Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, November 13, 2024

SPX and COMPQ: Just the Near-Term, Ma'am

Monday, November 11, 2024

SPX and COMPQ: Maybe, I Guess

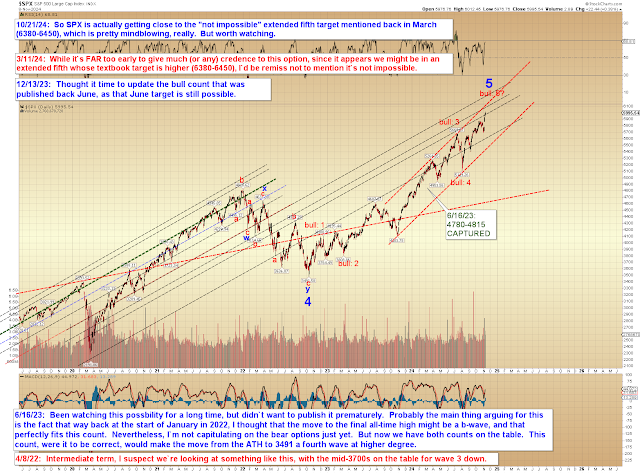

Nothing much happened since last update, so -- barring an impulsive decline in the meantime -- we'll continue watching that potential SPX target from March:

And we'll keep watching COMPQ:

The question a lot of people seem to have is: Does the election of Trump change anything?

Maybe. The question I have is whether the seeds that have already been sown can be overcome by anyone at this point.

The problem is a good chunk of our GDP over the last few years has come directly from new government debt. And the Treasury market is so far not playing along with the Fed's rate cuts, which means: one, that the market doesn't think inflation has abated enough and two, the cost of servicing that debt may remain high. And while I suppose if GDP were to really boom, it would help that last chart -- all this is really just the tip of the iceberg, as far as America's problems go. Is the election of a new President enough to solve all our problems? Maybe, I guess. But maybe not.

So, I'll leave it at that for now. We can come up with more bullish long-term counts if it seems appropriate. Trade safe.

Friday, November 8, 2024

SPX, COMPQ, TLT: Powell's Well That Ends... Well?

Tuesday, November 5, 2024

SPX and COMPQ: They Didn't Make That One Easy

Last update noted that, though my faith had been shaken, I was still very slightly leaning toward another wave up. As of this moment, the futures market is indicating a big gap up at the open (still 5+ hours to go, so that could change of course); since that matches my lean, I'll presume we get new highs one way or another. Assuming those new highs occur, that will suggest two possible rally outcomes, discussed on the second chart below (COMPQ).

SPX first, though. If SPX can sustain a breakout, it would still imply a trip 5940-70, as discussed on Oct. 28:

Next is COMPQ, which lays out the options, including a more-bullish potential pattern, simply because it can't be ruled out yet:

In conclusion, it appears the market will finally get another wave up. We have some initial target zones to watch, assuming that happens, and a line in COMPQ that might suggest a longer bullish run. Trade safe.

Monday, November 4, 2024

SPX, COMPQ, INDU, NYA: Careful Out There

Friday, November 1, 2024

COMPQ and INDU: Bulls Put on Notice

In Monday's update, I wrote:

If it breaks down before then, then there are still options for that decline to be a C-wave, but we'll have to start watching things more carefully, because, as we know (and as illustrated on the NYA chart), we are likely into a larger fifth wave. And my old personal adage is, "Never bank on fifth waves." For now, we'll continue to presume there are still higher prices out there, but I did want to illustrate that it's not a great place for complacency.

The market is now in the process of attempting a breakdown, so we do need to start watching things more carefully. INDU is still three waves down, so it's not time for bulls to panic just yet, but the chart discusses some of the options in the event that the current decline goes on to become impulsive:

COMPQ moved a bit higher, then reversed:

SPX invalidated its proposed triangle, but I'll present a more detailed chart on Monday.

In conclusion, we've known for a while that we were in the ballpark that a fifth wave could complete, so while it would still be nice to see one more wave up, the likelihood of that wave may be more deeply called into question if this decline becomes impulsive. Trade safe.