In Monday's update (which was published Sunday night), I wrote:

I'm inclined to lean toward Friday's low being a b-wave, so suspect that low will be revisited/broken early this week.

I feel I need to mention that at the time I published that, futures were still trading in the ballpark of Friday's high. After I published, futures headed sharply lower -- then, by the cash open, the market gapped down and revisited Friday's low. So that was a hit and (when I actually made and published the call) was harder than it looked -- it just didn't end up being of much practical use for cash traders, unfortunately.

After revisiting Friday's low, the market immediately began rallying, which continued until late in the session yesterday. Which means SPX is back to roughly the same price it was on Friday. Which means there's not a lot new to say yet.

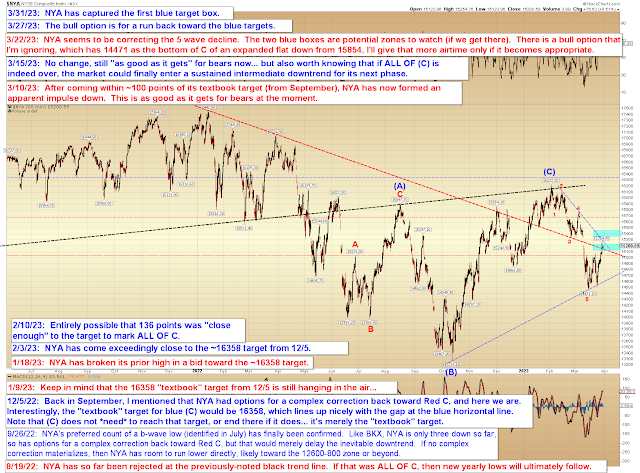

Unlike SPX, NYA did manage to break a bit past its blue target. It remains within the current inflection zone until roughly 15,700+/-.

Oil has continued rallying since last month's update:

In related news, the Fed's balance sheet spiked by about $400 billion from March 8 to March 22:

A little of that spike did roll off since March 22, but we'll all be waiting with bated breath to find out whether we're still "fighting inflation" -- or have decided to go back to fueling it. Interesting that they spent a year gradually and painstakingly rolling off the balance sheet, only to add half of it back in only two weeks.

I'm reminded of something I wrote in July of 2021:

The Federal Reserve has at last painted itself into its final corner -- or, to use another, perhaps more apt, metaphor: The Fed has placed itself on a treadmill from which there is no escape. There appears to be nothing it can do from here (other than a very modest taper) that won't immediately tank the markets. Even talk of such things spooks investors, which is why Powell has been so dovish of late. The Fed must keep rates low. It must continue QE (in one form or another) and continue buying Treasuries and Mortgage-Backed-Securities. The Fed cannot do anything but keep running at or near its current pace in perpetuity.

The Fed's new reality is like a treadmill-based parody of the movie Speed: If the Fed slows down too much, the market will implode, killing innocent economies in the process.

We just got a taste of exactly that with the SVB (et al) collapse. The Fed had to Speed up again, or risk more serious issues in the banking sector snowballing into a juggernaut. And that "catastrophe averted" was after the aforementioned modest taper.

And then that reminded me of something else from the same piece:

The Fed likes to talk about its "tools," but all its tools are currently running at full capacity just to keep the market from collapsing under its own weight. There are no more tools to call upon.All it will take is a catalyst.Later, people will blame the catalyst as if it were the "cause" (you and I know they will do this because they do it every time) -- but we'll know it was not the cause. Our short-sighted choices were the cause. Our inability to recognize, appreciate, and properly manage our good-fortune was the cause.In short, we ourselves were the cause. We have met the enemy, and he is us. The catalyst will only be the trigger that forces the reckoning.

Last month, the market was all ready to begin collapsing under its own weight, but then the Fed ramped its "tools" right back up to "full capacity" and saved the day.

And all this made me again wonder about the second portion of the outlined equation, and to wonder if that's what the market is waiting on: A catalyst. China invades Taiwan, Russia uses nukes, commercial real estate collapses, that sort of thing. In other words, something that exposes just how weak and unprepared we really are right now.

Just food for thought. We'll see what the market does to close out the week. Trade safe.