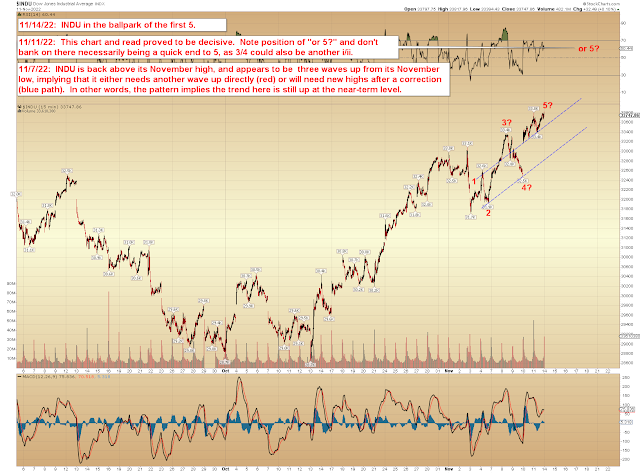

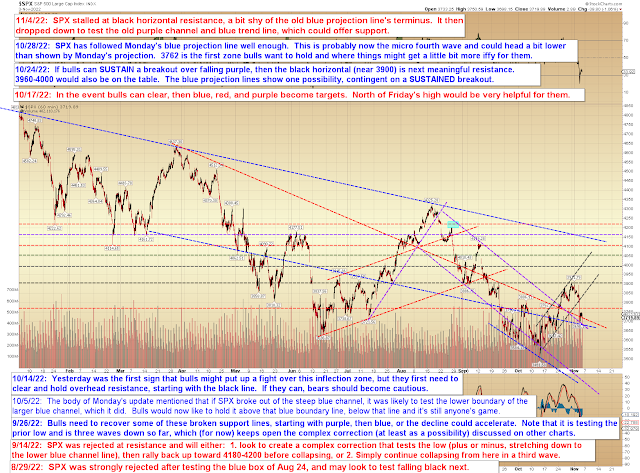

Last update discussed that the market seemed to have completed several fourth waves recently and noted:

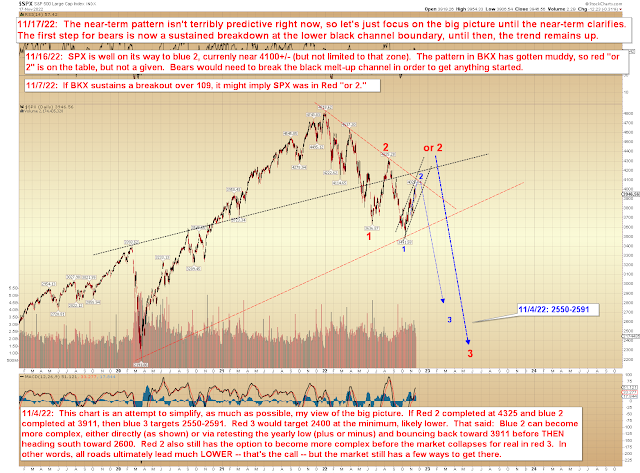

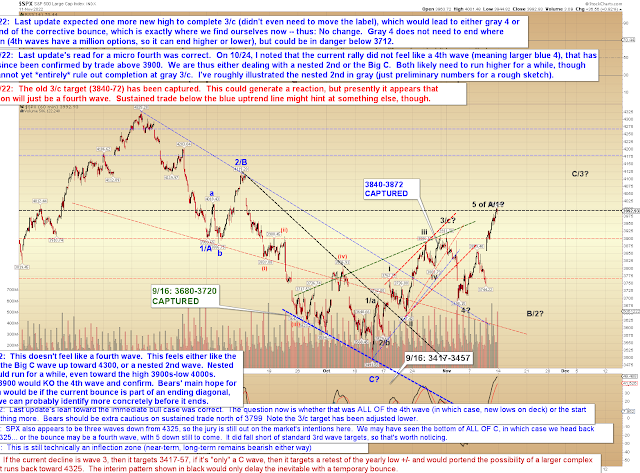

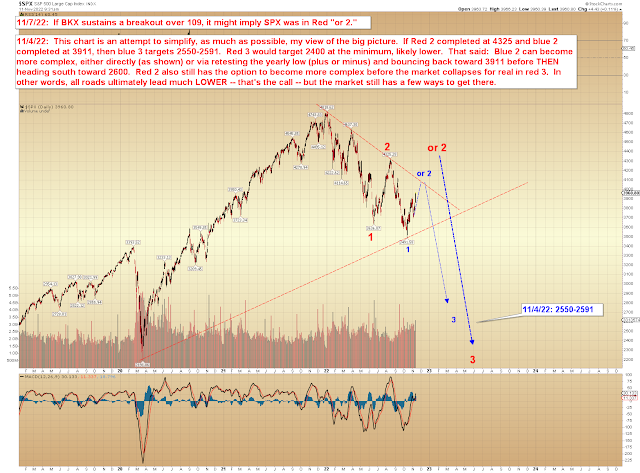

All this implies that the market might be unwinding its upward momentum, meaning the rally might be getting a little tired. I say "might be" because this is the type of market that can easily find a second wind and burn bears who get too aggressive too early, so I'm not inclined to get too far ahead of it... but it's interesting to note that we are approaching the blue 2 zone (chart below).

That said, it's quite possible that if there is a reversal, it will just be a correction on the way to red "or 2," so I'm awaiting an impulsive decline before actually changing footing. As of this exact instant, this is more of a "time to be cautious" moment for bulls, as opposed to a "bet the farm short" moment for bears. It could always turn into one, but we don't have an impulsive decline yet.

As of this instant, we still do not have an impulsive decline, and it does appear that the last dip was probably just another corrective fourth wave. So for now, we're just going to focus on the big picture:

In conclusion, the next real test for bulls will come near the downsloping red trend line and blue 2. Until then, bears would need to sustain a breakdown of the rising black channel to get anything started. Trade safe.