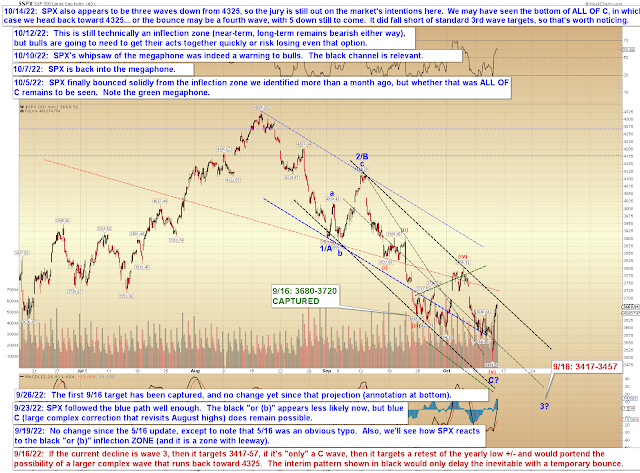

I've outlined a couple options above -- both of them point higher for now. As I noted, bears' remaining near-term hope would be for an ending diagonal (or a b-wave high that runs down to Friday's low, but then runs back up to today's high), but even a diagonal would need to run higher before it ends.

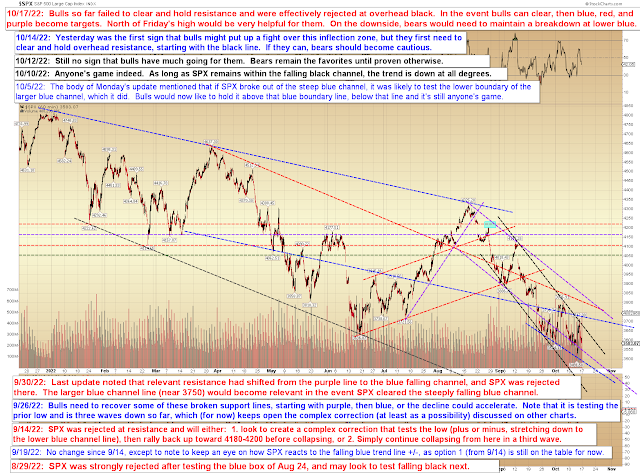

Today, we're going to keep it simple, and just focus on the near-term uptrend line for now:

For the past few updates, I've presented the bull case, so let's take a quick look at the bear hope... but again, referring back to the "keep it simple" approach above, bears need to break the near-term uptrend in order to gain much traction. So while tagging this overhead resistance line (chart below) isn't reason in itself to be bearish, it is at least reason for bulls not to get too exuberant just yet:

In conclusion, last update opined that the market needed to run higher, and it did... and near-term, this pattern would normally need to continue to unwind higher (assuming it isn't something weird, such as a WXY, which one can never rule out). That said, COMPQ has reached a potential intermediate resistance zone, so the market may react to that -- and SPX did capture its old 3/c target. This is a moment where one might want to take a more cautious stance if already long, if nothing else. If one is inclined more bearishly, then this is an area to watch closely. Trade safe.