Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Monday, January 31, 2022

INDU, COMPQ, SPX, and a Whole Bunch of Interesting Data

Friday, January 28, 2022

SPX Update: Other Than That

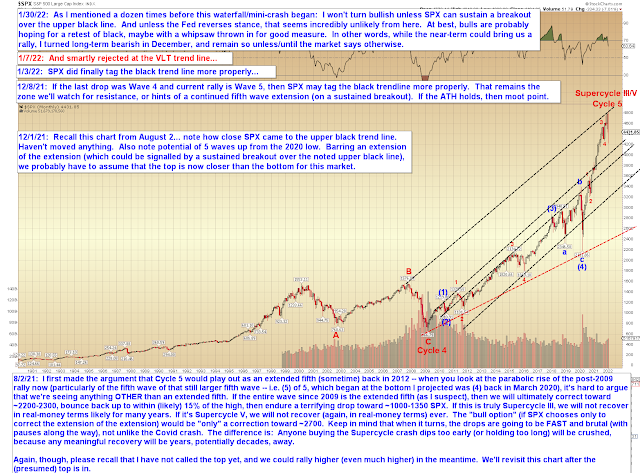

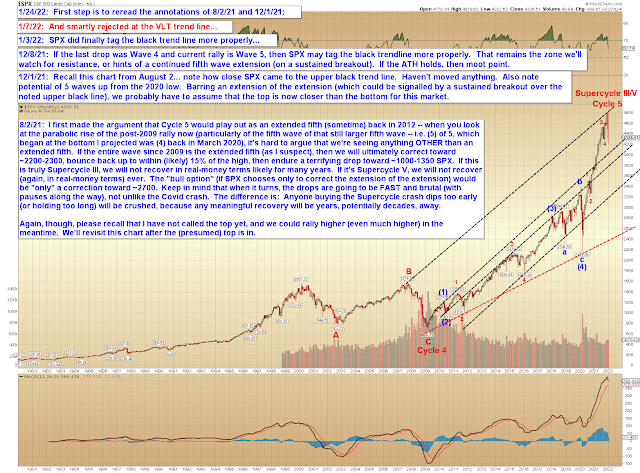

Now, here's the "market point": The Covid crash was a pretty clear fourth wave. That means we have almost-certainly been riding out the fifth wave ever since. And the fifth wave is the final wave of a move -- which, now that we're finally getting into a potentially-complete wave structure, means we're likely approaching the end of the 12+ year bull market.What we're currently trying to nail down is whether the fifth wave of the fifth wave of that larger fifth wave has completed or not.Read that again.As I mentioned last update:

Even if SPX manages to make a new high, that will probably be the fifth wave, and (barring an extension) is thus reasonably likely to be followed by a correction (or worse) anyway.

In other words, even if SPX manages to make a new all-time high, we are probably into territory where we should be considering selling the bounces. Let's look at the near-term chart first, with the emphasis that "bull 5," even if it shows up, could very well be the final high of this 12+ year bull market.

Wednesday, December 1, 2021

SPX and NYA: Is It Time to Sell the Rallies?

Even if SPX manages to make a new high, that will probably be the fifth wave, and (barring an extension) is thus reasonably likely to be followed by a correction (or worse) anyway.

In other words, even if SPX manages to make a new all-time high, we are probably into territory where we should be considering selling the bounces.

Let's look at the near-term chart first, with the emphasis that "bull 5," even if it shows up, could very well be the final high of this 12+ year bull market.

Let's look at the old intermediate term chart of NYA next. Worth noting that NYA recently captured its 17,000+ target (published 8 months ago):

So that's the bear case, but what are the remaining bull hopes here?

Well, their first hope would be for an "extension of the extension." The rally since 2020 has been an extended fifth wave -- bulls would like to see the (presumed current) fifth wave of that fifth wave extend. That's always possible, but given that inflationary pressures are finally forcing the Fed's hand (per Powell yesterday), it's hard to imagine there's going to be enough fuel for that extension if the Fed follows through and indeed pulls away the punch bowl. If they don't, then that might be another matter.

But here's the nice thing: On the next chart, we'll look at a signal to watch that could tell us if the fifth wave of this fifth wave is going to extend. Thus, we can reasonably presume the fifth wave is ending here if that signal does NOT materialize.

So, on the chart above, in the event SPX sustains a breakout over the upper black line, then we might forget about selling the rallies for a while and watch to see if bulls can get an even-more-extended fifth wave. We can't yet rule that out, given that the fifth wave is short relative to wave 1 on that chart -- but nevertheless, I'm taking the approach of "making the market prove itself here," so if it doesn't break out, then we'll stick with the idea that the top is now closer than the bottom

Referring back to the NYA chart for a moment: The second option bulls have is for a more complex fourth wave (shown by black "or 4" and "or 5"), similar to what happened in 2020, but at a much smaller scale. We'll simply have to track that possibility as it unfolds -- but again, unless there's an extended fifth here, that potential wouldn't change the longer-term outlook too much.

Now, all that said, I would again like to emphasize that calling a top to the most powerful bull market in history is no easy task, so if you think the market is going to keep going up, then hey, you could be right. I could be wrong, or could be early, or whatever. Or the market could choose to extend the fifth of the fifth here, which no one can really predict. I can't promise anything, and nothing I publish here is trading advice; I can't manage your risk for you. That's what brokers are for.

All I know is that we just about tagged the upper boundary of the very long-term channel, we reached the long-term NYA target, we came within 6 points of the long-term SPX target, and there are roughly enough waves (give or take a couple micro waves) to mark a complete five-wave rally from the 2020 crash low.

Near-term, if bulls are going to get their fourth and fifth wave to new highs, then now may be the time. Longer-term, until the market dictates otherwise, I'm sticking with the idea that the top is closer than the bottom, and thus that it's probably not a bad time to take some risk off the table.

Trade safe.

Tuesday, September 27, 2016

SPX Update: No Material Change

No material change since last update, except to note that, as the prior update could only speculate would happen, the decline from 2179.99 does appear reasonably impulsive at micro degree. Although I have outlined 2180 as the "level to beat" on the chart below, as also noted in prior updates, the all-time-high is more important from a technical perspective.

Note that 2/B could potentially be complete at yesterday's high, so any additional rally is not guaranteed.

In conclusion, there's no change from the last few updates, and I am continuing to treat bounces as sell opportunities -- please refer back to Monday's update for the intermediate charts. Albeit this is not an "ultra-high-percentage" bear pattern (as some of them are; protect yourself accordingly), but short still appears to be the higher-odds play for the time being. Trade safe.

Wednesday, April 2, 2014

SPX and NYA Updates: Long-Term Resistance

Monday's update anticipated that the S&P 500 (SPX) was headed directly to new highs, and confidence in that view was added during Monday's session, when SPX broke, back-tested, and held 1867. Tuesday's session closed at a new all-time high.

In today's update, we'll discuss the bull and bear cases and the zones to watch for each.

On Friday, I wrote: "Due to the larger trend, this is probably bears' last shot to break these markets down, so any strong bounces from here would likely lead to new highs." That now applies to bulls in reverse (sans larger trend, of course).

If the market is indeed plotting the head-fake whipsaw I talked about on Monday, then we're likely to see a significant sell-off afterwards, as most traders will be caught wrong-footed. This is because classic technical analysis would see a breakout here as very bullish, with targets in the mid-to-high 1900's. After we examine the preferred count and the arguments in its favor, we'll also delve into those more bullish potentials in a bit more detail.

The preferred count continues to see this pattern as a triangle, which has either taken the form of a symmetrical triangle or an ending diagonal. The pivot between those two options is 1887.

Here's a more detailed look at the potential symmetrical triangle, using the NYSE Composite (NYA):

SPX reached the key 1885-87 pivot yesterday, but in the event it sustains trade north of 1887, then the symmetrical triangle is in play. Interestingly, the textbook target for the symmetrical triangle also represents a long-term resistance zone.

I think one of the goals of trading ranges is to wear everyone out -- and in doing so, ranges sometimes serve the function of making traders a bit sloppy afterwards. While the range is underway, everyone becomes hyper-focused on the near-term charts; then some feel thrilled or relieved when the range finally breaks. Trend followers sometimes even become strangely complacent afterwards, due to the emotional release of stored tension that was generated by the range.

But I'd suggest we stay alert even if there's a sustained breakout over the 1887 pivot, because we have resistance showing up on the long-term chart, right near the symmetrical triangle's target zone:

So, put simply, the preferred count currently still anticipates that the new highs will turn into a head-fake and whipsaw -- but let's talk about the more bullish option as well.

Prior to the development of the apparent triangle trading range, I had been viewing the bull potential as wave i-up of v-up complete, with the correction as ii-down of v-up (now also complete), and iii-up of v-up still to come. The series of apparent three-wave moves which created the trading range gradually drew me away from that wave count. At the moment, I'm no longer favoring it -- but because three-wave moves aren't always what they seem, my original bull count isn't dead and I still have to continue to respect as a viable option. That option will likely regain favor as the preferred count if the market sustains trade north of 1914.

In conclusion, the preferred triangle count accurately predicted the end of the trading range and the immediate new highs, which gives some additional credence to that count. Of course, we don't want to get too far ahead of the market or too rigid in our expectations, but the pivots continue to bear watching as potentially-important reversal zones. For the time being, I'm continuing to favor the view that the anticipated new highs are part of a terminal pattern. Trade safe.

@PretzelLogic

Wednesday, March 5, 2014

SPX Reaches Critical Inflection Point: A Look at the Bull/Bear Battle Lines

Well, we have an interesting market now. I don't trade news, but everyone who does has had a bad news event to sell, followed by a good news event to buy, both within the prior few sessions. And both basically the same event.

So, those bulls who were waiting for a "good news event" as the signal to go long have gotten it, and should now be long. (The really good news, of course, is the fact that Taco Bell has finally resurrected their Chili Cheese Burrito. Do not let me get started on this topic...). Other bulls have been waiting for a breakout to new highs as the signal to go long, and they've gotten that, too.

The question now is: How many buyers are still left to chase the market higher here? It's decision time.

One of the things that bothered me about the turn at 1867 was the bad news event that came with it. I'm always suspicious of "bad news" tops -- the best tops are made on good news, in order to pull in the last buyers and trick everyone into continuing to look upwards. A good top isn't one where people are shorting the bounces afterwards -- it's one where people are buying the dips. In other words: "bad news" tops are usually too obvious to work, and they're too easy as a contrarian play. The exception to this is tops which are marked by incredibly major, world-altering events -- but, interestingly, those events usually seem to come weeks or months into a turn, after the market has already topped on a good news event.

Back to the present (no relation to the direct-to-DVD sequel, starring a much-older Michael J. Fox): I can see both sides of the trade here, and they strike me as pretty even at this exact moment. Bulls have a breakout and back-test of falling support in their favor; but at the same time, so far there's been a bit of "failure to launch" -- each prior breakout has been turned back rather directly and the breakout levels have failed to act as support. That behavior needs to change for bulls to gain momentum.

The upside for traders is that this has turned into a massive inflection point for the market. I discussed this in passing at the end of last month, but the near-term charts are now helping to clarify some of the key levels. So today we'll look at the bull/bear battle levels -- and the targets which are suggested for the victor of those battles.

First up is the S&P 500 (SPX). The two highest-probability wave counts here (and minor variations thereof) are 180 degrees reversed from each other. The bear count has the market within a topping process (bottoms are often "an event," but tops take time). The bull count has the market on the verge of a third wave rocket launch. 1895ish appears to be the dividing line between the two options.

For more perspective, let's refer back to the long-term SPX chart I published on February 28. The chart below is materially unchanged since then -- but as outlined above, the near-term chart is now helping to point the way in identifying the key levels.

A related signal chart, which I've posted a few times in the distant past, is the ratio of high yield corporate bonds to the 20+ year treasury bond fund (HYG:TLT). This ratio serves as an effective barometer of the market's current appetite for risk.

In conclusion, the market has bent and stretched the wave structure a bit recently, and this has created a nice inflection point for traders. The market now appears to be on the verge of a big move, and the noted key levels should help point the way. Trade safe.

@PretzelLogic

Wednesday, June 5, 2013

Bulls and Bears Squaring Off at a Major Battle Line

Yesterday's outlook gave 55% odds to the idea of a wave (2) top for the S&P 500 (SPX), marked on the chart as either 1643 or 1647, and the market reversed strongly off the 1647 level, then declined all the way back to retest Monday's low. For the near and intermediate term, this is now a potentially dangerous setup for the market. I'm continuing to favor the bears for the foreseeable future, but since I'm not a perma-bear, I'm also looking for signals which could indicate a bottom. In this update, we'll discuss both arguments in detail.

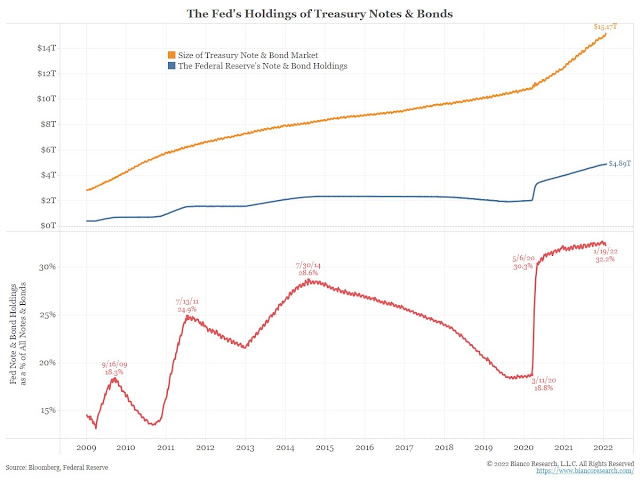

There's an upward market bias inherent with the QE-Infinity program, and the market has rallied virtually nonstop since that cash started hitting the Primary Dealer accounts in November. The notable exception to this endless rally was the weeks leading into the fiscal cliff dilemma (late last year). As it turned out, during the end of 2012 the Primary Dealers were withholding that cash from the market, due to their discomfort with the entire situation. Keep in mind that a similar thing could happen at any point, so QE-Infinity in itself does not guarantee a market without corrections. Further, if liquidity is being destroyed (somewhere down the chain) faster than the central banks are creating it, then the market environment becomes deflationary.

All that said, I still don't favor the idea of 1687 being a long-term top, but as I wrote on May 23:

In conclusion, the long-term presently remains pointed higher, but that may be irrelevant at the moment. We can't see around every bend in the market, but most times we don't need to: the near-term appears to be pointed downwards, and the intermediate-term, while too early to confirm, also looks likely for further downside. This is not a bad time to behave defensively.

Though I've been bearish since 1687, my long-term bias remains bullish, and this leads to an interesting cognitive situation. I'm not sure how to put it into words exactly, but I'll try: I "want" to find a reason for this market to bottom, but I'm not seeing it yet. In fact, my work suggests that if the 1622 level fails, we could actually see a significant sell-off. Right now, the bull patterns I'm finding (from an Elliott Wave perspective) are obscure patterns that are generally low-odds, while the high-odds patterns continue to favor the bears, as they have ever since the reversal at the all-time high.

Long-time readers know that I attempt a feat many believe is "impossible" with these updates: I try to predict the market across virtually every time frame (short, intermediate, and long), three to four times each and every week. I'm bound to get some calls wrong, and I absolutely do -- but since early May, I haven't missed many and that puts me in a good psychological position right now as an analyst. I'm not talking about ego in this sense, although this may be something that only another public analyst can probably really understand. Basically, when you hit a top as well as I hit this one (my May target-2 for SPX was 1680-1690), then you have a lot of psychological wiggle room to really see what's going on afterwards, because you're not trapped by your prior bias/analysis. When you get caught looking the wrong way, you tend to try and find ways for the market to prove you right in the end (in order to justify the fact that you were screaming to buy at much higher prices, or to sell at lower prices).

It can be a pretty tough gig actually, and analysts don't get enough credit for the painful crises of conscience that (I assume) we all endure at times after a missed call. If you've ever wondered why analysts love to toot their own horns when they get a call right, it's not because they want everyone to think they "get every call right," it's because they're trying to compensate for the incredible guilt they feel over the calls they blew. A small handful of readers love to remind analysts of their bad calls -- but believe me, nobody needs to. We know our bad calls better than anyone, because those mistakes take up residence in our memories, especially late at night when the house is quiet and still. In fact, many of us remember our bad calls much better than we remember our good ones.

Moving from independent trader to public analyst over the past couple years wasn't an easy adjustment for me -- the challenges of each role are actually quite different. But I digress.

I think the market's in an interesting position here, from a number of different standpoints. In terms of sentiment, bearishness has increased recently, but the BTFD ("buy the friggin' dip!") mentality is still reflexively strong, and we've been hearing a lot of "buy the dip" talk the whole way down so far. This in itself bothers me, because I feel like the long trade has become almost too reflexive and easy at this point. I know that during last week, I was one of the few lone nuts suggesting we sell the bounces, and many were suggesting the opposite. Anecdotally, that tells me there are probably a lot of bulls now trapped north of 1650. What's most interesting is that even many bears seem afraid to sell into this rally. And why wouldn't they be, after being beaten to death since January? Maybe a better question is: could they, even if they wanted to? I know there are several popular bear subscription services who've recommended heavy short positions all the way up (some with stops I consider outrageous), and I can only imagine that many of their subscribers are dead broke by now.

So, my question is: are there even any bears left to sell short this market? Because if the only sellers remaining are bulls, there could be a problem. Short-selling gets a bad rap from some folks, but the reality is shorts provide an important layer of support for the market, because at some point down the line, shorts have to buy back whatever they sold. Additionally, shorts tend to trip all over each other trying to cover their positions en masse, which is why bottoms usually have the classic V-shape -- and shorts are generally the ones who kick-start the momentum for the next rally leg.

On the other hand, bulls all by themselves make "bad sellers" because they are simply trying to get out, often in a rush, and they have no requirement to buy back in; bulls can sit in cash or government Trashuries for as long as they want. As a result, a decline without short covering can be fast and brutal. Remember the last time the U.S. banned short selling (of 799 financials), in 2008? How did that work out? (Hint: not well; prices fell more than 12% over the next 14 days.)

So my bottom line point here is: While I've stayed bearish since the 1680-90 target was hit, I still "want" to find a reason for the market to bottom. I think a lot of people are feeling the same way -- and that tells me we have to be extremely cautious, because when everyone's looking the same direction, the market has a tendency to do the exact opposite. Let's take a look at the arguments for both cases.

Starting off with the bear case, we have a few patterns that aren't terribly encouraging for bulls, and which I first called attention to on May 30. The SPX chart below should be examined in conjunction with the NYSE Composite (NYA) chart shown later.

If we look at this purely from the "trade what you see" perspective, we find the cleanest wave count is the bearish nest of first and second waves shown below. I remain marginally in favor of this count, but I am quite alert to the fact that this is (suspected to be) a fourth wave decline, and fourth waves rarely follow the "most obvious" pattern. They usually turn infinitely frustrating at some point, and become all but impossible to predict.

Note the black "alt: (2)" as the current wave could become more complex. In either case, if the count shown in blue and red is correct, there should be downwards acceleration coming when 1622 is claimed. If there is no downwards acceleration on a breakdown, then we have to give weight to the "less obvious" wave counts. Again, I'll discuss this in a bit more detail on the NYA chart.

The hourly chart has now been updated with target 3 potential -- beyond that, there's been no change in a while.

Tuesday, February 19, 2013

Understanding Technical Analysis Using the Current Market

In the pre-market update of February 14, I anticipated that 1514 would become an important short-term support level, and so far the market's bounced twice from that level. I'm going to use this opportunity to unveil a bit of the "magic" behind technical analysis, and discuss some of the logic behind it, and a few of the reasons why anticipating future price action based on technical analysis works more often than it doesn't.

The 10-minute SPX chart now sports a pretty decent triangle consolidation, which has been formed with two rejections at the 1524 level, and two bounces off the 1514 level (see chart below). 1514 has been tested several times now, and support becomes more important each time it's tested. In a moment I'll discuss why. I'll also discuss why we can further anticipate that this is now quite likely to have turned into a market where additional buyers will show up at higher prices, while additional sellers will arrive at lower prices.

We've discussed and charted the triangle above. In classic technical analysis, triangles typically show up as continuation patterns to the prior trend, which in this case was up; more rarely, triangles are reversal patterns. In Elliott Wave analysis, triangles always show up as continuation patterns, but typically show up as the penultimate (second to last) wave in a waveform. There are two challenges here for Elliott Wave: the first challenge is determing whether or not this is a true Elliott triangle, and thus "destined" to resolve higher. The second challenge is which wave it would actually complete if it is a triangle. Neither question has a clear-cut answer right now, so this becomes a bit of a "confirmation" market. Trade below 1514 would rule out an Elliott Wave triangle, while trade above 1525 would largely confirm it. (continued, next page)

Wednesday, June 27, 2012

SPX Update: Questions for the Short-Term, but Long-Term Bearish

I have some questions over the short-term, though, and the only one capable of answering these questions is the market -- hopefully in the next session or three. Here are my short-term questions:

- Is the current rally Minute Wave ii, or the lower degree Minuette Wave (4)? (I'm favoring the Wave (4) interpretation.)

- Is the current rally over? (I suspect it is -- though it could have one more slightly higher high.)

- If the rally is Wave (4), will Wave (5)-down extend and blow through the lower target zone?

I'm favoring the idea that this corrective rally has about run its course, that it's Minute Wave (4), and that the market will make a new low beneath 1309. I'm split on the idea of an extended fifth wave here, and there's really no way for me to know in advance.

For the intermediate term, I strongly suspect that Minor third wave down is now underway, but the caveat is that the market needs to confirm with a print beneath 1306.62.

If my preferred intermediate outlook is correct, and we are now in the early stages of a Minor degree third wave decline, then there are some things to be aware of. Third waves are powerful, especially third wave declines, and bounces will be muted and sometimes fall short of targets. Third waves gain their power from the fact that the majority have been caught wrong-footed. If you're on the wrong side of the trade, expect this wave will not let you out without damage -- because everyone else will be trying to get out too, and that will keep the bounces muted. (This is relative to the time-frame of course -- Minor degree waves last weeks to months, so I'm not talking about day trades.)

So, third wave declines require the majority to head into them positioned long. Here's the funny thing about sentiment: I suspect that the majority of people wouldn't really believe my projections, because if they did, then we couldn't have an extended decline. People who think the market is headed significantly lower aren't holding equities; they are either short or flat. And people who are short or flat have nothing to sell to drive the market lower in the first place -- so if I'm right, the majority are still long right now: it's something of a requirement.

Right around the time the majority turn bearish, it will be time for a large bounce.

Let's move onto the charts, and take a quick look at the intermediate picture. The questions I outlined above are reflected on this chart (as well as the next one). If Minute ii-up is underway, then just move all the blue lines over to the left.

Next, the short-term chart, and the expectations of the wave (4) count. After re-examining the first stage of the decline, I have moved the Minor (ii) high to match the price high at 1363. I now suspect that the move from 1363 to 1346 was, in fact, the first wave... though it looks a bit odd because it had an extended fifth. This also matches the strength of the recent decline into the 1309 low, since that would still be a portion of the Minuette wave (3).

The alternate black count may or may not have more rally left in it. If the market does more than a very marginal new high, suspect the black wave ii count. Conversely, if the move starts to accelerate lower from here, suspect either the extended fifth or the alternate count, and we should start looking for lower targets. If this is a standard fifth wave decline, it should make a new price low, but there should be numerous bullish divergences on the indicators when it does.

In conclusion, the short-term was dead-on clear last week and I hit the last 3 turns almost to the penny, but things just aren't always that clear, unfortunately, and the short term is now a bit hazy. It will clarify again soon enough. Regardless of the market's short-term path, the intermediate term appears decidely bearish. Trade safe.

Friday, June 22, 2012

SPX Update: Rally Likely Over -- Ready for the 1100's?

Below is the preferred count I published on June 1. The decline fell 6 points shy of my target zone (and the red wave (ii) illustration here was never meant to be anything other than a rough guideline) -- but overall, it's probably safe to say, "not too shabby." This is one reason I stick with Elliott Wave as my go-to analytical tool: I simply know of nothing else that can call two intermediate turns this accurately before the first turn has even happened.

Let's update that hourly chart, add in some more clutter, and see where we are now in the intermediate picture. My wave (iii) targets have been slightly adjusted from the June 1 chart. Bear in mind that the market is a living, breathing, dynamic environment -- so further adjustments will likely need to be made on the fly.

Next, let's zoom in a bit to the 15-minute chart. I am uncertain if wave 3 has bottomed or not, so don't bank on that wave 4 bounce -- instead watch the red dashed trendline in the one-minute chart (shown next). My best guess is that 3 has reached a possible very short-term bottom (or nearly so), based on the one-minute chart, but it's not entirely clear. Yesterday's 18 point bearish trade trigger target (which I've removed from the chart) was easily reached during the session.

Next is an indicator chart I haven't had the opportunity to share since late last year. This indicator combines the readings of TRIN (a breadth indicator) with the down volume to up volume ratio (which indicates selling pressure), and shows that when the two indicators reach the signal line in concert, it becomes extremely high probability that there will be lower lows made in the near future. This fits with my interpretation of the wave structure, but it's always nice to have some additional confirmation.

By the way, the last time I referenced this indicator (December 2012), it failed to work! I don't think that will be the case this time, though -- the odds are definitely against a second failure here, so there should be lower lows in the market's near-term future.

Finally, I do want to outline an alternate intermediate possibility. This potential is lower probability, but there's no way to rule it out yet. The strength of the decline was fully appropriate to kick off the assumed third wave, so there's currently no reason to to think a double-zigzag will develop here -- but we'll stay alert to this going forward.

The main purpose of the chart is actually to outline the very bearish 190 point sell trigger which will be activated with a breach of the lower dashed blue trendline, but I figured I'd save space and annotate the alternate count onto this chart too. The bearish sell trigger also jives with the idea of a third wave down. My preliminary target zone for the larger third wave is 1120-1130, but that would not mark the entire wave down -- there would still be a fourth and fifth wave, which, if correct, should allow the market to reach the trigger target in the high 1000's.

In conclusion, it appears reasonably likely that the market has begun the expected third wave decline. Third waves represent a "point of recognition" for the masses, and they tend to be strong and unrelenting. Discounting the alternate potential for a moment: if this is indeed now wave (iii) down, then bounces will often come late; upside targets for bounces will frequently fail; oversold indicators will reach deeply oversold conditions and stay pegged there; and declines will run deeper and faster than most think they should. Trade safe.

Friday, May 25, 2012

Understanding Elliott Wave Analysis, Part I

(Part II can be found here)