Since December, I've been arguing the case for a bear market via charts. Today, let's look beyond the charts.

On a superficial level, the case for a bear market is now becoming apparent to more and more people: Quite simply, the Fed has signaled that it is going to meet inflation aggressively, with Powell repeatedly making hawkish statements on Wednesday. In fact, he went out of his way to overstate (some might say "exaggerate") the strength of the labor market. Here's one of several examples:

"Labor demand is very strong, and while labor

force participation has increased somewhat, labor supply remains subdued. As a result,

employers are having difficulties filling job openings, and wages are rising at their fastest pace in

many years. FOMC participants expect the labor market to remain strong, with the median

projection for the unemployment rate declining to 3.5 percent by the end of this year and

remaining near that level thereafter."

Pretty strong language -- and he reiterated this view multiple times during the Q&A portion, so it's clear he's trying to focus on factors (beyond inflation) that can act as justification for rate hikes. Further:

"We know that

the best thing we can do to support a strong labor market is to promote a long expansion, and that

is only possible in an environment of price stability. As we emphasize in our policy statement,

with appropriate firming in the stance of monetary policy, we expect inflation to return to

2 percent while the labor market remains strong. That said, inflation is likely to take longer to

return to our price stability goal than previously expected. The median inflation projection of

FOMC participants is 4.3 percent this year and falls to 2.7 percent next year and 2.3 percent in

2024; this trajectory is notably higher than projected in December, and participants continue to

see risks as weighted to the upside."

So Powell is stating quite clearly that, to quote the man himself, "the committee is committed" to raising rates and attempting to tame inflation -- and the FOMC believes that the economy can handle it just fine (they always believe this).

Bulls hoping for last-minute wavering by the Fed aren't taking Powell's words to heart. Powell has quite clearly stated that the free money party is ending. But it's been so long that many investors may have forgotten that the old market wisdom of "don't fight the Fed" cuts both ways.

For the first time in a while, the Fed is explicitly warning that they will no longer be backstopping the bulls.

It's also worth mention here that some firms are anticipating upwards of

7 rate increases for 2022 (Goldman Sachs). The last time we saw that many rate hikes in a single year was 2005 (which saw, if memory serves, 8). Of course, QE didn't even exist in 2005, so there was no concurrent taper to create additional market pressure along with those rate hikes -- and although stocks traded sideways-up through 2005, we know where it all eventually led.

History may not always repeat, but it often rhymes.

In any case, the point is, the Fed has signaled that it intends to act, and the market is ignoring that for now -- as we suspected it might, based on the potential of a large C-wave rally. We do have 13 years of conditioning for the market to typically rally on the Fed, and short-covering rallies can be funny and powerful things.

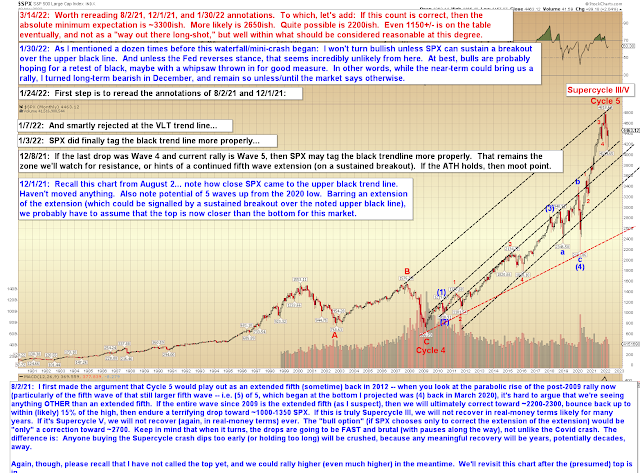

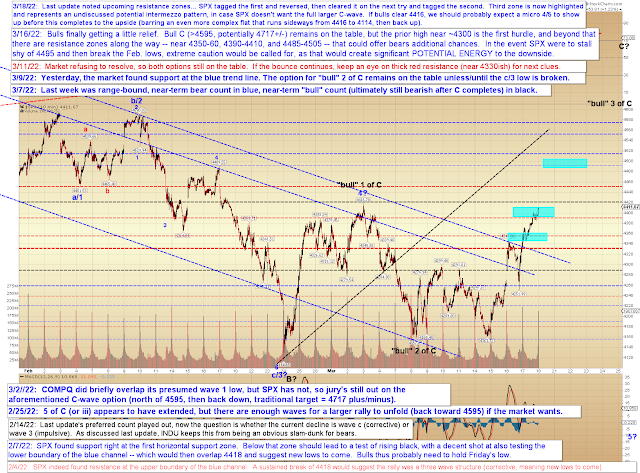

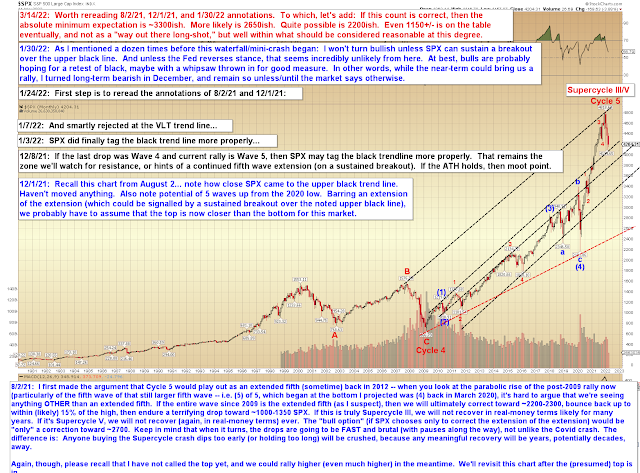

Moving on to the charts, SPX broke above 4416, so this (as I noted last week) indicates that the rally likely still has even farther to go, with the next inflection coming near 4485 -- and beyond that, potentially into the 4700s, so bears may want to continue to show patience. We are most likely in 3 of C right now, so presumably this pattern will need a fourth wave correction, then a fifth wave up, before there's much potential for a more serious reversal (again, barring some intermezzo patterns that we'll discuss in more detail if it becomes appropriate).

Bigger picture, the most bullish case would be to revisit the very long term upper-black trend line -- but even then, I would remain long-term bearish unless SPX could sustain a breakout there.

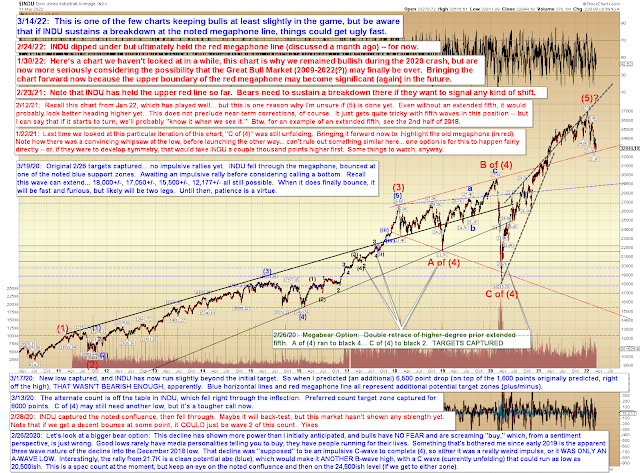

I also wanted to call attention to a comparison of SPX and oil, because recently these two markets in tandem have reminded me of 2007-2008:

Does the above chart mean anything? Don't know. But being that I was a heavily-active trader during the 2007-09 bear, the similarity has been on my mind lately.

In conclusion, we should probably expect SPX to at least continue toward the next inflection zone (around 4485), where there are some oddball patterns that could come into play. If it clears the next inflection zone, then bears may want to continue to show patience, as the potential that we're in a larger C-wave is still very much alive. Trade safe.