Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, September 23, 2022

SPX Update: SPX Nears Downside Target

Wednesday, September 21, 2022

SPX Update: Fed Day

Monday, September 19, 2022

SPX Update: Little Hope for Bulls

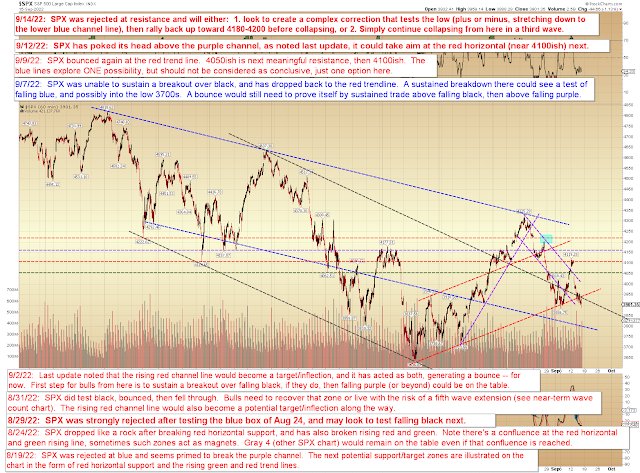

Not much happened on Friday, so there's still no change to the outlook

Near-term, the market still has options that could delay the inevitable bearish resolution of this pattern, but there isn't much to suggest any meaningful hope for intermediate or long-term bulls. In my opinion, this bear market still has a long way to go.

As we can see on the chart below, SPX is into a near-term inflection zone:

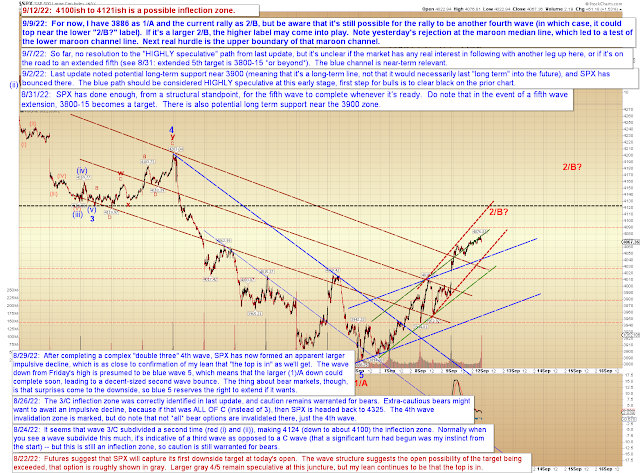

The count that would allow bulls a near-term reprieve is shown in black on the chart below. There's simply no way to predict complex corrections, though, so the market may just ignore that option if it so chooses:

In conclusion, while bulls might find a near-term respite if they can manage a complex correction, there isn't much meaningful bullish hope that can be drawn from the current charts. Big picture, if we are indeed entering a third wave, the market could be setting itself up for a classic October crash. Trade safe.

Friday, September 16, 2022

SPX Update: No Material Change

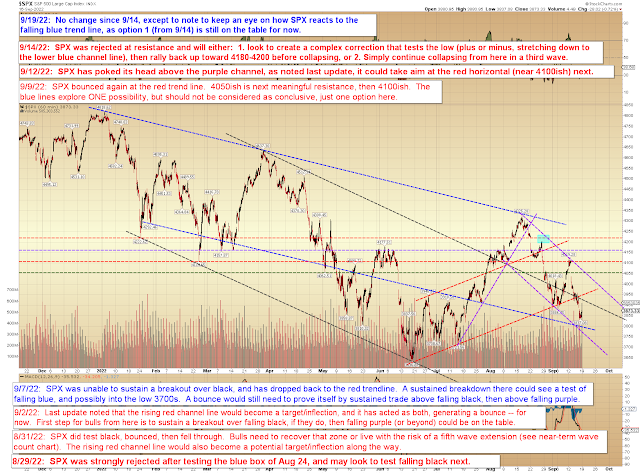

The market continues to perform as expected, so let's get right into the charts.

The simple trend line chart:

And no change to the intermediate chart:

In conclusion, the market has a couple ways it could delay the (what I view as) inevitable resolution, but I remain long-term bearish, as I have virtually all year. Trade safe.