Let's talk about the bigger elephant in the room: In my estimation, people who still believe the Fed will reverse course aren't paying enough attention. The Fed has made it abundantly clear that their number one goal right now is price stability, which can only be achieved by taming inflation. In order to tame inflation, the Fed is going to continue to hike rates and feed volatility. The simplest way to understand this is to recognize that the Fed's goal is to achieve, essentially, a "negative wealth effect."

Which means asset prices

must fall. To the Fed's current mindset, the fall of asset prices is a feature, not a bug.

The Fed is not worried with the S&P below 4000 -- the Fed wants the S&P below 4000. To achieve its goals in this environment, it needs SPX below 4000. And well below 4000.

QE and government "stimulus" spending created runaway inflation; to reverse inflation, the Fed must reverse the effects of QE and government spending. The Fed needs demand to weaken and supply to increase, and in order to do that, the Fed must drain the excess liquidity that was poured into the market and the economy.

Put simply: The Fed needs to destroy wealth to tame inflation. And, more importantly, it seems committed to that goal.

Some bulls have argued that we won't see a recession because household and business balance sheets remain strong. But bulls are stopping their analysis too soon and aren't taking this to its logical conclusion: The Fed cannot tame demand if balance sheets remain strong. Which means that in order to achieve its goals, the Fed needs balance sheets to become weak, so destroying balance sheets becomes part of the plan. "Balance sheets remain strong" is thus not an argument that "there will be no recession," it is instead an argument the Fed will continue pushing the market down.

By all current appearances, it seems the Fed only reaches its goals by continuing to feed volatility and destroying wealth until the economy is in recession. Thus, the Fed is not going to reverse course when the economy starts to struggle (unless inflation has abated), because they currently view a struggling economy as necessary to tame inflation. And the Fed won't bail the market out as it heads lower, because the Fed wants the market lower.

Needless to say, this is not the same environment the market faced during the 13+ year bull; it is the complete inverse. Bulls have not yet come to terms with this new reality. Just as many bears struggled back in 2012 and 2013 with accepting the reality that Bernanke's Fed was committed to reflating every bubble it could, bulls will now suffer the same fate, in reverse. With every dip, they will assume the Fed is waiting just around the corner to again bail the market out. And why wouldn't they assume that? After all, that's what happened for the past 13 years.

But the Fed will not bail the market out. Not this time. At least not yet.

My personal theory is that the Fed won't bail out the market until it's too late and too much damage has already been done. I base this speculation largely on the charts, but even if I had no charts, I would probably speculate the same thing, because the Fed always overshoots, in both directions. Thus, I suspect that by the time the Fed tries to reverse course, it will be too late to stop several large entities from collapsing under the pressure (the market is not ready for this environment, and most humans do not adapt to change quickly enough to make the adjustments they will need to make to save their organizations).

We're already seeing some early hints of this type of trouble, and things haven't even gotten rolling yet. As one example,

the fate of El Salvador is tied to Bitcoin; and when BTC tanked recently, El Salvador proudly proclaimed they had "bought the dip" (they did this north of $30K; and again, this is symptomatic of the ongoing bull market mentality -- you

"buy the dip" in bull markets; you

"sell the rip" in bear markets). Which means that, down the road, as the Fed continues draining, Bitcoin will continue to tank -- and eventually El Salvador may end up defaulting on its debt. What ripple effects will that have?

Surely we're also going to see several other collapses along the way as well. What consequences will ensue? One major collapse often begets another.

At some point, the dominoes will start to fall on their own, and the Fed will not have enough firepower to stop the chain reaction. And possibly not enough firepower to save the entire system, especially if there are other "unforeseen" events that enter into the equation (we've talked about some of these previously) to overpower the Fed's goodwill at precisely the wrong time.

That's my speculation at this moment, anyway, based on the Fed's stated goals and on the charts.

So I think the Fed wants a recession right now, and that's why they've lit this fuse -- but it's ultimately going to spiral out of their control, and things will collapse farther and (at some point) faster, than the Fed wants.

And that's when the Fed's lit fuse finally meets the rubber road less traveled (or however that cliche goes), and it all blows up.

Bulls are not seeing this because they're used to the "Fed put," and after 13+ years, a fair percentage have probably never even traded without it. They are conditioned, like Pavlov's dogs, to buy the dip every time a bell rings (although if memory serves, Pavlov's dogs' dip was guacamole, and they actually ate it). Bulls have no idea what they're in for. Even many bears are not seeing this clearly, for the same reasons. In my estimation, even most who are bearish are not nearly bearish enough. We discussed this a bit on the forum, but traders and investors are still thinking in terms of bull market corrections, not in terms of true bear markets. (That's why they haven't really started pulling funds out yet!) Many are acting like, "Oh, two legs down, cool! All good now, the market will be 'back to normal' in no time!"

That's not how it's going to play out this time around. We're still just at the beginning of the carnage, when many investors are thinking this is getting close to the end.

But then, that's sort of how it needs to be right now. Unfortunately.

Winston Churchill once said: "This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning."

In my view, that assessment would be too optimistic to describe the current market.

*****

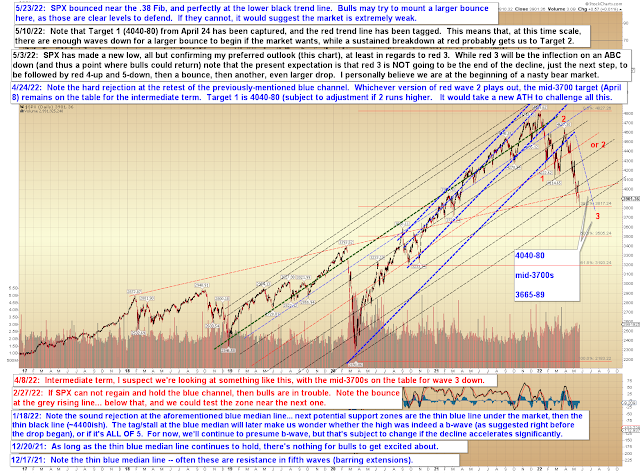

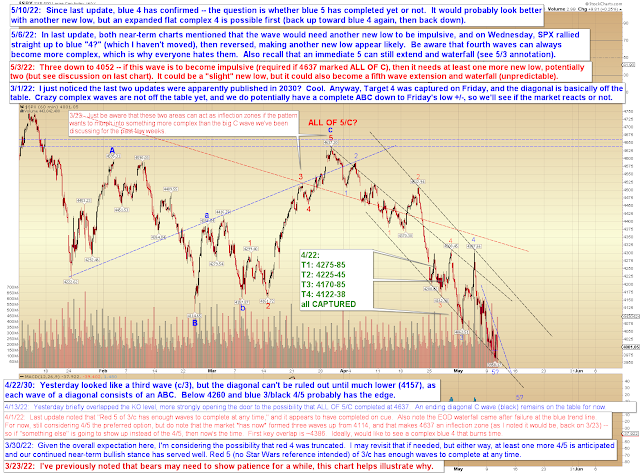

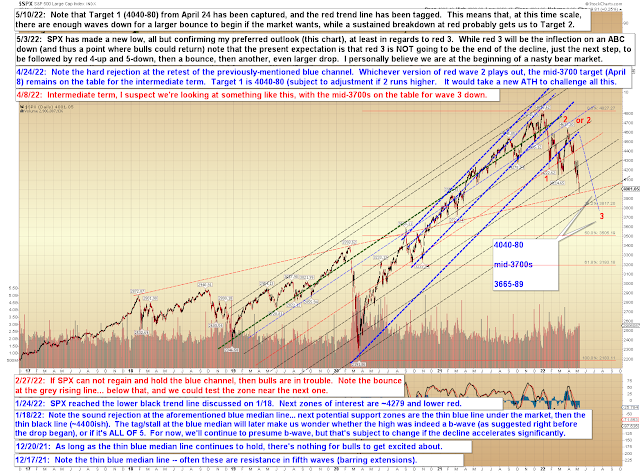

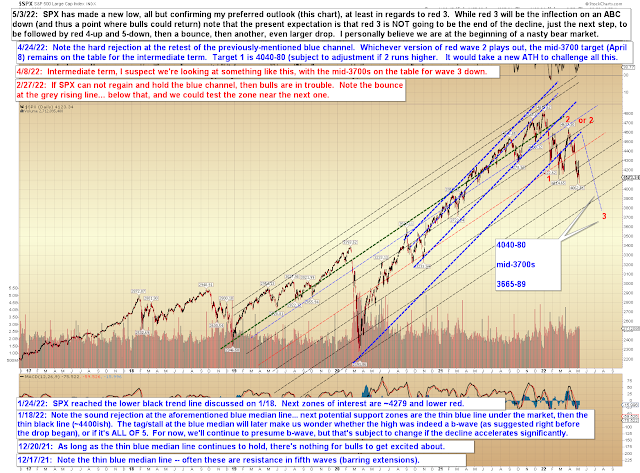

Chart-wise, SPX decided to capture April's target zone, then make things complicated with a potential b-wave low, since things had been too easy for us for too long. Last update hypothesized a level, but wave-structure-wise, SPX probably needs to stall around here to keep the potential b-wave on the table:

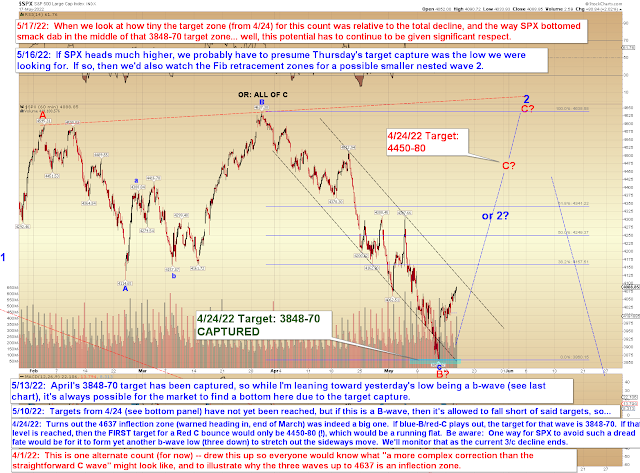

It would have been much easier if SPX had not bounced from smack in the middle of April's target zone:

In conclusion, I remain bearish on the bigger picture, now we're waiting for the market to announce whether this will become a more tradeable bounce, or if it's just a very-short-term pause. Trade safe.