On 10/24, in an update titled

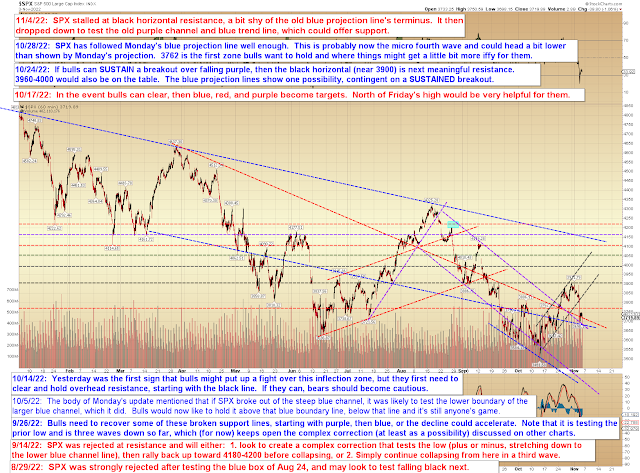

More Cause for Bear Caution, I wrote multiple times that the rally didn't "feel" like a low degree fourth wave to me, implying that it was going to head more than a little bit higher, and that has since been confirmed.

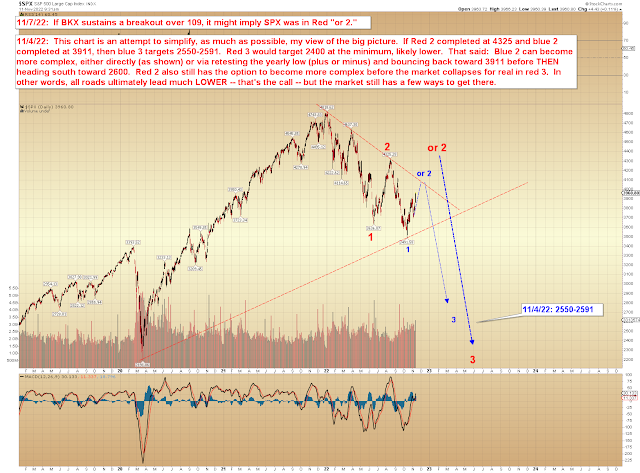

I also wrote: "Big picture, presently I'm slightly leaning toward this either being the Big C wave that we've discussed a million times, or a nested 2nd wave," and presented the following chart, with the nested 2nd and the Big C wave terminuses shown in red and blue respectively:

Here's that same chart with the updated price action now:

SPX has gotten a lot closer to Red 2, but it's still not there yet, obviously. So that's the bull case, and it's the way I'm still slightly leaning -- but let's take a quick look at the bear case, which we'll discuss after the chart:

The bear case says that we've about completed 3 waves up (gray 3/c), and because three waves can complete a corrective move, it is indeed always possible for any structure to terminate at such an inflection. If we refer back to the first chart, we can also see that SPX is backtesting the lower rising black trend line -- so I'm not entirely closed to the idea that maybe this will be it for the bounce. I'm very much open to it, I'm just not presently leaning that way, as I wrote on the 24th.

So, in conclusion, we are at (3/c could have completed on Friday, though it would look a little better with a bit more upside first) or approaching a bear inflection zone, and it's going to be tricky, because even the bull count would likely correct lower from that inflection (in gray 4? on the second chart), so both counts will seem up in the air for a time. That said, I'm still slightly inclined to think bulls get more rally after that correction, but as I said, I'm very much open-minded to the bear potential, so when that correction occurs, I'll mark the zones to watch. Trade safe.