Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, October 21, 2015

SPX Update: Short and Sweet

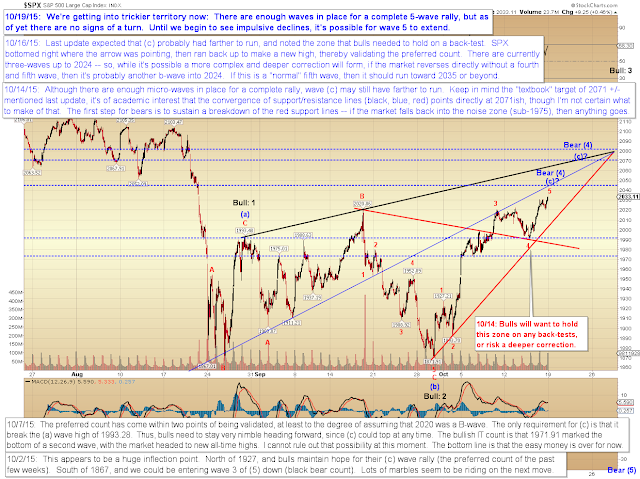

Since last update, the market has ground its way sideways/up, reaching the 2035-40 target. There's just nothing to add based on the recent action, except to note that the longer SPX hangs around the current price zone, the higher the odds that the current wave extends. As I've noted on several occasions, the "textbook" target for the current wave is 2071 +/-.

Beyond that, there's nothing else to add. Bears should remain cautious if SPX can sustain trade north of the blue dashed resistance line. Trade safe.

Monday, October 19, 2015

SPX and INDU: Giving the Bulls Some Airtime

SPX is finally getting a little bit tricky to read. For the near-term, we've been on the right side of this move (heading both directions) ever since the Fed Spike to 2020 (the first time). Since then, at each inflection point, the market has tipped its hand just a little, allowing the preferred count to capture virtually every dollar of the rally from 1871. Intermediate-term, we've been on the right side of the trade since the all-time-high.

But right now, the near-term has become a bit veiled, and the intermediate picture along with it.

We could be completing a large c-wave rally -- but there are no signs of a turn yet, so it's quite possible the move has farther to run. My current instinct is that we may see a correction unfold here, but the final highs probably aren't in just yet. Don't hold me to that, though: sometimes the market just doesn't want us to know for sure what's coming next. My system got us about 150 points off the low -- right now, that's all I've got. If your system is giving you some type of actionable signal here, then by all means, follow that. I'll let readers know when the wave patterns allow me to form another strong(er) opinion.

TRAN is interesting now, inasmuch as it stalled shy of the next key upside level, then started to back away from that level. This keeps all options open for the time being.

I can't do much to influence the market, but for the sake of bears, I'll try to do my part here. Speaking generally, I can sometimes completely end a move by finally giving more airtime to a wave count that considers the preferred count may have been too conservative or too aggressive. (I'm being facetious, of course -- I can't end a move all by myself! It takes thousands of readers collectively considering whatever chart I put up, in order to end the move. It's more of a group effort!)

So, here's a chart that could end this rally: A more bullish flat than previously supposed.

Here's another interesting chart: The red line represents the approximate boundary of the Massive Multi-year Megaphone (or "MMM" for short -- no relation to the sound people make about ice cream, or to Massive Multiplayer Online gaming.). If you don't know what Megaphone I'm referring to, just Google "Fully leveraged short position total account wipeout jaws of death the top is in. Again." and you'll probably pull up 70-80,000 references -- mostly from folks who were a little early.

In conclusion, we're into an inflection zone that could generate a turn if this is a basic (c)-wave with a very simple and straightforward structure (approximate percentage of the time a structure is completely straightforward: 0.0002%). We're still a little short (no pun intended) of the "textbook" target for this wave, though, so it's quite possible there's more room for the rally to run, and my instinct is that it probably will run at least a bit farther, possibly after a correction. Nevertheless, we're very near a point of perfect balance, so I'll keep watch for impulsive waves in the downward direction, which will be our first solid indication of a turn -- and I'll also keep watch for near-term patterns that signal how much more upside could be left (if any, of course). Until then, trade safe.

Friday, October 16, 2015

SPX Update: Market Validates Near-term Preferred Count

The preferred count in Wednesday's update anticipated that SPX was forming an expanded flat, and headed down to test support near the breakout level. Wednesday's update ended with:

In conclusion, we can't rule out an immediately bearish wave -- i.e., we can't rule out the idea that ALL OF (c) is complete. However, that presently appears to be at least a slight underdog to the idea that (c) (or "3" for the bulls) is still unfolding. If bears begin claiming levels that should be acting as support, then we may have to give bears more credit.

Bears never broke support, instead the market did a perfect back-test. On Thursday I did a quick "bonus" update at no additional charge (yours to keep even if you return the set of steak knives!), and noted that:

...we do currently have enough waves down for a complete C-wave decline, if that's what the market wants, and futures are currently green. If that low breaks down in a significant fashion, then bulls should respect that as potential trouble -- vice-versa for bears if INDU can break back up into the topping pattern.

The low never broke, and the count of a complete C-wave decline proved out.

So here we are again, in an "the easy money is over" situation, and we're reduced to simple trend following until the market gives us its next clear signal.

Bigger picture, let's not get too focused on the (c)-wave count as the "only" count. There are definitely bull options for this to be a third wave, so there's no need to sell every new high. The worst disease for bears to get right now is "Fear of Missing the Top," because this leads to emotional trading and bad decisions. Tops are usually pretty clear. Worst case, you get something like the Fed Spike we had last month and an abrupt reversal. So what. That move made the market's intentions obvious immediately -- and there was still plenty of money to be made following the preferred count into its target zone of 1865-80 SPX.

As noted previously, even a bearish c-wave could extend as high as 2071 (and a bull wave would make new all-time highs), so without an impulsive decline (and a corresponding top) to act against, front running a wave like this can be hazardous to one's account, especially since there are no clear stop levels.

In conclusion, the preferred near-term counts have been consistent big winners recently, but at the moment, there's nothing new in the chart to draw a new short-term signal from. The last signal was to buy support, and there's nothing to reverse that signal yet. The next signal will come soon enough. Until then, trade safe, and have a great weekend.

Thursday, October 15, 2015

INDU: Bonus Bear Chart

Just a super-short update, with a "bonus" bear chart today. If we take away all the fancy wave counts, we're left with this interesting back-test and rejection at the red neckline. Funny thing is, I drew this chart weeks ago, and just stumbled across is last night. The red line was already on it -- and so we do have to respect that, so far, it's acting like resistance. It's is worth paying attention to whether the market can make its way back up through the resistance of that distribution pattern at the top:

Not much more to add -- we do currently have enough waves down for a complete C-wave decline, if that's what the market wants, and futures are currently green. If that low breaks down in a significant fashion, then bulls should respect that as potential trouble -- vice-versa for bears if INDU can break back up into the topping pattern. Trade safe.

Wednesday, October 14, 2015

SPX Update

Last update anticipated that near-term higher prices were likely. Yesterday, price obliged, largely confirming my view that the prior high was a b-wave. It still appears reasonably likely that the high isn't in yet, based on the fact that the recent corrective fractal appears to have simply become more complex. It's possible the low will be in this morning, but a bit lower isn't out of the question:

Zooming out a bit, bulls likely want to hold any pending back-tests, or risk ambiguity:

In conclusion, we can't rule out an immediately bearish wave -- i.e., we can't rule out the idea that ALL OF (c) is complete. However, that presently appears to be at least a slight underdog to the idea that (c) (or "3" for the bulls) is still unfolding. If bears begin claiming levels that should be acting as support, then we may have to give bears more credit. It's a tough call here, only a few points off the high, but things should clarify more as they develop. Trade safe.

Monday, October 12, 2015

SPX and INDU Updates

There's not much to add after Friday's exciting session (by which I mean Friday's unexciting session), but I've drawn up a couple charts anyway, mainly to fulfill my contract with myself, which states that I must annotate at least 45,974 charts each year.

We're into a zone where we should probably at least begin watching for topping action, though one formula suggests this wave could run as high at 2071 +/- before experiencing any correction more significant than the one we saw on October 2 -- so Friday's warning to "let the market lead" remains in effect, at least until such time as it leads us to a more clear suggestion of a correction.

I've drawn up a near-term chart of SPX which gives us the first levels to watch:

Let's take a look at a count that allows for the potential of a fairly direct top, though here again, we have nothing yet that indicates a turn has begun:

Also, I stumbled across this old SPX chart, and updated it because the support/resistance lines are relevant, and the market reacted to one of them on the Fed spike (to 2020) last month:

In conclusion, there are now enough waves in place for a complete (c)-wave rally, and the minimum requirements have been met and exceeded. The trend at all degrees currently remains up, but if bears can sustain a break of 2007, then we can at least start considering the idea that a deeper correction may be underway. Trade safe.

Friday, October 9, 2015

SPX, INDU, TRAN: Time to Let the Market Lead

Just a few charts today -- the annotations explain everything. First is TRAN, which has developed into a bit of a conundrum:

Next is the IT INDU count, which -- as previously discussed -- does allow the possibility that ALL OF Wave IV is complete:

Finally, the ST SPX chart:

In conclusion, there are several upside inflection points for the bear count -- but bears should keep in mind that we've never been able to rule out the possibility that Wave IV completed at the crash low. The preferred near term count has had us looking up since SPX reached the target of 1865-80, so it's not as if we've missed out because we were "too bearish," as many others were -- it's simply a good idea to let the market lead now, and wait for clear signals. Trade safe.

Subscribe to:

Posts (Atom)