Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, August 3, 2022

SPX and BKX: Inflection Zone

Monday, August 1, 2022

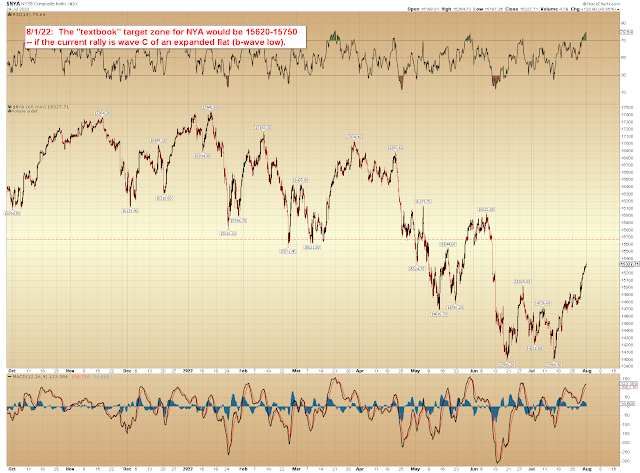

SPX, BKX, NYA Updates

Friday, July 29, 2022

SPX and BKX: Bad News is Good Again

- It presupposes that the Fed has near-complete control over the market.

- It presupposes that if the Fed slows down, then the bull market will return -- despite the fact that the prior bull market was not supported by a "slowing/neutral Fed," it was supported and driven by a Fed that had both feet on the liquidity accelerator.

- It presupposes that bad econ data will fix inflation, thus allowing the Fed off the hook.

- It presupposes that everything else in the world goes swimmingly -- which means, among other things, that Russia will simply back down, oil will suddenly flow abundantly again, and our Vaunted Leaders will stop (seemingly) actively working to destroy America and the American people.

- It essentially presupposes that "good times are here again, just as long as that pesky Fed doesn't ruin everything!" Which is kind of laughably naive, when you think about it.

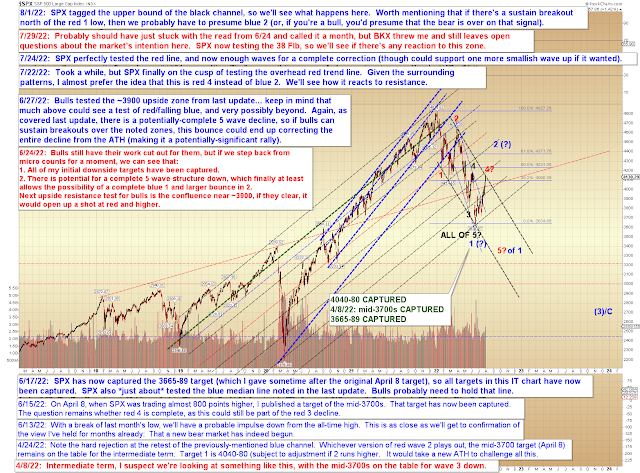

Nevertheless, in the event of a breakout, there is potential resistance not far above, in the 4085-4100 zone.

And futures are into that zone now, so we'll see how the market reacts to it, then take it from there. In SPX, the current rally is still just three waves up and not yet a larger impulse, so it is still a corrective form -- for now. Trade safe.

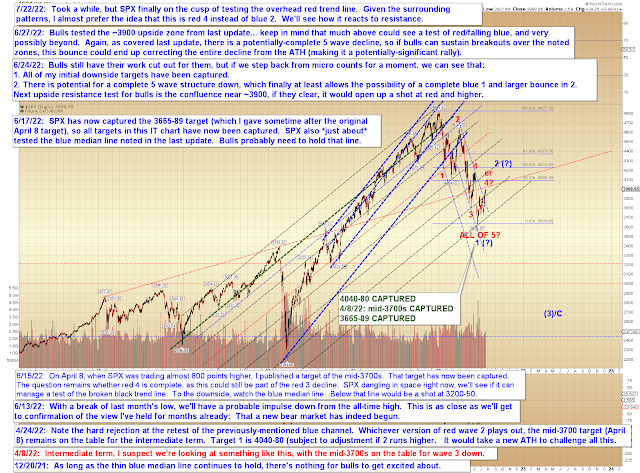

Wednesday, July 27, 2022

SPX, BKX, COMPQ, INDU Updates: Top Looks Closer than the Bottom

Monday, July 25, 2022

SPX and BKX: Minimum Upside Target Now Captured

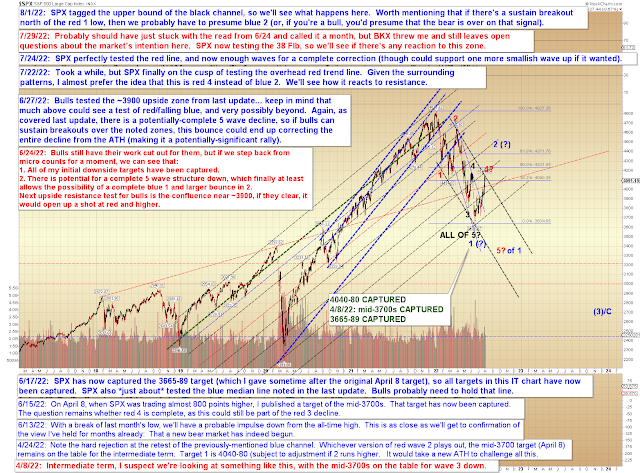

Last update decided we'd stick with the most straightforward count for the time being, and the market obliged by reacting to resistance on the nose:

On the chart above, I have changed the color of some of the labels, as I somewhat like the idea that this current wave is red 4, with us still in the larger wave 1 down.

Near-term, SPX captured its target zone:

BKX has done enough to call it complete if it wants:

In other news, The WHO officially declared Monkeypox a global emergency, then smashed their amplifiers with their guitars, before performing an encore of "Magic Bus." I don't know why we have to listen to Pete Townsend on global health issues and think The WHO should stay in their lane, but whatever, I thought it interesting as it might serve as "news" to give the pundits a "reason" for the market to decline in a fifth wave ("Oh, the rally was underway, but then MONKEYPOX yada yada yada, bulls just can't catch a break!")

In conclusion, there are enough waves in place for the market to reverse here. It's always tricky determining if there's still "one more little wave up" needed, and that's the case here as well -- so the pattern could support slightly higher prices, but they are neither required nor desired. If you held my feet to the fire, I'd probably lean toward the idea that the top is in for this wave, but I would heavily hedge that lean with the standard caveats. Trade safe.

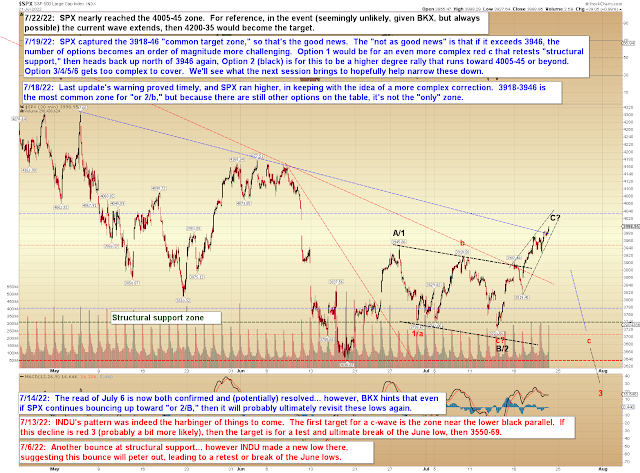

Friday, July 22, 2022

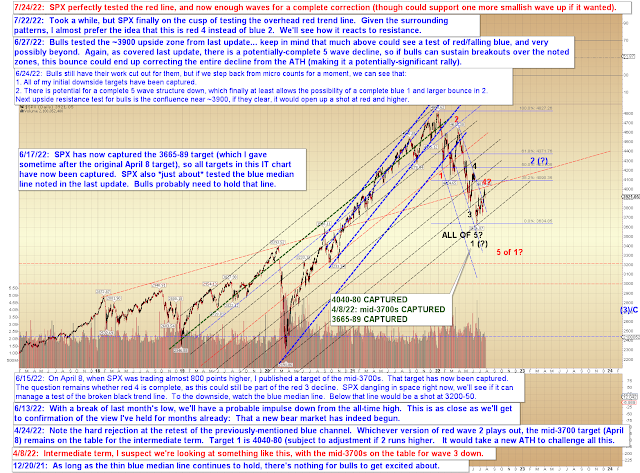

SPX and BKX: Wait and "C"

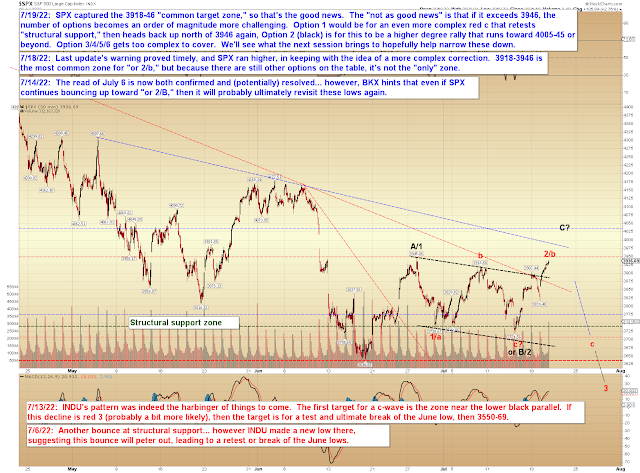

Tuesday, July 19, 2022

SPX and BKX Updates: Market May Have Had Enough of Making It Easy

The last couple of weeks in the market have formed a complex pattern, but we've stayed one step ahead of it the whole time, so it's been relatively easy to predict -- but things may be about to grow much less predictable. Because the market is complex enough on its own, I don't like to present too many options (even though such options often exist in reality), since then things get too confusing for readers, so today we're just going to focus on the two most straightforward options, then we'll see what the next session or two bring.

First up, let's look at BKX again, to confirm that it does indeed appear to be three waves into the last swing low: