"One way or another, to get inflation under control, the Fed will need to push bond yields high and stock prices lower," Dudley said.

A couple days before that, Deutsche Bank became the first major bank to forecast a U.S. recession. They're currently predicting a "moderate" recession, which is a recession that only impacts political centrists. (Personally, I suspect we'll get a more radical recession, so moderates may be safer, relatively-speaking.) Deutsche Bank opined that the U.S. economy will take a “major hit from the extra Federal Reserve tightening by late next year and early 2024,” concurrent with “two negative quarters of growth and a more than 1.5% rise in the U.S. unemployment rate.”

Former Fed Governor Lawrence Linsday, who's famous for having "LL" embroidered on every damn thing he owns, predicted on Monday that the US will fall into recession as soon as this summer. (I suspect this is closest to correct; I think we get there sooner rather than later. Late 2023 seems too far off.)

So. It seems that the cows are finally coming home to roost, and it's nice to see some big names are only a few months behind us in anticipating a longer-term bearish outlook. On December 1, 2020, I wrote:

...the fifth wave is the final wave of a move -- which, now that we're finally getting into a potentially-complete wave structure, means we're likely approaching the end of the 12+ year bull market.

***

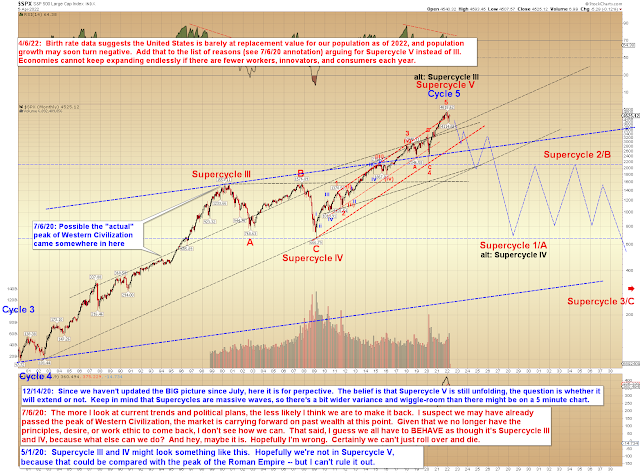

On the next chart, we'll look at a signal to watch that could tell us if the fifth wave of this fifth wave is going to extend. Thus, we can reasonably presume the fifth wave is ending here if that signal does NOT materialize.

And here's that chart (as published December 1):

As I've said for years: The charts lead the news. And, as I've also said for years, it really makes no sense that Goldman Sachs isn't paying me an 8-figure annual salary (plus bonuses). Speaking of, the folks at Goldman are currently putting the odds of a 2024 recession at only 35%. Very optimistic, GS, very optimistic.

Anyway, it's interesting to see some big names finally jumping on board -- assuming we are where we think we are, that will continue to happen more and more. Let's get to the current charts.

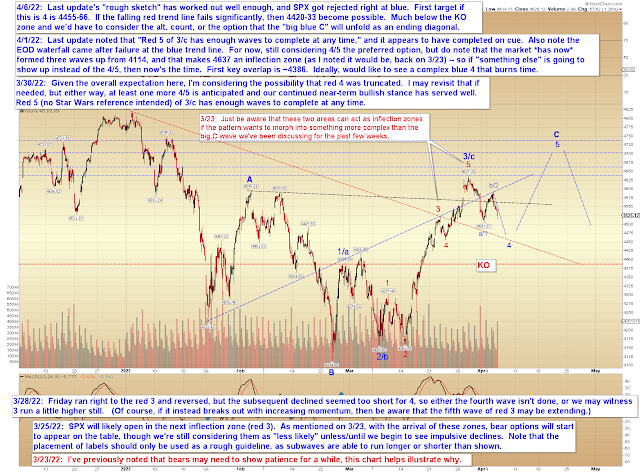

The preferred count captured and slightly exceeded its fourth wave target:

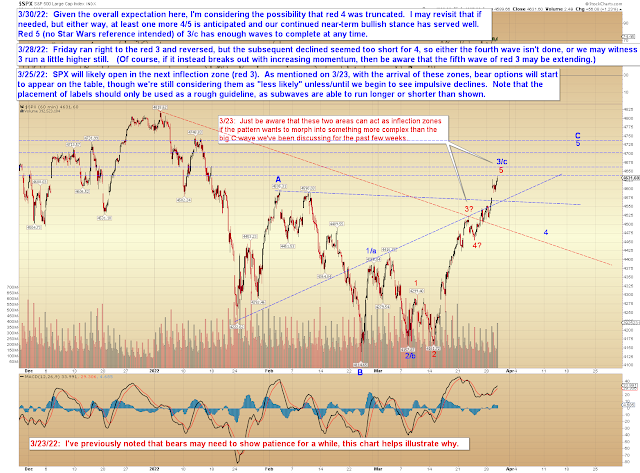

The alternate count remains the alternate:

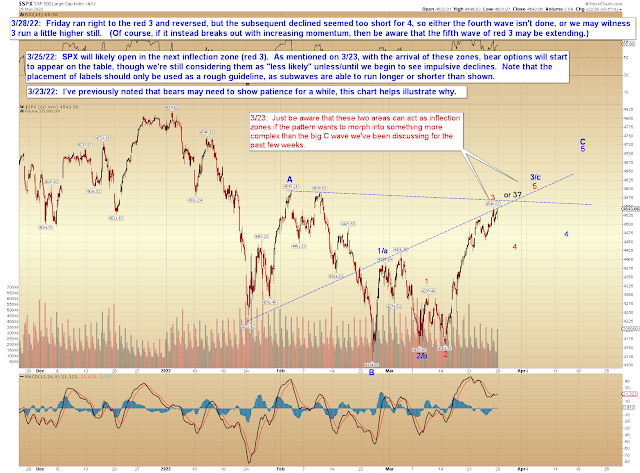

While intermediate term, I suspect we're ultimately headed toward the mid-3700s:

In conclusion, no real change to the charts, but interesting that the rest of the world seems to be gradually waking up to the bear potentials. Trade safe.