Today is a Fed Day, which means the market usually grinds around waiting for the announcement, then goes crazy for a minute, then seems to settle on one direction, which is often a fake-out, then heads the other way. Not always, of course, because that would be too predictable. But more than half the time.

It will be interesting to see if the Fed goes with the .50 increase they've been telegraphing for weeks, or if they go with .75, given that inflation is the highest it's been since the days when the Dodge Aries K was cutting edge new car technology. If the Fed raises .75, investors will never trust their jawboning again.

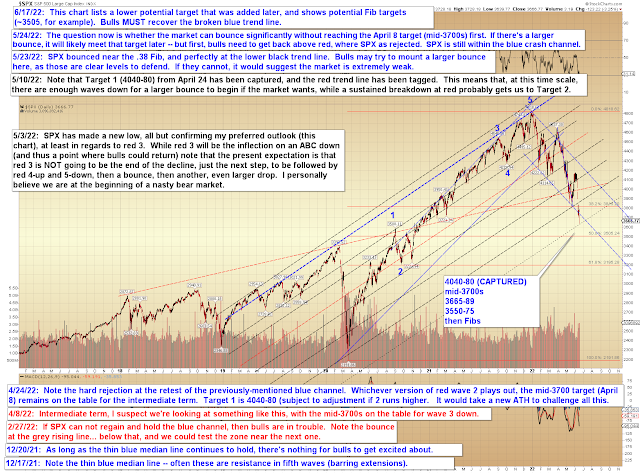

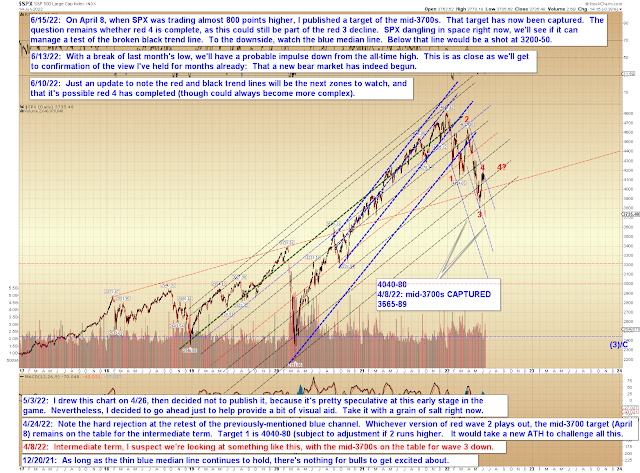

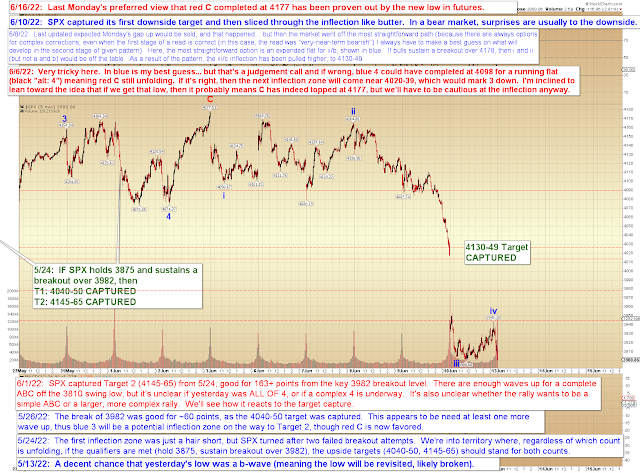

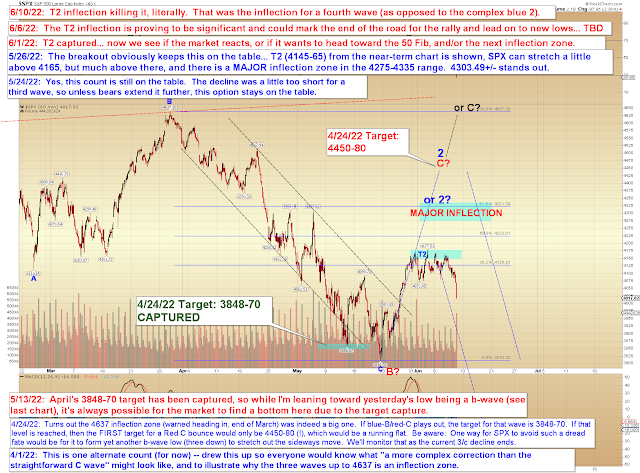

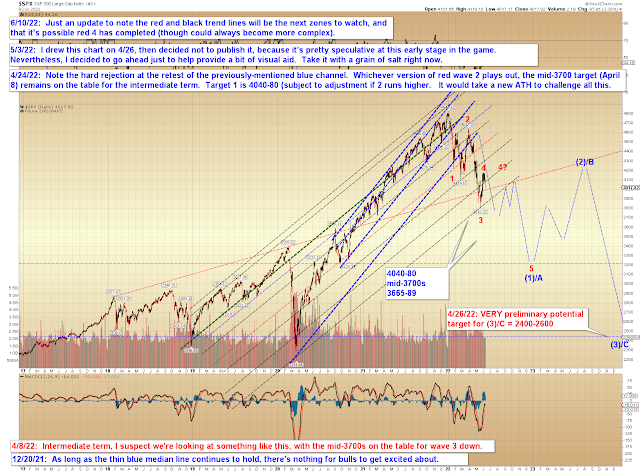

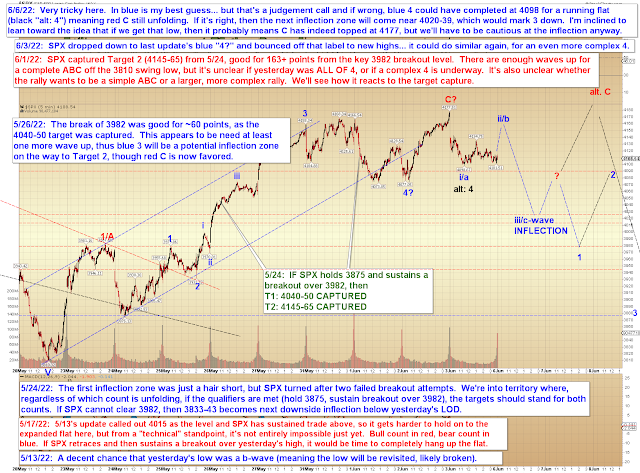

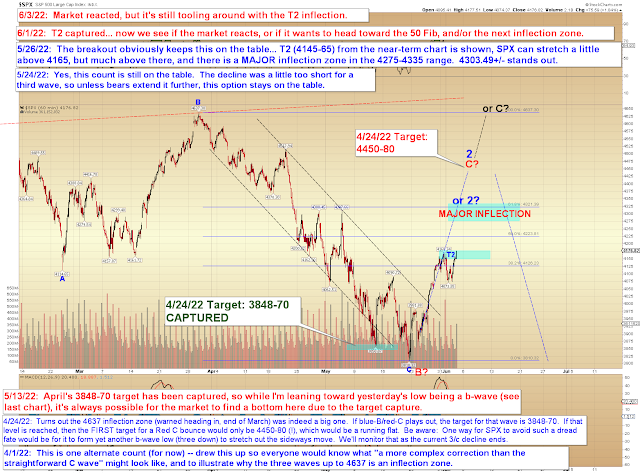

Chart-wise, first up, my back-of-the-napkin target (read: I looked at the chart and this was where it looked like the market wanted to go -- very early in a pattern, targets are best derived by relying on experience instead of calculators, for me, anyway) of "mid-3700s" was captured:

COMPQ faces an interesting test:

BKX still in the same place:

NYA, unless it's working on a WXY or something ultra-complex, will look terrifying if that black trend line fails for more than a brief moment:

And finally, in a fast-moving market like this, big picture trend lines can become more important that micro counts:

In conclusion, there are some potential support zones nearby (50 month MA in COMPQ, trend lines in other markets), so we'll see if bulls can mount any sort of bounce here. If they can't, particularly if NYA's lower line fails, we could enter waterfall territory. Trade safe.