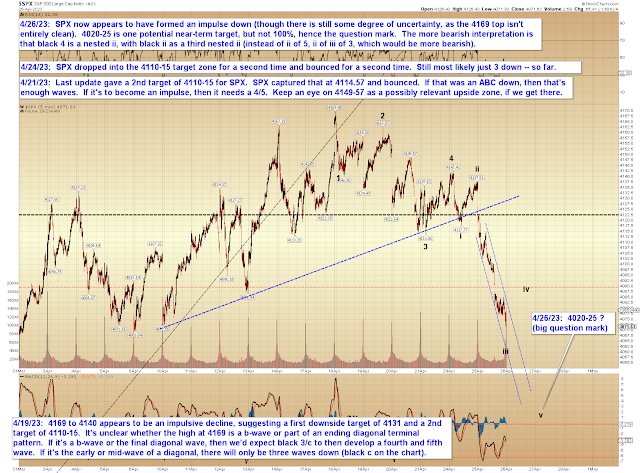

Last update discussed that SPX and NYA had both reached support, and both markets proceeded to form sizeable bounces from that support. I want to say that puts us in trickier territory, but the reality is, this market has been stuck in a trading range for a year. So it's all tricky territory lately, and don't let any temptation toward complacency (in either direction) convince you otherwise.

Year-long trading ranges are the type of thing that could give Freddy Kruger himself nightmares.

There's no change to either NYA or SPX at the intermediate level.

Near-term, I outlined a bear case (the bull case is obvious and was already discussed last update):

In conclusion, so far, the market has bounced twice at major support. As noted several times previously, bears still need to break that to get anything going. On the flip side, bulls have yet to claim the next key resistance levels, so they can't claim victory yet, either. And on another note, if you've survived this year-long trading range without blowing up your account entirely, pat yourself on the back. When the market treads water, often the best we can hope for is to do the same. Trade safe.

Friday, May 5, 2023

SPX and NYA: Back to the Scene of the Crime

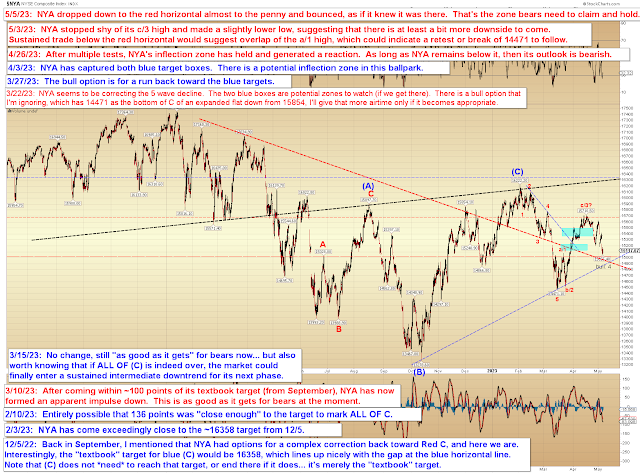

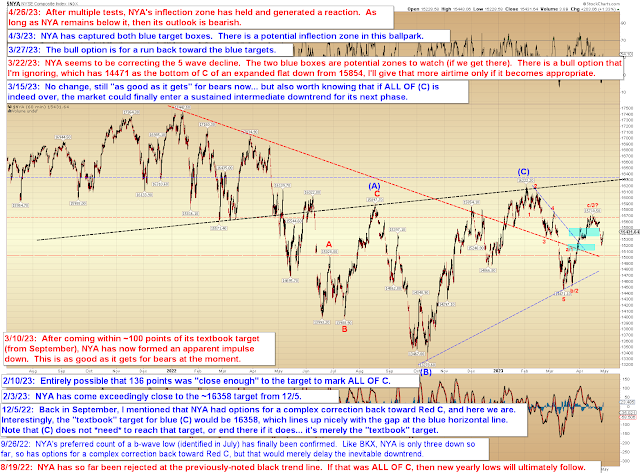

NYA is interesting, because, unlike SPX, it did not make a new high, instead making a slightly lower low. This suggests that these markets need at least a little more downside

That read came through, and the markets delivered more downside -- in fact, both SPX and NYA declined right to their downside inflection zones (even though anyone not well-versed in Elliott Wave probably thought my placement of the red horizontal line seemed arbitrary!):

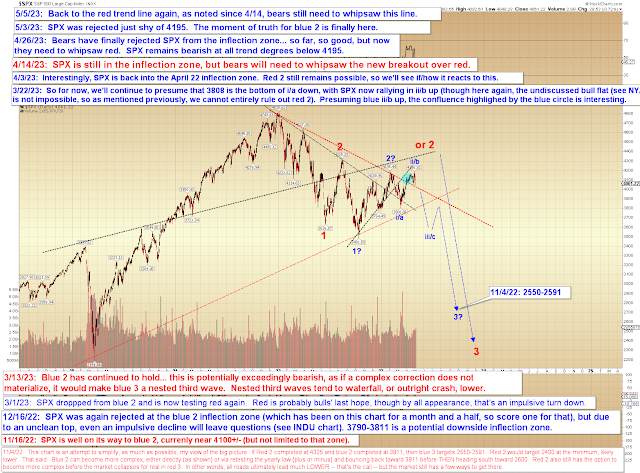

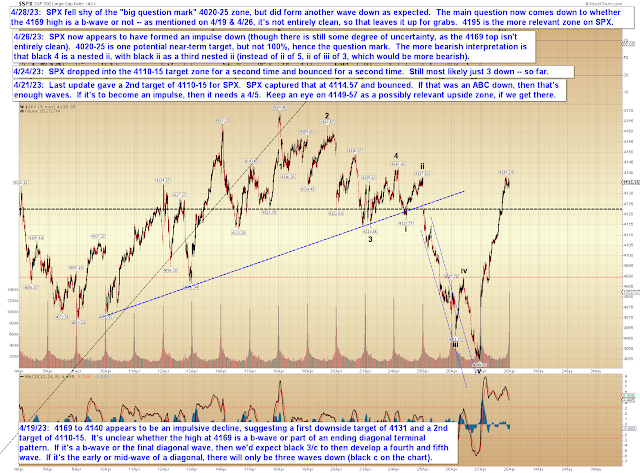

SPX also tested/is testing its important trend line:

These are important tests, and bears need to come through, since we can see on the near-term SPX chart that the decline has taken the form of three waves so far:

In conclusion, last update thought the pattern begged more downside and that happened -- now the market has reached support, so bears need to keep pushing and break that support. If they can't, then Red 2 (second chart) will stay on the table. Trade safe.

Wednesday, May 3, 2023

SPX and NYA: Moment of Truth

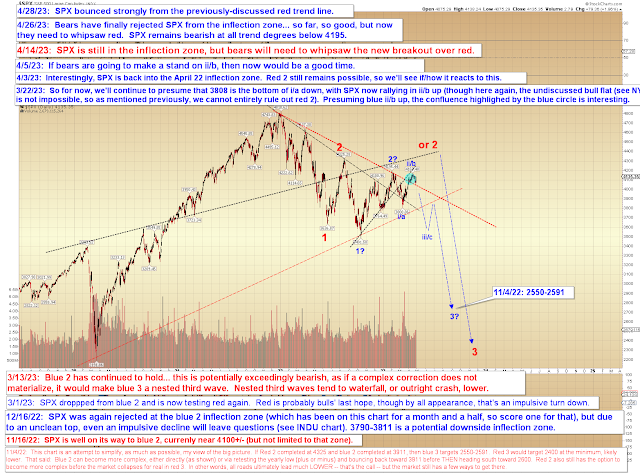

Since last update, SPX effectively retested its prior swing high and was strongly rejected. This is the moment of truth for blue 2:

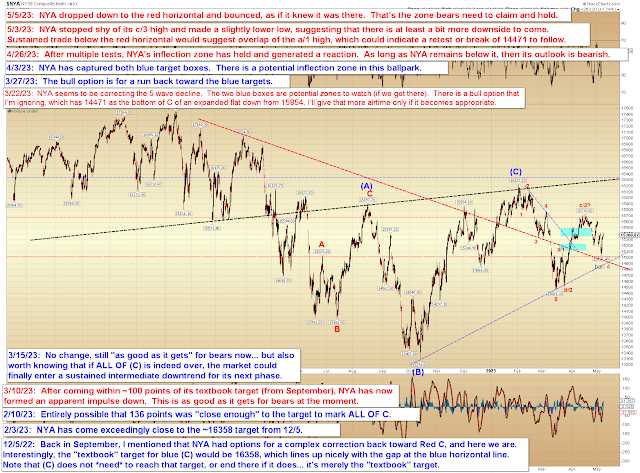

NYA is interesting, because, unlike SPX, it did not make a new high, instead making a slightly lower low. This suggests that these markets need at least a little more downside, as NYA's current decline would be expected to at least reach parity with its prior little leg down (from 15710 to 15201), which would mean it (most likely, these are never 100%) needs to make its way down to 15110-20 at the minimum. Note the red horizontal is now potentially a key overlap:

Today is, of course, a Fed day, which means Powell needs to decide whether to let inflation run amok or whether to continue trying to convince the market that it's being stupid and that (to quote a Fed interoffice memorandum) The Fed is Really Serious About Taming Inflation This Time, We Mean It (for Realz Y'all!) So Bulls Should Quit Acting Like Everything is Going Back to "Normal" Tomorrow Because It's Not.

Either way, things could get interesting soon. Trade safe.

Monday, May 1, 2023

SPX and NYA Updates

bears still need to whipsaw the intermediate red line to be in better shape, while bulls still need to sustain a breakout over 4195 to help their cause.

Trade safe.