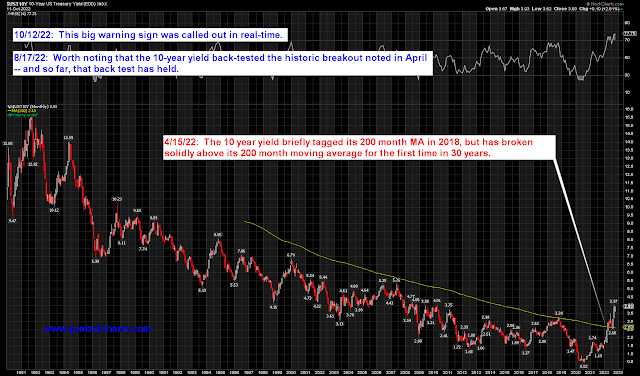

Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Monday, October 17, 2022

SPX Update: Longest Inflection Zone Ever

Friday, October 14, 2022

SPX and BKX: Careful Out There...

- It's a bit deeper than would be expected from a standard c-wave

- It's a bit shallow for a standard third wave

Wednesday, October 12, 2022

SPX Update: They Shoot Markets, Don't They?

Monday, October 10, 2022

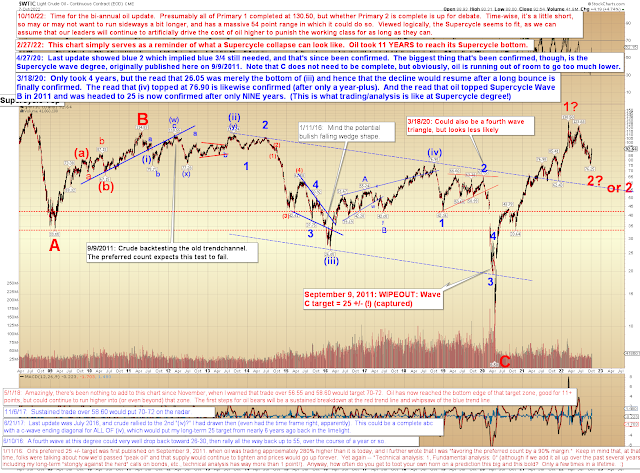

SPX and Oil Updates

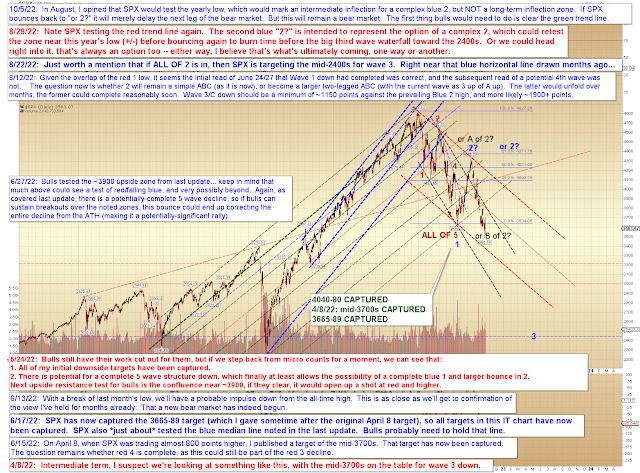

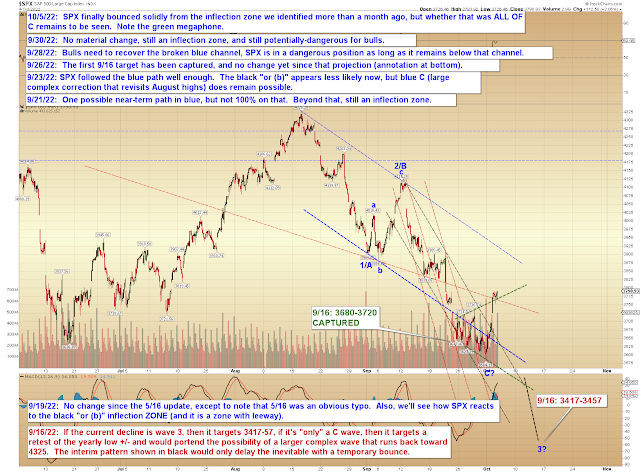

On October 5, I wrote:

[Y]esterday's violent rally could be the start of the complex blue 2 on the final chart, but I'd caution against reading too much into a "one day rally." Bulls will need to see some follow-through before getting their hopes up too much.

And last update concluded:

So far, bulls have not proven they have even the near-term ball, and it is still possible that this is all part of an intermediate bear wave.

Both of those warnings proved to be useful, and Friday's market dropped precipitously. So far, the decline from last week's high appears to be three waves, so it's in the ballpark of a near-term inflection zone, but could simply be an incomplete impulse wave (which would mean more downside to come after some small fourth wave corrective rallies).

Friday, October 7, 2022

SPX Update

Last update concluded:

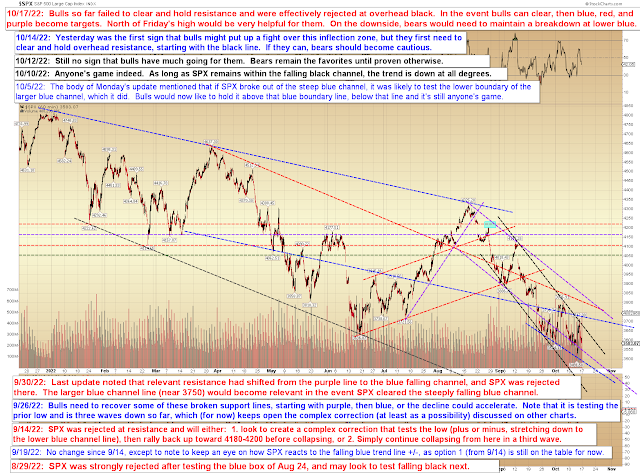

[Y]esterday's violent rally could be the start of the complex blue 2 on the final chart, but I'd caution against reading too much into a "one day rally." Bulls will need to see some follow-through before getting their hopes up too much.

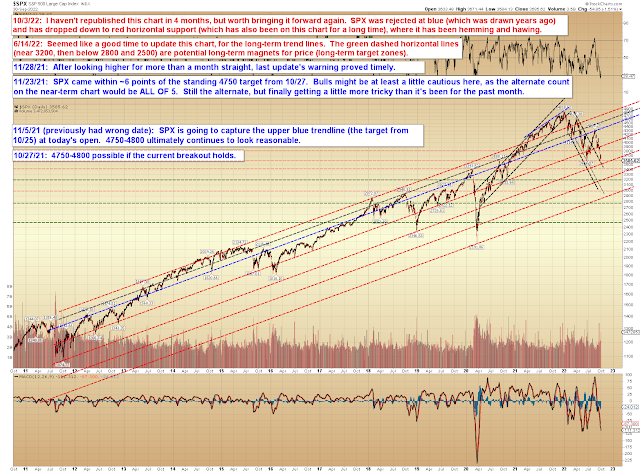

So far, there has been no follow-through. To the contrary, there's been a whipsaw back into the megaphone:

Same with the lower blue channel boundary:

And, big picture, bulls have not hurdled the key trend line yet:

In conclusion, no real change from last update: So far, bulls have not proven they have even the near-term ball, and it is still possible that this is all part of an intermediate bear wave. Regarding the "even bigger picture," it is my belief that this is still a bear market no matter what happens here. Trade safe.