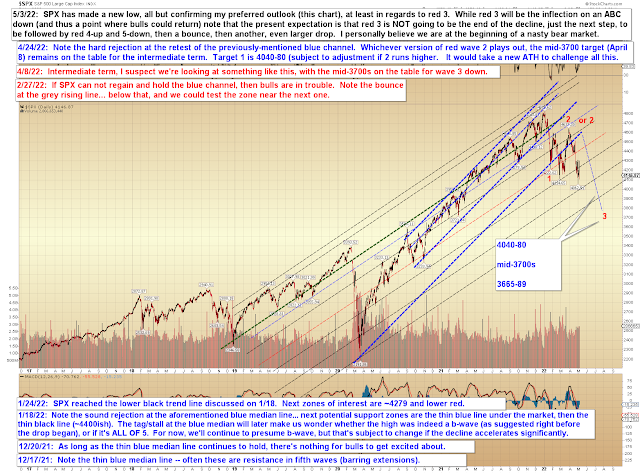

Something significant happened since last update: SPX made a new yearly low. This is significant because, for the past few months, I've been insisting that a bear market has already begun -- and this new yearly low is as close to "confirmation" as we're going to get at this stage.

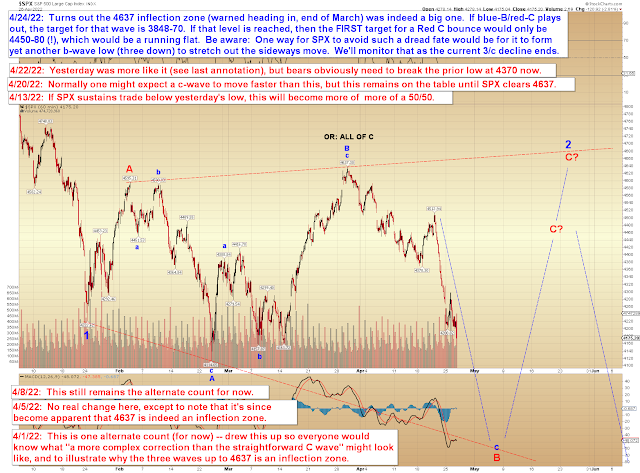

Let's look at the intermediate chart to understand why:

The first point is that this new low obviously removes any chance that 4114 was somehow "the end of the bear" (looking at you, Jim Cramer). Second, it's now pretty unlikely that SPX can bottom immediately without at least needing to return to make lower prices later (this would be in the event that it doesn't make lower prices directly). If it does start a larger bounce immediately (possible -- see forthcoming near-term charts), then it would, by all appearances, leave an incomplete wave at the low here and thus need to return to current levels to resolve that.

Now, even though I'm not currently publishing any intermediate or long-term alternate counts (because I'm viewing them as heavy underdogs), it's impossible to be 100% certain in this gig, so for sake of reference: The bull option would be for the current red 3 to be red C, which would complete the decline and rally up to new highs. At the risk of being wrong, I'll go on record here to say I think that's very unlikely (if my views on that weren't already obvious, given that I haven't published even so much as a hint of an alternate intermediate bull count in months).

I do find it interesting that,

supposedly, sentiment is "as bearish as it was in 2008." Having been a very active trader in 2008, I can say

that's complete garbage. In 2008, even bears were absolutely terrified that the entire system was on the verge of imploding. I don't see anything approaching that level of fear right now. To the contrary: Plenty of people are still touting the bull case. Plenty of people are saying things like, "Well, maybe if you were lucky enough to sell a few months ago..." (which

we were, because we're just that "lucky") "

then you should stay in cash, but otherwise, it's impossible to time the market and yada yada yada, so stay long and strong!"

Yep, "impossible to time the market." That's how we saw this top coming two years away.

For the last couple months, I've likewise heard plenty of people calling a "bottom" in the bond market, but it continued falling anyway.

The fact is: Most people are just not prepared for what's coming. Even most who are leaning bearish are not even in the ballpark of understanding what's coming if the Supercycle has in fact topped. Some are even speculating that the Fed will "let" it drop a little more, then step up with QE291 or whatever, and again bail the market out. Maybe they will -- but I suspect this faith in Fed Omnipotence is finally misplaced. Certainly I'll revisit my present assumptions if we ever need to, but from what I can see from here, the market's future looks darker than it has in a long time.

This bull, and even bear, complacency is to be expected after a ~13 year bull run, but it tells me bearish sentiment just isn't as bad as the numbers suggest. And it is most definitely nothing like 2008/2009. When people start assuming the Fed is completely powerless and the system is irreparably broken -- when every pundit you see on TV is sobbing uncontrollably during commercial breaks -- then it will be 2008-09 sentiment.

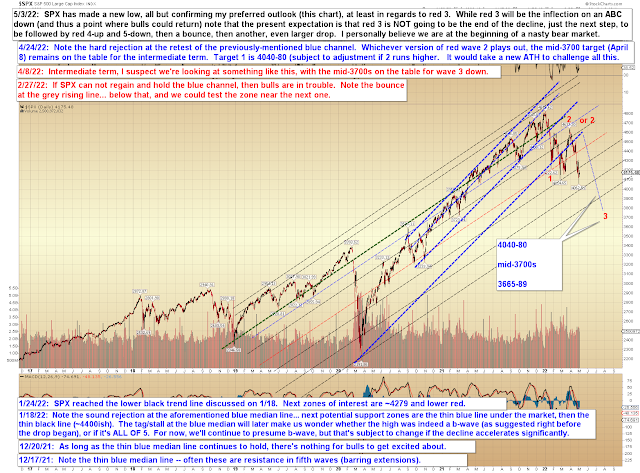

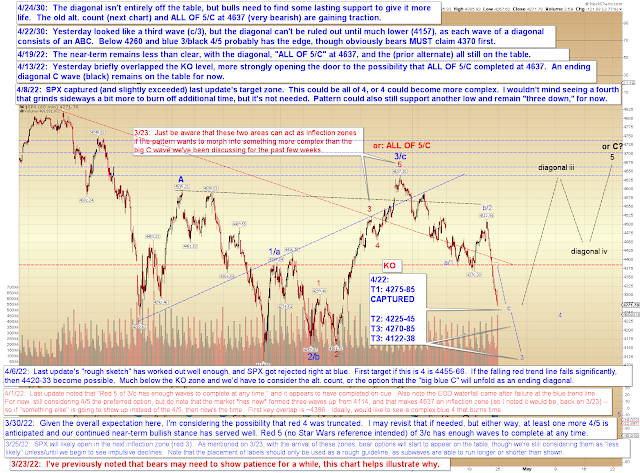

Anyway, let's take a look at one option for the bigger picture -- but do please take this with a grain of salt right now:

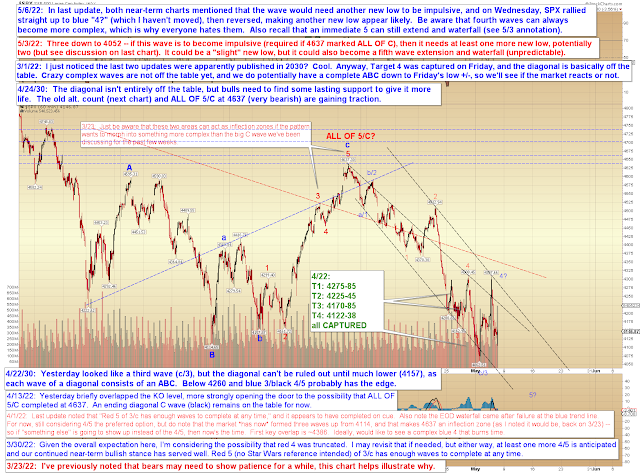

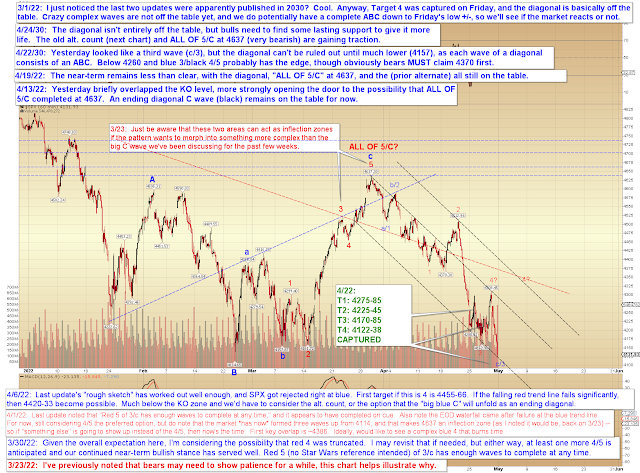

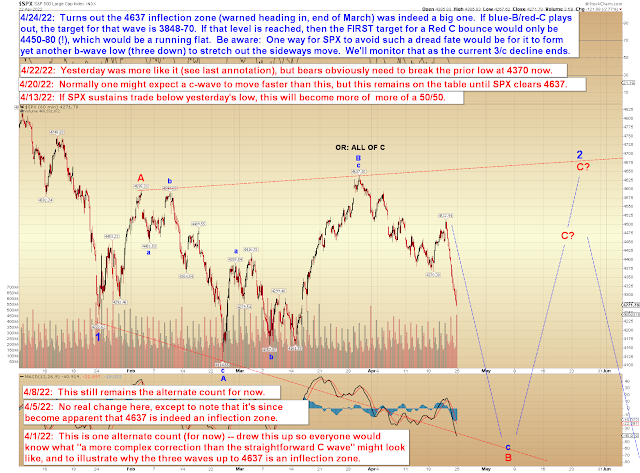

So big picture, I remain bearish. But near-term, the market always has options, so let's take a look at those. This chart has outlined the expanded flat since April 1, but expanded flats can tack on middle waves and run sideways much longer than is reasonable -- and they stink, because whether they will do that or not is completely unpredictable.

The next chart focuses more on the idea that ALL OF C completed last month. This count could see things get ugly more immediately.

Everyone no doubt wants to know which of those near-term options I'm favoring, and the answer is: Yuck. I mean, you're asking me to predict out of multiple largely unpredictable options here... but if I had to go, say 51% to 49%, I'd probably put the 51% lean toward some iteration of the expanded flat on the first chart, just because it would be the most confusing to the market, and would give bulls more hope and give bears more fear, and because I wasn't entirely crazy about the "resolution" it reached on the upside.

So, in conclusion, the big picture remains bearish -- but if they want max confusion over the near-term, they could opt for some version of the expanded flat... however, I don't have enough confidence in that option yet (currently) to grant that the full weight of a "predication" per se. Trade safe.