Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, February 17, 2023

SPX Update

Wednesday, February 15, 2023

SPX and INDU Updates

Monday, February 13, 2023

SPX and NYA Updates

Friday, February 10, 2023

SPX and NYA Updates

Tuesday, February 7, 2023

SPX, NYA, and Powell

Implicit in this statement is that, so far, things have been "painless." (I agree with that assessment and have said so a number of times.) Explicit in his statement is that Powell does not "think it's guaranteed" that things will remain painless.

Seemingly in an effort to drive home that point, he added (emphasis mine): “If we continue to get, for example, strong labor market reports or higher inflation reports, it may well be the case that we have to do more and raise rates more.”

Powell seems to be asking: "What exactly do I need to do to create more layoffs?" So the implications of that are interesting to ponder.

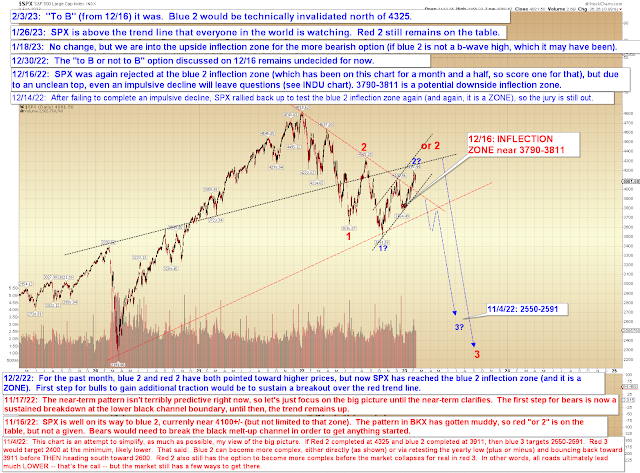

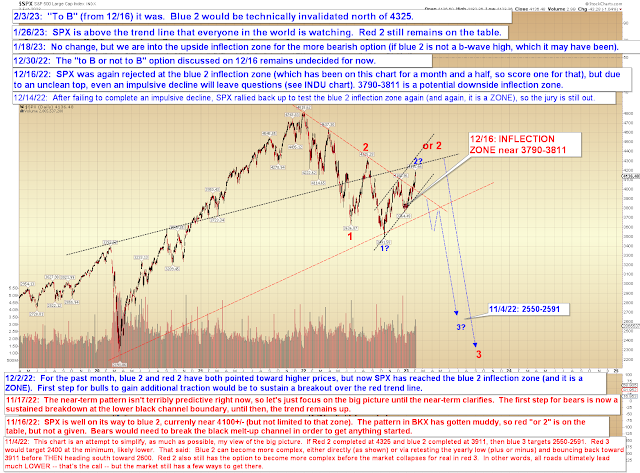

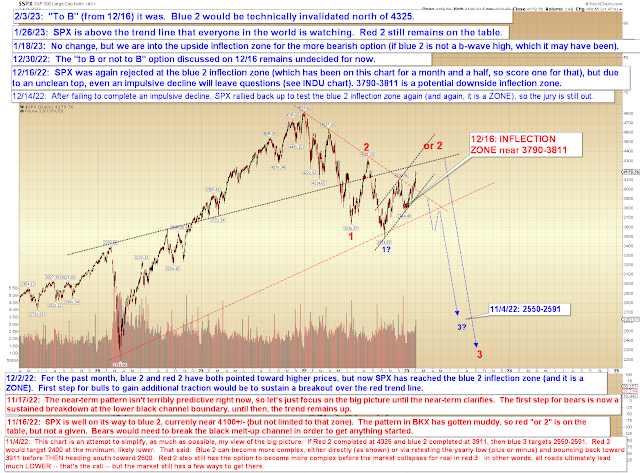

SPX has traded sideways since last update, so there's nothing to add in that regard. Yesterday closed at the blue trendline, with no clear whipsaw or breakout yet:

NYA has also traded sideways:

Beyond that, not much to add to the prior update. Trade safe.

Monday, February 6, 2023

SPX and NYA: Keeping It Lively

Friday, February 3, 2023

SPX and NYA: One Question Answered

On Wednesday, Chairman Pao(well) announced that financial conditions had tightened significantly (even though, by most objective measures, they have not) and that the "disinflationary process has started," hence that the Fed was probably just going to call it a day soon and get back to golfing and loan sharking, or whatever it is the Fed does when it's not creating new bubbles while actively dropping money from helicopters. The market responded, shockingly, by rallying.

Chairman Pao also cautioned that it would be "premature to declare victory" against inflation, and that inflation was "still running very hot" -- but most traders were too busy screaming "buy!" to hear that part. Interesting to note that, while goods are experiencing some disinflation, commodities and services are still accelerating.

Chart-wise, the "to B or Not to B" question from way back on December 16 (which revolved around the suspicion that 4100 may have been a corrective B-wave high and thus ultimately fated to be broken) has finally been answered in the affirmative. That of itself does not invalidate the potential of blue 2 (blue 2 would be technically invalidated north of 4325).

Near-term, SPX broke above the next trend line:

Finally, NYA has come very close to its "textbook" upside target: