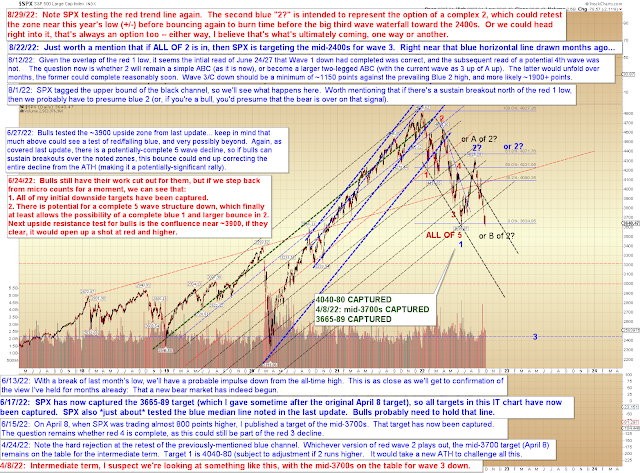

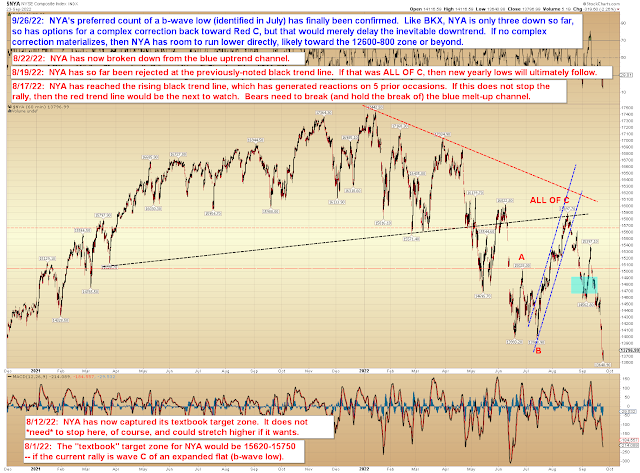

Way back in July, NYA and BKX formed patterns that I believed (in real-time) were "b-wave lows" -- in Elliott Wave terminology, a b-wave low is part of a pattern called an "expanded flat," which requires that, after a bounce, said b-wave low ultimately gets retested/broken. Then we bounced a bit farther than I'd originally anticipated, which tested my resolve, but I simply couldn't see those July lows as anything other than b-waves, so I stood by my initial read.

Months later now, and that resolve has finally paid off, as NYA broke below its (once suspected, but now confirmed) b-wave low:

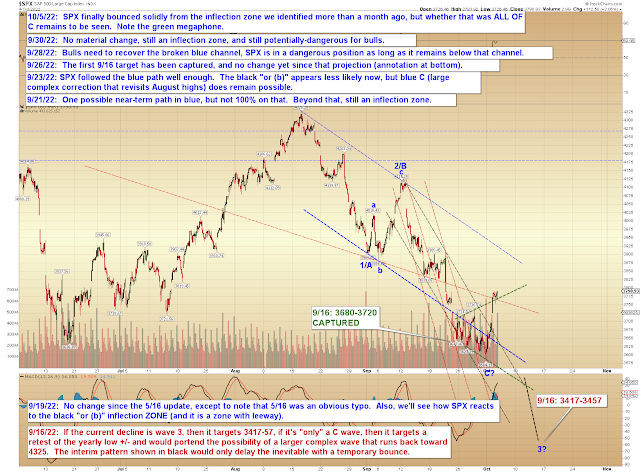

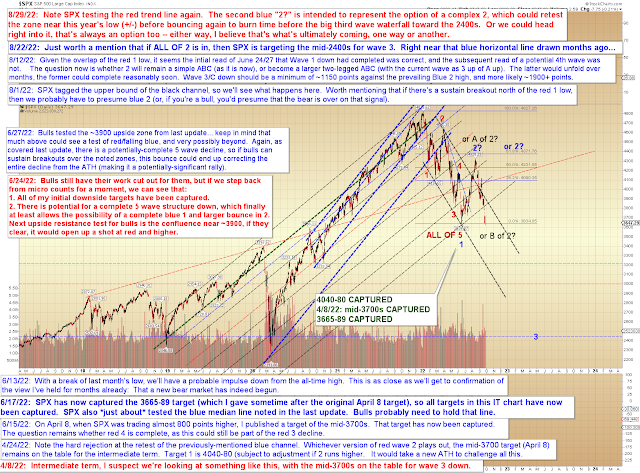

SPX hasn't broken its low yet, but that's immaterial, really, because if SPX bounces here, then so does NYA, and we're right back in the same position of a new, larger b-wave low, as I've discussed since last month. In other words, the market is still in a "pay me now or pay me later" position:

BKX is similar to SPX and NYA:

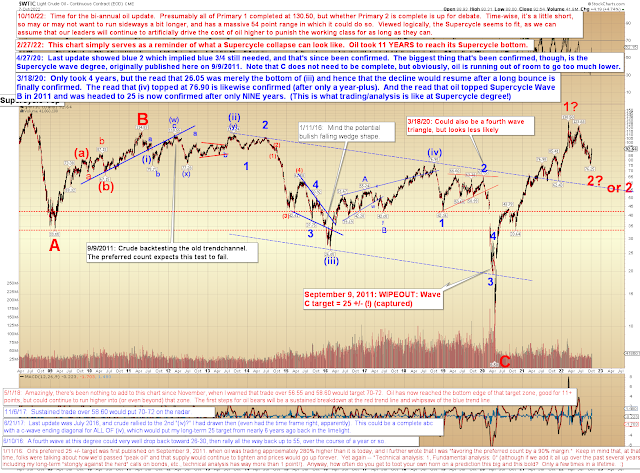

Here's how it lays out in the bigger picture, which remains unchanged to the point that I still don't feel anything needs to be added to the annotation from a month ago:

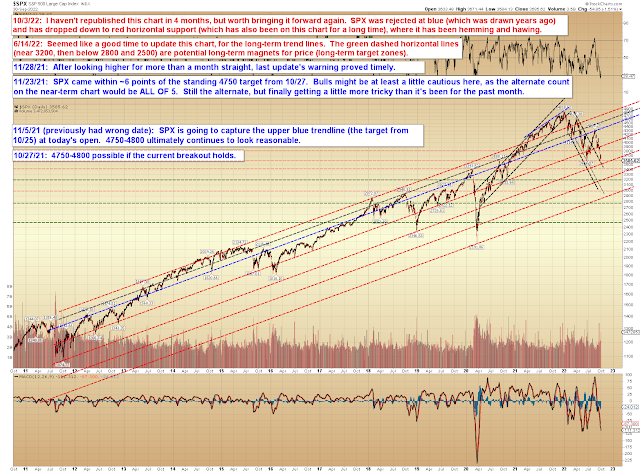

SPX's trend line chart suggests bulls need to start recovering some of these broken support lines, and soon:

Finally, COMPQ has reached a major confluence of potential support lines, which is interesting, given that I'm seeing three waves down (so far) across markets, and this implies that a bounce is at least possible in this zone. Whether a bounce will materialize or not depends on whether the market is ready to let go now, or if it needs to fool a few more people before letting go later. Either way, this bear market is still alive and well:

Finally, I want to refer back to a piece I wrote back in mid-May (see:

SPX Update: Not Even the End of the Beginning), because I believe the things I said then are finally starting to become apparent to the world at large, and these (albeit late) realizations might have a strong psychological impact on investors:

[T]he Fed's goal is to achieve, essentially, a "negative wealth effect."

Which means asset prices must fall. To the Fed's current mindset, the fall of asset prices is a feature, not a bug.

The Fed is not worried with the S&P below 4000 -- the Fed wants the S&P below 4000. To achieve its goals in this environment, it needs SPX below 4000. And well below 4000.

QE and government "stimulus" spending created runaway inflation; to reverse inflation, the Fed must reverse the effects of QE and government spending. The Fed needs demand to weaken and supply to increase, and in order to do that, the Fed must drain the excess liquidity that was poured into the market and the economy.

Put simply: The Fed needs to destroy wealth to tame inflation. And, more importantly, it seems committed to that goal.

Some bulls have argued that we won't see a recession because household and business balance sheets remain strong. But bulls are stopping their analysis too soon and aren't taking this to its logical conclusion: The Fed cannot tame demand if balance sheets remain strong. Which means that in order to achieve its goals, the Fed needs balance sheets to become weak, so destroying balance sheets becomes part of the plan. "Balance sheets remain strong" is thus not an argument that "there will be no recession," it is instead an argument the Fed will continue pushing the market down.

By all current appearances, it seems the Fed only reaches its goals by continuing to feed volatility and destroying wealth until the economy is in recession. Thus, the Fed is not going to reverse course when the economy starts to struggle (unless inflation has abated), because they currently view a struggling economy as necessary to tame inflation. And the Fed won't bail the market out as it heads lower, because the Fed wants the market lower.

Needless to say, this is not the same environment the market faced during the 13+ year bull; it is the complete inverse. Bulls have not yet come to terms with this new reality. Just as many bears struggled back in 2012 and 2013 with accepting the reality that Bernanke's Fed was committed to reflating every bubble it could, bulls will now suffer the same fate, in reverse. With every dip, they will assume the Fed is waiting just around the corner to again bail the market out. And why wouldn't they assume that? After all, that's what happened for the past 13 years.

But the Fed will not bail the market out. Not this time. At least not yet.

In conclusion, July's chart analysis has finally been confirmed, and May's broader environmental analysis is finally becoming apparent to everyone. The market is now in a position where it has to choose whether it wants to drag out the inevitable a bit longer with a more complex correction, or if it wants to simply continue declining rather directly. In both cases, we are, in my estimation, nowhere near the end of this bear market, and things will get a lot worse before they get better. Trade safe.