Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, August 26, 2022

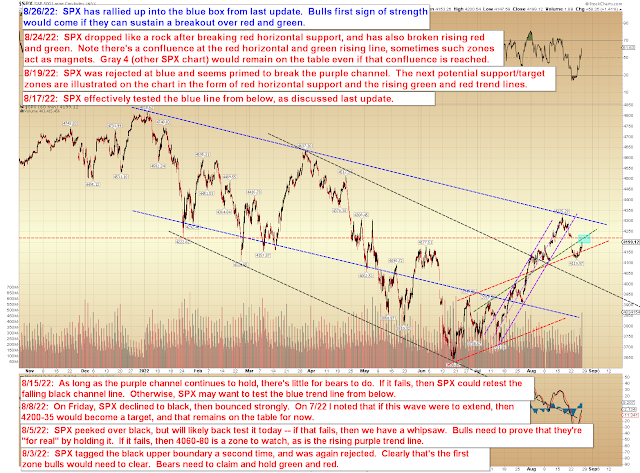

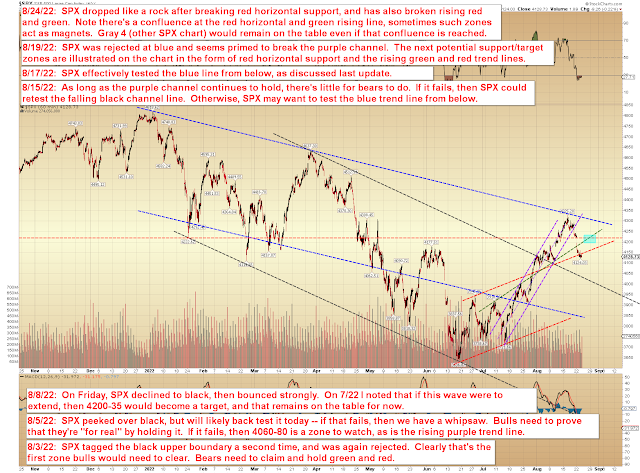

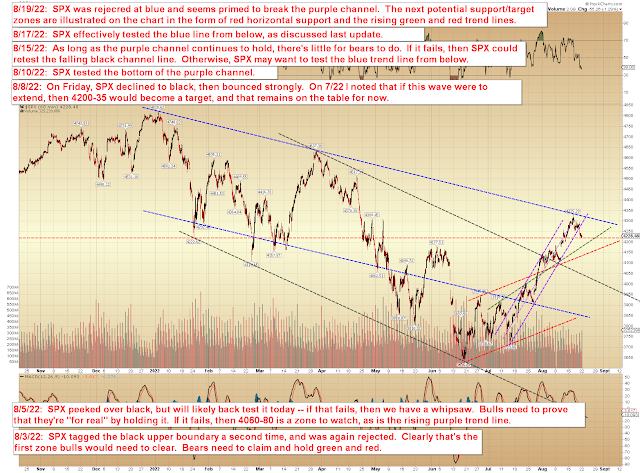

SPX Update

Wednesday, August 24, 2022

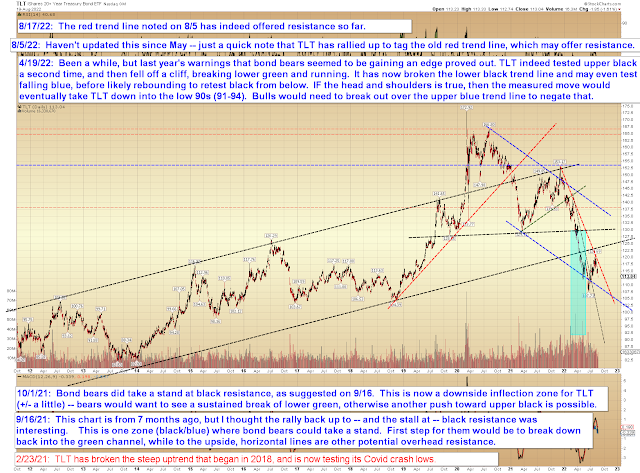

SPX, NYA, TLT: Inflection Zone

Monday, August 22, 2022

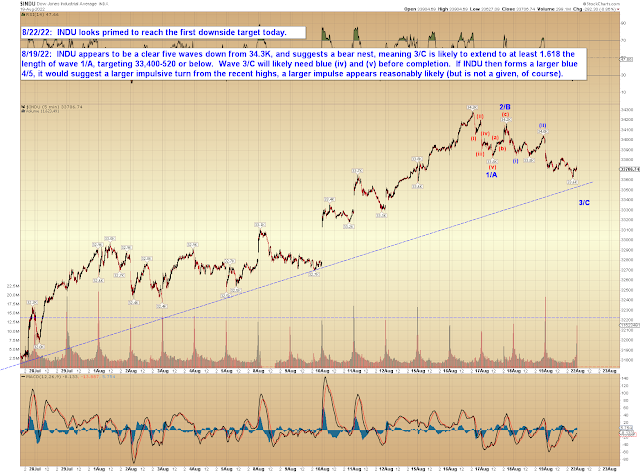

SPX, INDU, NYA, TLT: Downside Targets (Will Be) Captured

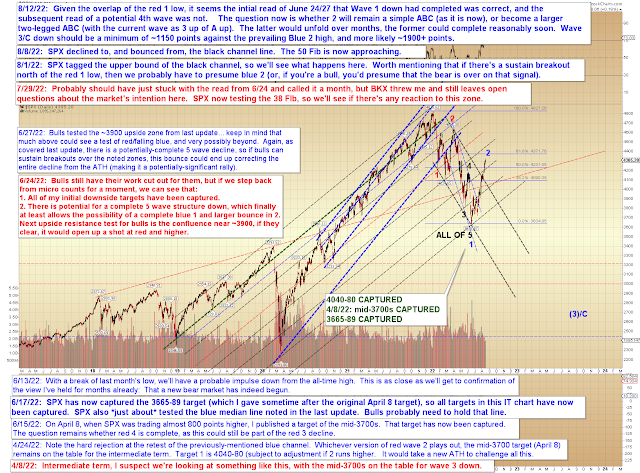

...on the first two charts, we can see that bears have formed a small impulse down (blue 1/A), but still have work to do in order to create a larger impulsive turn, which is what's required in order to suggest a larger trend change. I'm leaning toward the idea that they will (and that we've about seen the end of this bear market rally), but that's just a pure hunch, so take it with a grain of salt -- from an objective scientific standpoint, it's too early to say whether or not this decline will become impulsive.

Friday, August 19, 2022

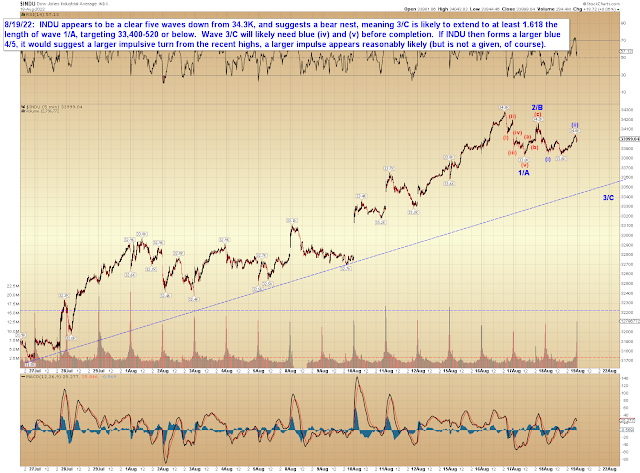

SPX, INDU, COMPQ: Bears Off to a Good Start

Last update concluded:

...multiple markets have tagged potential resistance zones concurrently, and that may cause a negative reaction.

In other words, if bears are going to show up again, this is as good a time as any for that to happen. Maybe even better.

And bears have indeed finally shown up again. Let's dive into the charts and resume the discussion after that, starting with INDU:

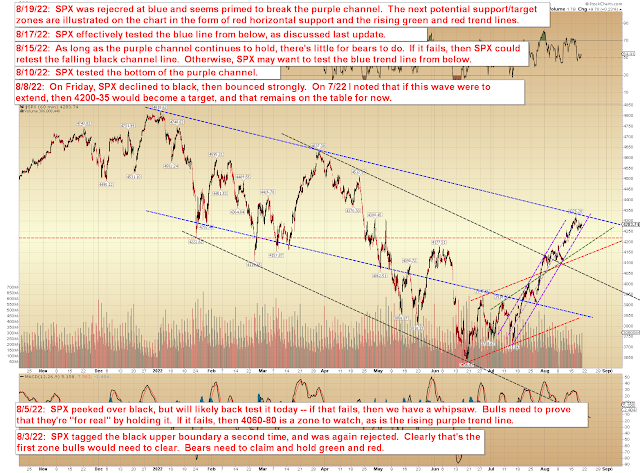

SPX looks very similar:

From a trend line perspective, SPX is on the verge of breaking down from the purple melt-up channel:

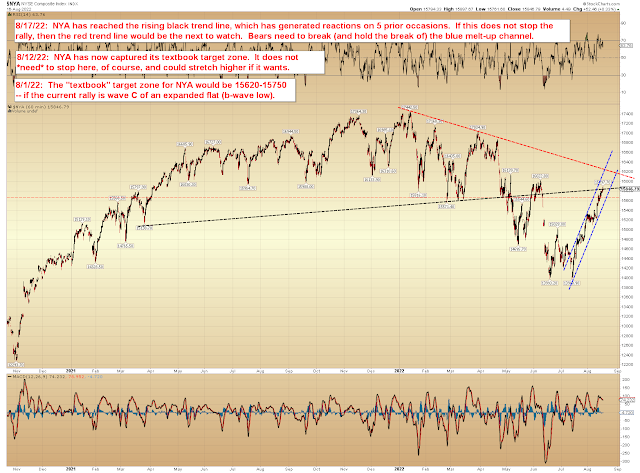

NYA was rejected on its test of the noted black trend line:

And nothing added to the COMPQ intermediate chart yet:

In conclusion, on the first two charts, we can see that bears have formed a small impulse down (blue 1/A), but still have work to do in order to create a larger impulsive turn, which is what's required in order to suggest a larger trend change. I'm leaning toward the idea that they will (and that we've about seen the end of this bear market rally), but that's just a pure hunch, so take it with a grain of salt -- from an objective scientific standpoint, it's too early to say whether or not this decline will become impulsive. Also, although futures are suggesting a gap down open, be aware that there is an option for a less direct route than shown on the first two charts, in the form of an immediate rally back up toward 4287-4300, which could then be followed by a renewed decline later today or Monday. Trade safe.