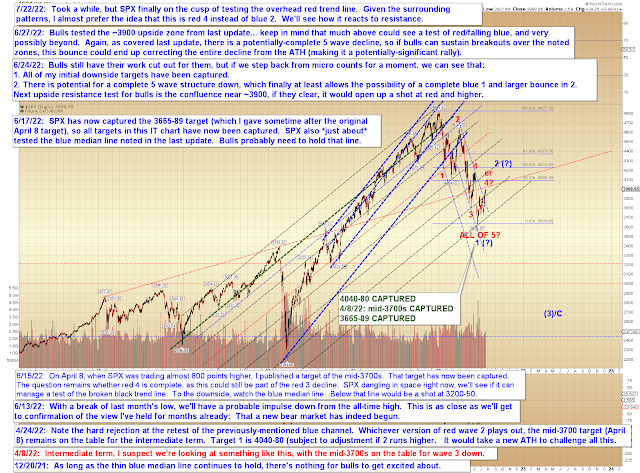

Last update decided we'd stick with the most straightforward count for the time being, and the market obliged by reacting to resistance on the nose:

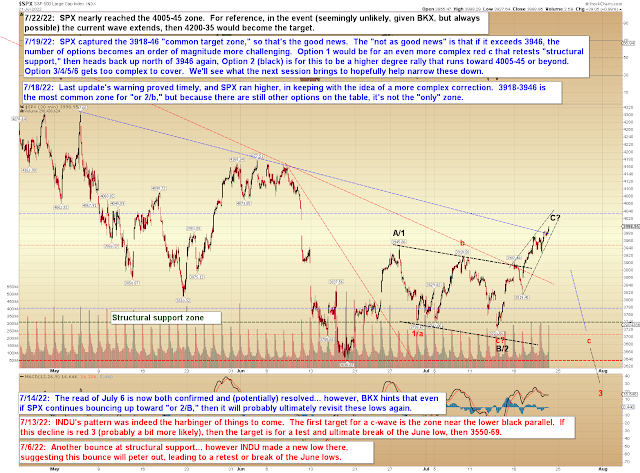

On the chart above, I have changed the color of some of the labels, as I somewhat like the idea that this current wave is red 4, with us still in the larger wave 1 down.

Near-term, SPX captured its target zone:

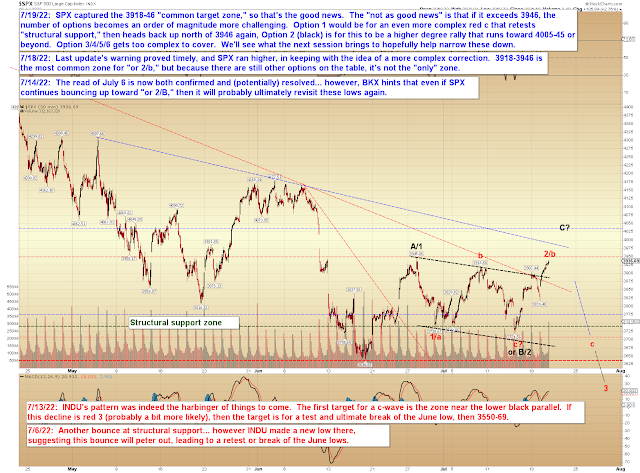

BKX has done enough to call it complete if it wants:

In other news, The WHO officially declared Monkeypox a global emergency, then smashed their amplifiers with their guitars, before performing an encore of "Magic Bus." I don't know why we have to listen to Pete Townsend on global health issues and think The WHO should stay in their lane, but whatever, I thought it interesting as it might serve as "news" to give the pundits a "reason" for the market to decline in a fifth wave ("Oh, the rally was underway, but then MONKEYPOX yada yada yada, bulls just can't catch a break!")

In conclusion, there are enough waves in place for the market to reverse here. It's always tricky determining if there's still "one more little wave up" needed, and that's the case here as well -- so the pattern could support slightly higher prices, but they are neither required nor desired. If you held my feet to the fire, I'd probably lean toward the idea that the top is in for this wave, but I would heavily hedge that lean with the standard caveats. Trade safe.