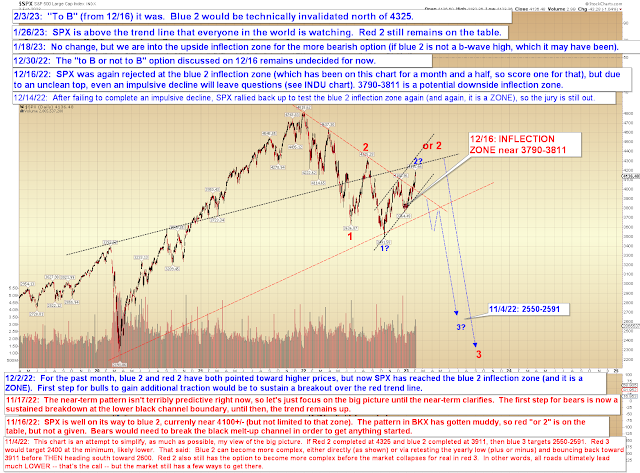

On February 10, I wrote:

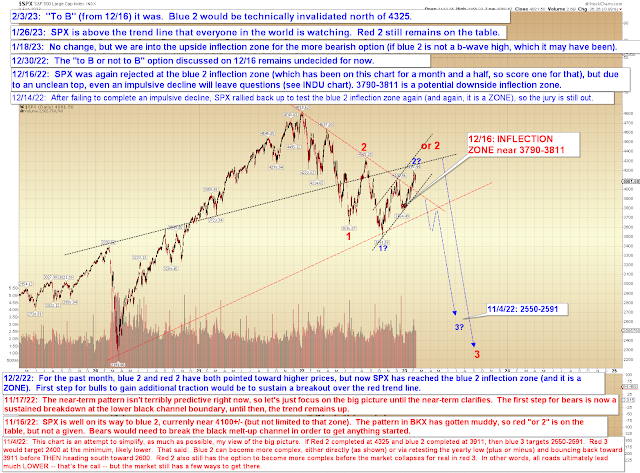

[B]ears are still very much in the near-term game here, and normally one would expect some downside follow-through to the pattern so far (though worth being aware that it's three waves down from 4176 so far, which, 9 out of 10 times, means it either needs to become five down, or it will turn into an expanded flat that runs back toward 4176 before heading lower later; 1 out of 10 times it's something weird like a double three).

On February 15, I discussed INDU's noisy pattern and that it had given me a little doubt, but wrote that "my initial instinct last update was that SPX had only formed three waves down and was thus likely to rally and return to the low, and I'll stick with my first read for now."

On February 17, I wrote: "[N]o change, except to add that there's now a possible micro bear nest in the near term pattern."

Given how wacky this market is, and how confused the majority of participants are, I have to say that I'm rather pleased that all of these reads were on-target, given the current environment.

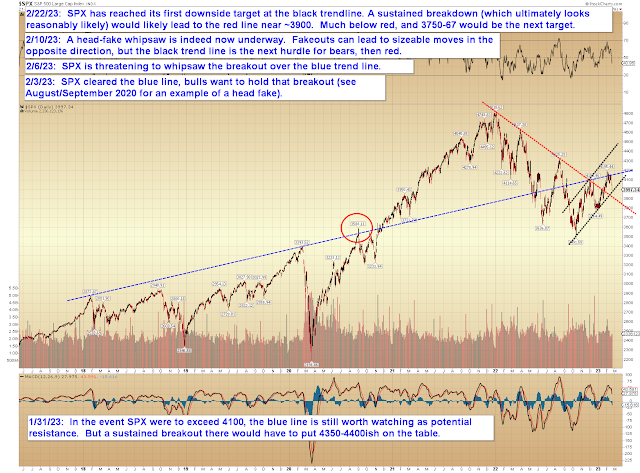

SPX has now reached the first downside trend line, which I discussed a couple weeks ago:

On the chart above, I mention that it "looks reasonably likely" that SPX will ultimately reach the red trend line; the chart below discusses why I said that:

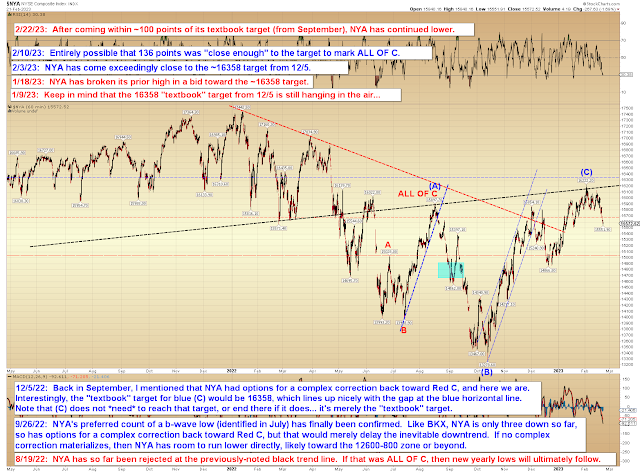

Finally, NYA reaching its target zone was one of the things that helped all the prior analysis work, to get us looking the right direction at the reversal:

In conclusion, SPX appears to need further downside before it can even consider forming a decent low -- and while it's a bit early to say for certain "how low," I suspect the red trend line at the minimum, and am on the verge of leaning toward the 3750-67 zone. Also, do keep in mind the larger wave position here: Again, it's too early to say without a larger impulse down, but it's worth knowing that it's at least within the realm of possibility that SPX has topped blue wave (2) and is headed much lower from here. Trade safe.