Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, September 7, 2022

SPX Update: Bounce or Break Territory

Friday, September 2, 2022

SPX and TLT Update: Next Downside Zone Captured

Wednesday, August 31, 2022

SPX Update: Still on Track, and a Brief Word on Bear Markets

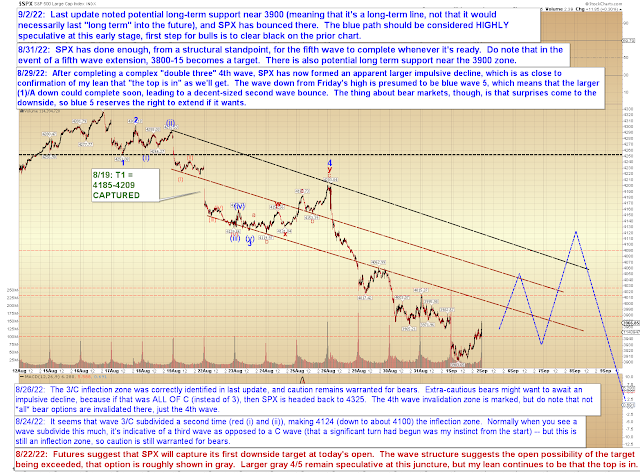

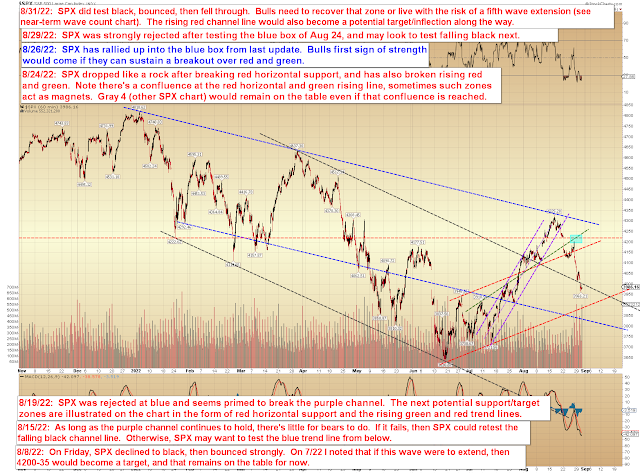

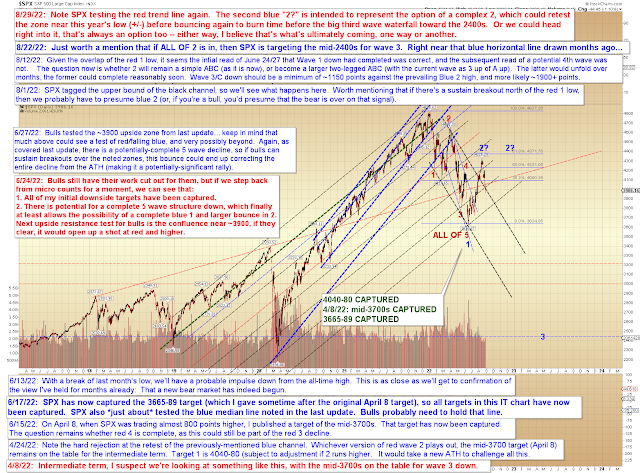

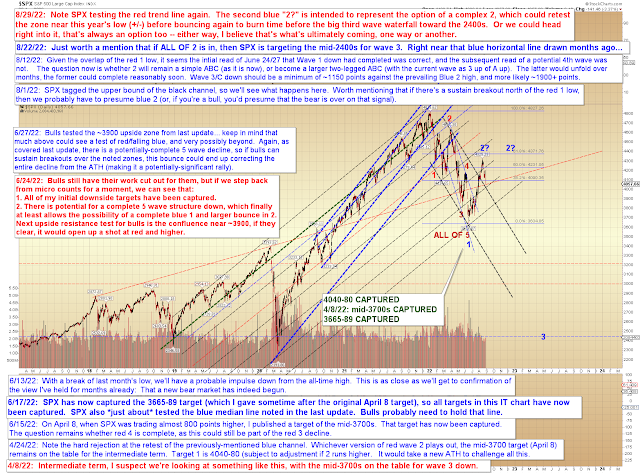

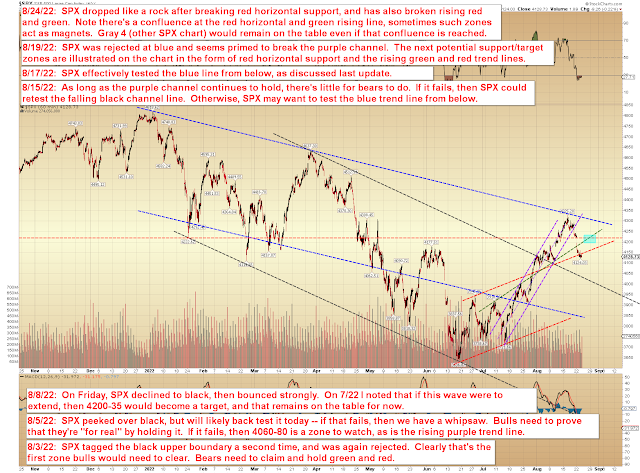

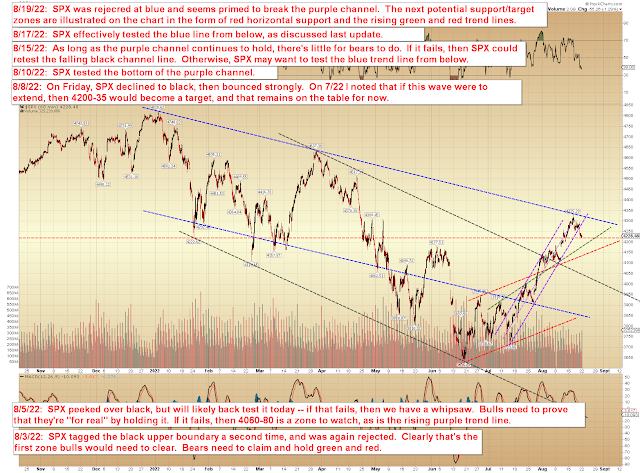

Last update expected SPX would test the falling black trend line, which it did, and also warned:

On the above chart, I noted that this is PRESUMED to be a fifth wave -- one of the tricky things during bear markets is that surprises come to the downside, and there is no law that says the current wave needs to complete in a "typical, usual, average" fashion. If it were to behave in the "typical" way, the black trend line (+/- a little) on the chart below would represent a logical spot for wave 5 to end and thus to wrap up the larger wave 1 down, leading to a wave 2 bounce. But I cannot stress enough that it does not "need" to do this, fifth waves can always extend, especially in bear markets.

On Monday, SPX indeed tested black, bounced, and then gapped beneath it on Tuesday. It's highly important for traders, and for us, to stay ahead of the curve, and part of the way we're staying ahead of the masses is by simply recognizing that this is now a bear market. And part of what "bear market" means is that support is going to fail routinely. As my friend Lee Adler has said: "There's no such thing as support in a bear market." I recommend taking those words to heart.

As I've mentioned for most of 2022, this is no longer the environment of the past 13 years, where "buy the dip" used to work on automatic. The environment has fundamentally changed to one of "sell the rip." It's the polar inverse of the past 13 years, and one of the things that's so dangerous in bear markets is that by the time all those years of "buy the dip" conditioning have finally, truly been beat out of most people, the bear market is closing in on a big rally (where, ironically, buy the dip would work again). But it usually doesn't happen before then.

Countertrend trading in most markets is only recommended for experienced and highly nimble traders, and this becomes doubly true during bear markets, because bear markets are completely unforgiving of poorly-timed longs. It helps to remember that the goal of the market now is to separate longs from their money -- and then, once you've come to terms with that, ask yourself if you want to throw your lot in with them by trying to beat the primary trend for a few quick short-term scores. If you're nimble and experienced, you may be able to do it; bear market rallies are fast and powerful, and there's lots of money to be made in them -- but those types of rallies are also few and far between, and typically only arrive after large wipeout declines, when the pundits are only able to manage vacant stares... so please choose your battles very carefully.

Please don't recognize the bear and then get wiped out by trying to be a bull.

Anyway, let's look at some charts, starting with the SPX trend line chart:

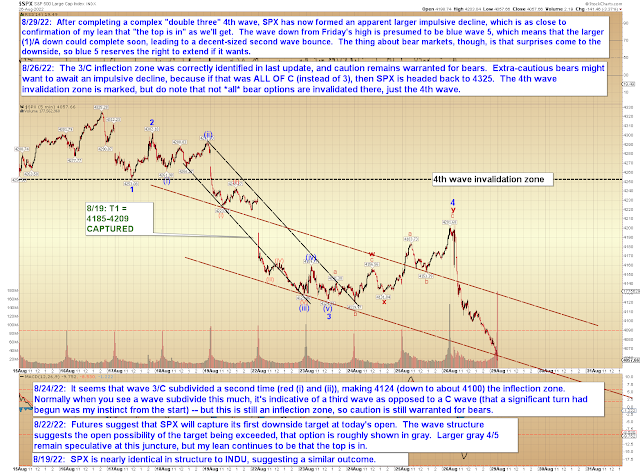

Near-term, this is still presumed (as in last update, I use that word quite intentionally; the most bearish case would be a deeply-nested third wave) to be a fifth wave:

Big picture:

In conclusion, the first thing bulls need to do is reclaim the broken black trend line (1st chart). If they can do that, then they could put together a larger bounce, or at least a sideways time-burner. If they can't, then a fifth wave extension stays on the table. Overall, everything appears to continue to be on track for the read I've emphasized for the past couple weeks: Namely, that bears have regained control. Trade safe.

Monday, August 29, 2022

SPX Update: Confirmation

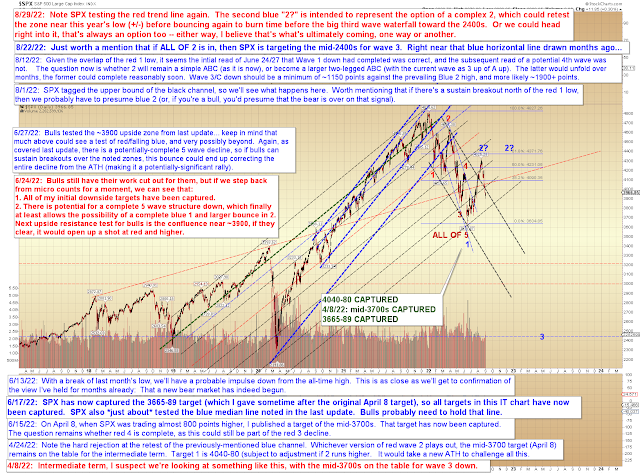

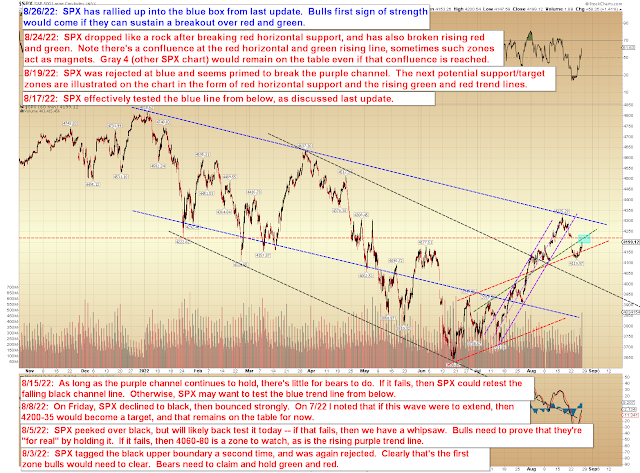

[O]n the first two charts, we can see that bears have formed a small impulse down (blue 1/A), but still have work to do in order to create a larger impulsive turn, which is what's required in order to suggest a larger trend change. I'm leaning toward the idea that they will (and that we've about seen the end of this bear market rally), but that's just a pure hunch, so take it with a grain of salt -- from an objective scientific standpoint, it's too early to say whether or not this decline will become impulsive.

Friday, August 26, 2022

SPX Update

Wednesday, August 24, 2022

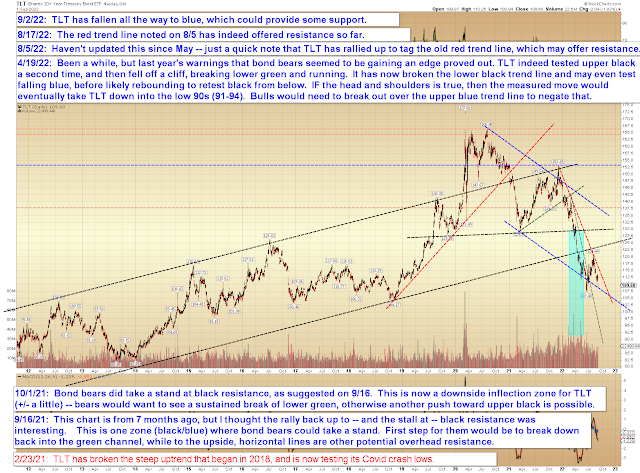

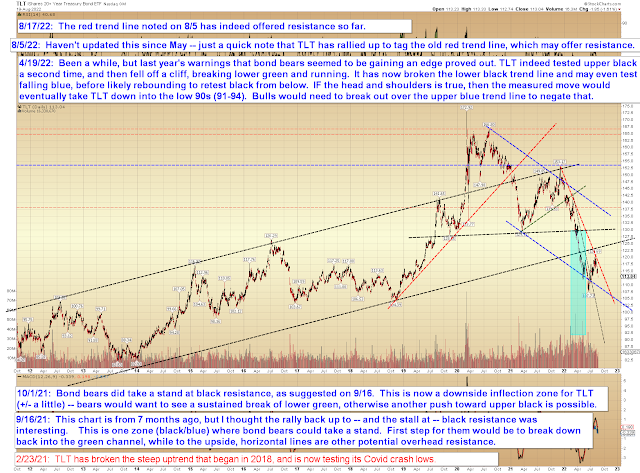

SPX, NYA, TLT: Inflection Zone

Monday, August 22, 2022

SPX, INDU, NYA, TLT: Downside Targets (Will Be) Captured

...on the first two charts, we can see that bears have formed a small impulse down (blue 1/A), but still have work to do in order to create a larger impulsive turn, which is what's required in order to suggest a larger trend change. I'm leaning toward the idea that they will (and that we've about seen the end of this bear market rally), but that's just a pure hunch, so take it with a grain of salt -- from an objective scientific standpoint, it's too early to say whether or not this decline will become impulsive.