"At what point then is the approach of danger to be expected? I answer:

If it ever reach us, it must spring up amongst us. It cannot come from abroad.

If destruction be our lot, we must ourselves be its author and finisher."

-- Abraham Lincoln, Jan. 27, 1838

Most people have busy lives and full-time careers that leave little time for deep dives into scientific research, so, often out of necessity, we find ourselves trusting the news and politicians to tell us what "The Science" is. And, since we're not cynics, we presume they're doing this in good faith. In recent years, we've heard many claims about "renewable" energy, which is almost always presented as an unalloyed good.

So, today we're going to examine an aspect we hear little about, in an attempt to answer a simple, yet fundamental, question:

Are "renewables" good for the real environment?

When I say "real" environment, I am referring to the environment that can be objectively measured and observed through scientific methods. This means that the impacts are verifiable and not dependent on hypothetical scenarios or speculative models that can be manipulated for financial or political gain.

In other words: Good old fashioned hard science.

Stay through the end for some shocking revelations, but if you've already read Parts I and II, you can skip past the italics immediately below.

(Previously, on Is There a Climate "Crisis": In Part I, mainstream paleoclimatology showed us that the Arctic is notably colder today than it was a mere 7-10,000 years ago. In Part II mainstream science from the IPCC, NOAA, NASA, et al, debunked the claim that extreme weather has "gotten worse due to climate change." Finally, as we've discussed previously, "change" and "crisis" are two very different things. There's a scientific consensus on climate change, but there is zero consensus that this change represents any sort of "crisis." The use of the term "crisis" originated with politicians and media and is not shared by (not all, but) most scientists.)

There's plenty more to examine in terms of climate, but for today's deep dive, we will simply look at "renewables" to see whether they are indeed "good for the planet." Since we've all heard the argument in favor (which essentially begins and ends with "renewables don't emit CO2 during operation"), we're not going to rehash that argument here and will instead examine the aspects of renewables that are less common knowledge, starting with:

Wind Power

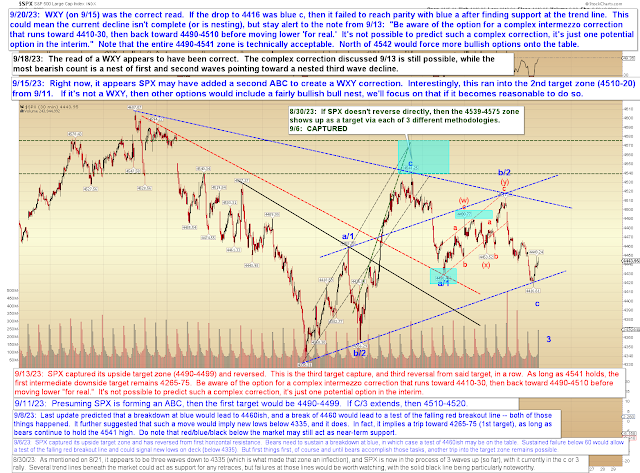

According to the

Wall Street Journal,

one single wind turbine requires

900 tons of steel, 2,500 tons of concrete and 45 tons of plastic.

Thus, a larger wind farm requires hundreds of thousands of tons of concrete, steel, and plastic. Obviously, that's not a "green" operation -- but we haven't even gotten to the good stuff yet, because the biggest thing wind requires is land. How much land? Prohibitive amounts, because wind is not a dense energy source like nuclear, gas, and oil.

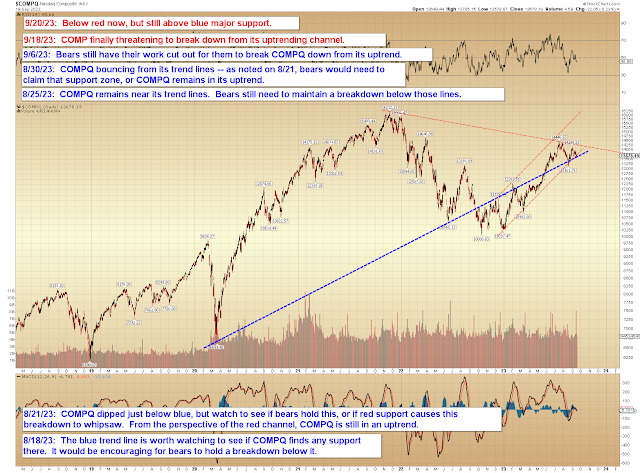

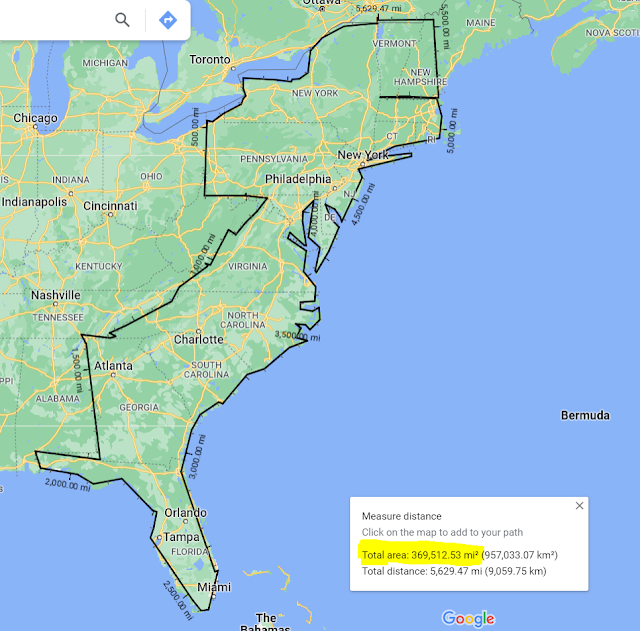

To meet present electricity needs for the continental United States,

wind turbines would need to cover an incredible 12% of the country's land mass.

That's 374,000 square miles of wind turbines.

Since it's hard to envision how large 374,000 square miles is, here's ~369,500 square miles outlined in black on Google maps (some of the lines have extra squiggles because I got tired of starting over):

Envision a massive wind farm that basically covers all of the following states: New York State, New Hampshire, Vermont, Connecticut, Rhode Island, Massachusetts, Pennsylvania, New Jersey, Delaware, Virginia and D.C., Maryland, North Carolina, South Carolina, Georgia, and all of Florida, including the panhandle.

(Yes, I know they wouldn't put them there (at least, I hope), but we're trying to envision how much land is involved.)

In other words, we'd have to plaster wind turbines across every inch of the original 13 Colonies, plus Vermont and Florida -- and then we'd ALMOST have enough to meet the electricity needs of the United States.

Does that sound like a pipe dream? Of course it does. But even if it didn't... does that sound like it would be at all "good for the environment"? Especially when we remember that every single wind turbine needs its own massive 2,500-ton concrete base. A quick calculation suggests we'd need about 40 million tons of concrete for this windfarm, enough to pave over the entirety of several whole states with a durable 4-inch-thick concrete slab. Sounds great for wildlife and plants, yeah?

(Also: If one is concerned about CO2 emissions, then one should be aware that cement manufacturing already accounts for about 8% of global emissions.)

I mean, we could probably just stop there on wind, because anyone who's looked at these logistics knows that wind is largely just "feel good talk" ("wind talk is just a lot of wind" - ha!) -- but we won't, because as the full picture emerges, we'll see that wind doesn't even qualify for that.

To understand the impacts of local wind use, let's explore how devastating wind power is to wildlife:

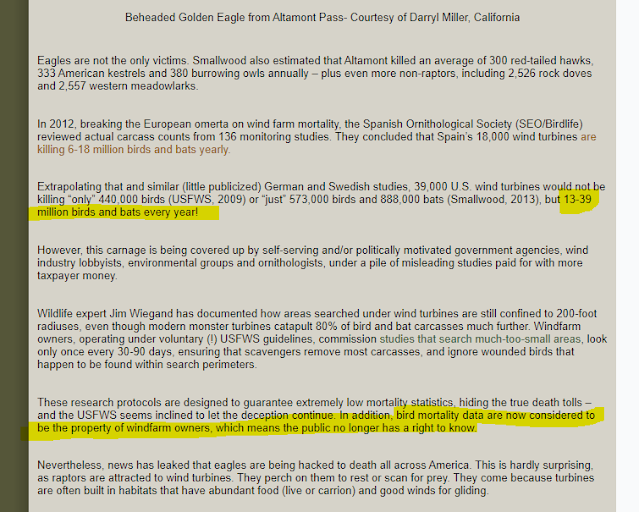

As we see above, wind turbines effectively become the apex predator in whatever ecosystem they're introduced to... but it gets worse.

TL;DR -- the meat of their report is this:

In 2012, breaking the European omerta on wind farm mortality, the Spanish Ornithological Society (SEO/Birdlife) reviewed actual carcass counts from 136 monitoring studies. They concluded that Spain’s 18,000 wind turbines are killing 6-18 million birds and bats yearly.

Extrapolating that and similar (little publicized) German and Swedish studies, 39,000 U.S. wind turbines would not be killing “only” 440,000 birds (USFWS, 2009) or “just” 573,000 birds and 888,000 bats (Smallwood, 2013), but 13-39 million birds and bats every year!

Wind turbines are particularly deadly to birds because there's something of an optical illusion at play with the center of the blade moving slowly, so it's hard for even humans to realize how fast the edges of the blades are actually spinning:

Cover that dying bird with oil and we'd have a week of news coverage of the environmental catastrophe, instead of complete silence from corporate media and our leaders.

Oh, and since "offshore wind turbines" are now being promoted, let's discuss those, too. First off, of course, you still have the issue of what is, essentially, a large industrial site being installed at sea.

Some environmental groups claim that offshore wind farms kill whales, but, surprisingly, those who promote offshore wind farms (businesses who sell wind tech; governments and their rubber-stamp "science" organizations) claim they don't.

Having personally listened to humpback whale song for many years while snorkeling off the west coast of Maui, I do not find the claim (made by several environmental groups) that "the noise of wind farms and wind farm construction

damages whales' ears and confuses them" to be at all outlandish. I'm not saying it's a correct claim,

because I just don't know -- I'm simply saying it makes sense to me, and since the government is not a disinterested third party here, I'm inclined to be skeptical of their claims that "installing massive industrial structures in the ocean has no impact at all on whales!" That claim, at least, seems outlandish on its face.

- 42 Whales

- 2,534 Dolphins

- 142 Porpoises

- 1,472 Seals

- Total = 4,190 adversely impacted marine mammals

And that's just for the survey! Not for the construction or long-term operation phase, which is undoubtedly far more disruptive and would stretch far into the future.

So I take back what I said earlier: Apparently, it's a known fact that offshore wind farms kill marine life and those advocating for this agenda are well aware of that but are deliberately deceiving the public for PR purposes.

In the further quest to answer this question in an unbiased (though now decidedly annoyed) manner, I found

this study from Nature to be helpful. In all, Nature identified

867 findings of environmental pressures and ecosystem impacts due to offshore windfarms, the vast majority of which were negative.

So negative environmental impacts due to offshore wind farms (OWF) are significant -- and as the study from Nature stresses, there are still many unknowns:

Impacts may spread far from the OWF area (e.g., lower number of organisms of migratory populations at the final destination), as is the case for land-based wind farms. It is, therefore, fundamental to consider the spatial and temporal distribution of the most sensitive species when determining the risks associated to a given project. For the adoption of such an approach, better data is required.

I think we can safely speculate that the "unknown" environmental impacts will likewise end up being predominantly negative. Thus, I'm sure offshore wind farms appeal to politicians and businesses who don't care about the environment, but for those of us who truly love the ocean and marine life (I chose to live in Hawaii for a reason!), offshore wind farms are an abomination.

In conclusion, wind power:

- Requires unfathomable amounts of land, which devastates the environment the same way any other large commercial or industrial site does.

- Would kill millions of birds and bats each year (though I imagine it would kill fewer each year, until eventually there are few birds alive wherever they constructed these monstrosities).

- Damages the ocean ecosystem, including the ecosystem far away from the physical site.

- Will kill otherwise-protected and/or endangered marine life.

So... what's the idea here? We're going to "save the planet" by destroying it? Keep in mind that these are real impacts on the real environment -- not speculative "doomsday scenarios" that have little-to-no basis in hard evidence. It's a bit like burning your house down solely because you're worried that your house might burn down, so you decide to "take charge" and make certain it's done right.

Either we've lost our collective minds... or... and bear with me here... maybe this agenda isn't really about "the environment" at all.

I'm not going to go too far into the woods here, but suffice to say we don't need to speculate in that regard,

because they've told us it's not about the environment:

So why aren't we listening? I have no answer for that. Truly.

[Note: Just before publication, but two days after I wrote this piece, the Biden Administration

announced a plan to promote environmental "justice" -- the spirit of which sounds exactly like the agenda disclosed above by Ottmar Edenhofer way back in 2010. They've been telling us plainly what this is really about, and it sure ain't "the planet." So, again:

Why aren't we listening?]

Anyway, I don't want to digress, so let's return to hard data that doesn't make us uncomfortable.

I believe we've seen enough to eliminate wind from "green" energy contention, but one last tidbit: Wind turbine blades usually only last about 20 years and are typically made of composite materials that are difficult to recycle due to their size, shape, and composition. As a result,

many blades end up in landfills or are incinerated, which releases harmful chemicals into the environment. Calling wind turbines "renewable" energy should be classified as false advertising.

It doesn't require binoculars to see that the politicians pushing for wind power are not "green" -- they are the opposite of "green," and are either completely ignorant of these issues (in which case, it's their literal civic duty to educate themselves), or they have zero regard for the real environment.

But next time you see wind turbines, see them for what they really are: A massive industrial power plant, serenely chopping birds to death and destroying the environment.

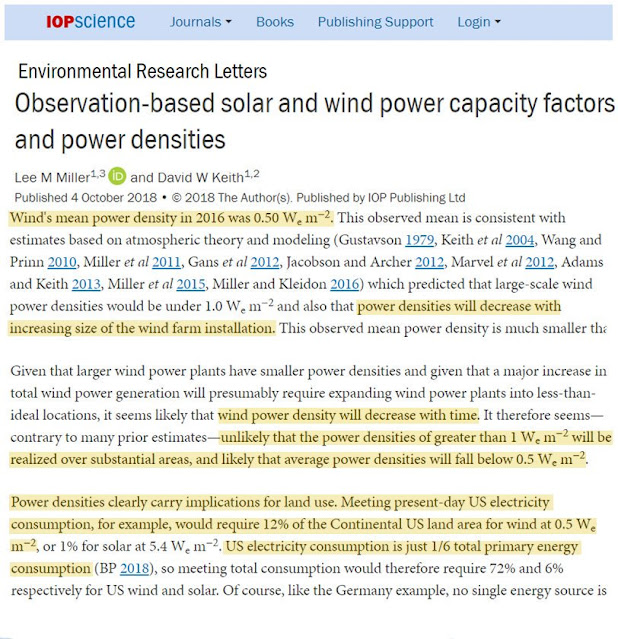

Solar Power

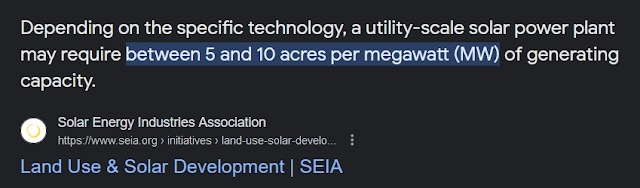

Is solar any better? We'll start by looking at the same issue of land. According to the Solar Energy Industries Association, an association involved in promoting solar (i.e.- they want to paint solar in a positive light), solar requires 5 to 10 acres of land per Megawatt (MW):

So let's average that and say 7.5 acres of land per MW. By way of comparison, the Palo Verde nuclear power plant in Arizona is the largest nuclear power plant in the United States with three reactors and a

total electricity generating capacity of about 3,937 MW. Which means that in order to replace that

one single nuclear reactor with solar, it would require 29,527 acres, which is 46 square

miles. Which is why a study from Princeton University concluded that solar needs 300-400x more land than traditional sources; in fact, as Michael Shellenberger explores:

Solar needs 379 times more land than nuclear:

A 200-megawatt wind farm,” notes Bloomberg, “might require spreading turbines over 19 square miles (49 square kilometers). A natural-gas power plant with that same generating capacity could fit onto a single city block.

There's a lot of competing information about how much land a national solar farm would truly require, but on the

low end of the

credible estimates (i.e.- not made by vested interests, and accounting for weather and for the fact that solar panels decrease in efficiency every year), we have the

National Renewable Energy Laboratory estimating that the nation could generate enough power by covering "just .6%" of the United States with solar panels. Well! That doesn't sound like much. Lemme do the math here... okay, so that's "just"

22,780 square miles!

Let's see how that looks on the map:

Okay, simple. So basically, we could just level the whole corridor from Boston to D.C., including the entire states of Connecticut, New Jersey, Rhode Island, and Delaware, pave over all that land with solar panels, and voila! "Green" energy!

So, in that scenario, Pennsylvania (where I grew up) would go from this:

to this:

Lovely! I can hardly imagine anything "greener"! Or better for the natural environment! Can you? Plants and animals would undoubtedly thrive with their habitats entirely paved over by solar panels. We are truly "saving" the planet now, yes? Who needs forests anyway?

"Oh," I hear readers object through my screen, "but they would NEVER replace forests with solar panels!"

They

already are. Killing forests to put up solar, that is. And we're

nowhere near the end game of "Net Zero" yet -- in fact, we've barely started.

This "tiny" (by comparison to the amount of energy it's generating) solar plant used to be a forest in Montana:

And this little "solar forest" is in North Carolina:

There are plenty more, but you get the picture. Just keep in mind how little power those giant solar plants are generating when compared to nuclear or natural gas.

"Oh, but we could just install solar panels out in the desert Southwest where no one lives."

Okay, but "no one" is not "no THING." I lived in the desert Southwest for years, and there's plenty of life in those vast stretches we describe as "desert." Unlike what many East Coasters think (I know because I used to be one of them), most "desert" is not rolling sand dunes like the Sahara, it's small plants and animals as far as you can see. Just because it's not as pretty as a forest doesn't mean it's not still a living part of Earth's natural environment and ecosystem.

(Above: The stereotypical landscape of the "desert" Southwest)

Besides, the Southwest is prone to hail and very high winds -- up to and including tornadoes! -- and solar panels aren't exactly known for their durability. Imagine a nation without reliable power for an indefinite time period after a hail storm:

Or after a windstorm:

Is it really a good idea to level 22,780 square miles of the environment, then pave over it with a million of these things, only to have them entirely wiped out a year or two later by Mother Nature, leaving us high and dry?

So, while solar power may not be quite as devastating as wind power on environmental land (only because it doesn't require as much land), it's still plenty bad, and too fragile to rely upon. In cold weather and in hospitals, people will be in real trouble if the grid goes down for any meaningful length of time. Major weather events have always and will always occur with regularity. Our large, fragile "national solar farm" would be all-but guaranteed to be destroyed, probably several times.

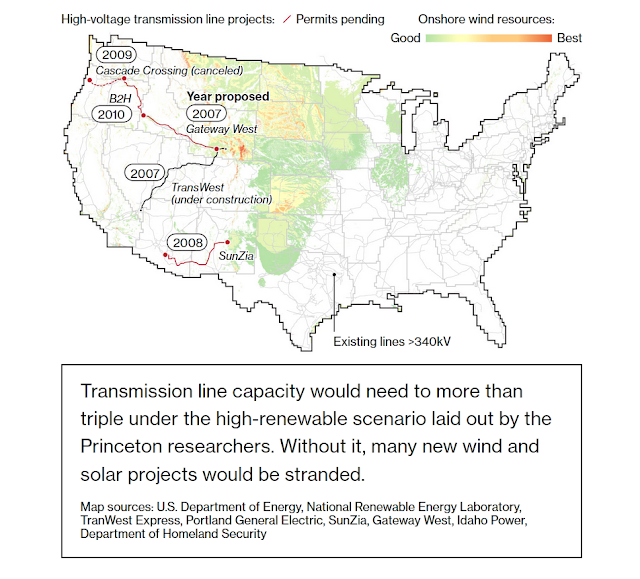

And of course, even if we put our giant solar or wind farms NIMBY ("Not in MY Backyard!"), we still have to get that power to the rest of the country. And that requires a lot of new power line infrastructure. Here's Princeton/Bloomberg again:

So, in order to convert to wind and solar, we'd not only need to level entire-states worth of environmental land, but we'd need to more than triple the number of power lines. Princeton describes power transmission lines as "the most difficult land use challenge," even worse than the solar/wind power plants themselves.

Not to mention, the manufacturing process for solar is very energy intensive, and panels require silicon, glass, nickel, copper, silver, indium, and tellurium, the latter several of which require significant mining.

But who cares, let's pretend we're politicians and skip right over that. After all: We need to do this because some speculative model that's failed at every prior prediction said so! You darned "science" deniers with your concerns about the stupid environment!

Instead, we'll talk about solar panel disposal, because these things only last (at best, if there's ZERO significant weather in the meantime) 25-30 years -- a shorter lifespan than your home's metal roof -- and panels decrease in efficiency every year they're in use. But unlike your home's roof, which is easily recycled, there's little solar panel recycling occurring in America (see:

Researchers and Companies Are Preparing for a Looming Tsunami Full of Photovoltaic Waste), so most solar panel waste ends up in landfills.

Which means, just like wind, solar power is anything but "renewable."

Referring back to the Wall Street Journal piece quoted earlier, by 2050, solar panels alone would more than double the tonnage of the entire world's plastic waste:

If we think we have a problem with plastic in the oceans

now, how will that be

with more than double the plastic? And that's

just from solar panels. That would dwarf the global plastic from

plastic straws by an order of magnitude, yet we're told straws are "bad" but solar is "green."

[D]ifferent varieties of solar panels have different metals present in the semiconductor and solder. Some of these metals, like lead and cadmium, are harmful to human health and the environment at high levels. If these metals are present in high enough quantities in the solar panels, solar panel waste could be a hazardous waste

So, here again, we've been sold a bill of goods by vested interests.

Solar panels in "Net Zero" quantities would:

- Destroy entire-states-worth of natural habitats.

- Produce massive amounts of waste (including hazardous waste, as well as doubling the tonnage of global plastic waste), which would be ongoing, creating more and more waste at each future replacement cycle.

- Require significant mining and manufacturing processes.

- More than triple the number of power lines in the United States.

- Be prone to being entirely destroyed by stormy weather.

To classify solar as "green energy" is pretty outlandish. Unless one believes for-profit-and-politics doomsday models (that currently have a 0% success rate at future prediction) should be prioritized over, you know, the actual planet.

(And the actual reality of their hypothetical "doomsday" is going to shock you by the end of this piece.)

Both solar and wind also require giant banks of batteries, to store power for when the sun isn't shining or the wind's not blowing.

And we haven't even gotten to the batteries yet. (insert ominous music here)

"Batteries Not Included"

How many batteries does it take to store electricity for an entire country?

According to the Department of Energy, the answer is just over 6.0 TWh in the USA's "zero carbon" scenario. Cool. What does that mean?

Well, the easiest part to answer is the dollar cost, which, if

purchased from Tesla, would be just over $2 trillion. Trouble is, that order won't be filled anytime soon (if ever) -- at least not without a bunch of people going without power for a few decades -- because Tesla claims that

after its newest Shanghai Megafactory comes online in 2024,

then it will have

global production capacity of 83 GWh per year.

There are 1000 GWh in a TWh. This means that (assuming this factory indeed goes online in 2024 without delay or snafu) it would "only" take Tesla 72.29 years to fill a 6.0 TWh order! And that's if they ceased all other production and worked on nothing else!

This is one of the many reasons I laugh when people say things like, "We have the ability to switch to 'renewable' energy RIGHT NOW!" No, we don't. Again, though, saying "we don't" assumes we want a humane transition that doesn't involve the broader populace starving and freezing to death. (And given what we're learning here, I'm not entirely sure it's 100% correct to assume that. I'm kidding, of course! (No I'm not.)) Anyway, those are the easy parts of the equation.

The real questions we need to address are the environmental impacts of battery manufacturing.

One of the worst environmental impacts of lithium battery manufacturing is the extraction and processing of the raw materials needed to make the batteries. Lithium is often extracted through a process known as evaporation, which involves pumping approximately 500,000 gallons of water (to extract

each and every single ton of lithium) into underground lithium-rich brine deposits.

This can cause contamination of groundwater, soil, and nearby ecosystems:

Here’s a thoroughly modern riddle: what links the battery in your smartphone with a dead yak floating down a Tibetan river? The answer is lithium – the reactive alkali metal that powers our phones, tablets, laptops and electric cars. In May 2016, hundreds of protestors threw dead fish onto the streets of Tagong, a town on the eastern edge of the Tibetan plateau. They had plucked them from the waters of the Liqi river, where a toxic chemical leak from the Ganzizhou Rongda Lithium mine had wreaked havoc with the local ecosystem.

There are pictures of masses of dead fish on the surface of the stream. Some eyewitnesses reported seeing cow and yak carcasses floating downstream, dead from drinking contaminated water. It was the third such incident in the space of seven years in an area which has seen a sharp rise in mining activity, including operations run by BYD, the world’s biggest supplier of lithium-ion batteries for smartphones and electric cars. After the second incident, in 2013, officials closed the mine, but when it reopened in April 2016, the fish started dying again.

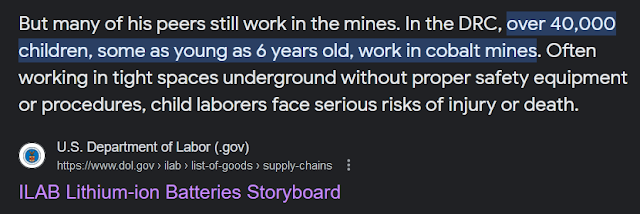

Cobalt, another key component of lithium batteries, is often mined in the Democratic Republic of Congo, where child labor and other human rights abuses have been regularly reported.

The mining and processing of cobalt can also lead to water and soil pollution, habitat destruction, deforestation, and loss of biodiversity.

In addition to the environmental impacts of raw material extraction and processing, the manufacturing of lithium batteries also requires significant amounts of energy.

So, here again, we find that absolutely nothing about the mining, extraction, and/or manufacturing process of electric batteries is the least bit "green."

The justification for the environmental destruction and human rights abuses that are both inherent in "green energy" is entirely predicated on the assumption that a bit more CO2 (which is not a "pollutant,"

CO2 is the most important gas for life on Earth, but that's a whole 'nother can of worms) will cause the planet to warm slightly, which in turn, is

speculated to be "bad." Despite the fact that (as I covered in the

last piece), the hard evidence that anything "bad" is actually happening is nearly nonexistent.

In other words, support for "green" energy can only be achieved by keeping the populace in the dark about all this, and/or by some serious mental gymnastics.

But hey, okay, sure, whatever, batteries destroy the environment, so what -- at least they're reliable sources of power, right? RIGHT?

Hornsdale Power Reserve was fined when its Tesla battery in Jamestown failed to produce power during an unexpected outage in Queensland.

Three other South Australian wind farms, including those at Snowtown, Hornsdale and Clements Gap, have been previously fined a total of more than $2.5 million for similar breaches.

In a separate judgement, Justice Besanko fined Hornsdale Power Reserve --- which owns the 150-megawatt Tesla battery at Jamestown -- $900,000 for failing to provide grid stabilization services that it had been contracted to provide.

The failure was identified when an unexpected outage at the Kogan Creek coal plant in Queensland in 2019 caused grid disturbances.

At the time, the battery had been paid to be on stand-by to rapidly produce power to help restabilize the grid in the event of such outages.

But he said the battery did not power up when needed.

And that's what's happening right now out in the real world where people are just trying to use this stuff as backup power. So yeah, if we actually tried to make this transition, be prepared for a complete nightmare of unreliable power, constant blackouts, and unforeseen problems.

Further, as everyone already knows, lithium-ion batteries are toxic waste -- and sometimes catch fire and/or explode. I wonder what sort of environmental catastrophe would occur if the USA's massive 6.0 TWh battery bank were to catch fire and explode? (Not to mention the long-term power outages.) Don't worry, I'm sure they'll have some solution for that, which, since this is the U.S. Government we're talking about, will fail spectacularly in practice.

Here's some more interesting information from

the EPA:

Li-ion batteries are made of materials such as cobalt, graphite and lithium which are considered critical minerals. Critical minerals are raw materials that are economically and strategically important to the U.S., have a high risk of their supply being disrupted and for which there are no easy substitutes.

In other words:

These minerals are called critical because their supply chains are complex and their availability is limited, which makes them vulnerable to geopolitical tensions, market fluctuations, and supply disruptions.

Oh. So we'd be making ourselves completely dependent on something we might not even be able to replace in an emergency, or even when it reaches the end of its use cycle in 15 odd-years.

Which immediately makes me picture a worst-case scenario, because, as I've warned my youngest son many times: "It's easy to picture what happens if things go perfectly-right -- but remember that one out of every so-many attempts, everything will go precisely wrong. Plan for it."

So, here's what I immediately pictured. Imagine this:

It's the 15-year anniversary of the day the last fossil fuel plant in the USA was finally decommissioned and dismantled. Although our power grid has been unreliable and prone to problems, at least we're no longer emitting CO2!!!, so the minor inconvenience of a handful of our friends and relatives freezing to death has been worth it. At least that finally made our Thanksgiving cheaper, since we only needed to buy a small bug-based turkey-substitute last year.

But now, there's trouble in Paradise: Our worst adversary knows our replacement cycle and sees that we are in a weakened economic state due to stagflation. War looms on the horizon and this hostile power has blockaded our access to critical minerals... at exactly the wrong time. Our batteries are dying and desperately need to be replaced. But alas, we have no way to replace them and are growing weaker by the day. And the weaker America becomes, the stronger our adversary grows in comparison. A few months later, the power grid can no longer be sustained. The USA goes dark.

Permanently.

Chaos ensues as all services (police, fire, medical) and food supply lines cease operation. Starving populations riot; roving gangs pillage others for survival. But in cities, even the stolen food runs out quickly. Ultimately, only a handful of people will survive, primarily those who defied the bans and kept their old gas-powered cars hidden away despite the threat of felony convictions.

But even they will eventually be hunted down and captured or killed by the enemy.

America, once the shining city on the hill, is no more.

Yes, sure, that's a worst-case -- but the general idea is not so far-fetched as to be a zero-percent chance. In fact, given that the one constant throughout world history has been regular and cyclical war, I would say that while the timing is unknown, a similar event would almost be guaranteed to happen eventually.

In my view, it's myopic and stupid to even consider making our nation's very survival entirely dependent on the actions of foreign governments. For me, this ends the discussion entirely, frankly. Solar, EV, wind, whatever -- it's fine for people who don't know any better or who don't care about the environment to use that stuff as supplemental power, but it's out of the question for this nation to make itself critically dependent on resources that lie beyond its borders.

*****

Slight digression there, but in any case, I think we're answered the question we set out to answer: "Are 'Renewables' Good for the Environment?"

The answer is a resounding and emphatic "NO." Frankly, when I started writing this piece, I knew "renewables" had some environmental issues, but even I had no idea how truly horrendous and destructive they really are. Renewables are not even "somewhat" good. Renewables are absolutely devastating to the real environment.

So, with that answered, let's drive it all home and conclude with:

What Would Net Zero Accomplish? How Much Would Temperatures Change?

Now here's where it really gets interesting. And shocking.

According to the U.N., if our fossil fuel use continues on its current trajectory, global temperatures are predicted (let's assume they get a prediction right for once, for sake of argument) to rise a total of 2.7 °C by 2100. Now, keep in mind that this is not "an additional 2.7°C from today," because these targets are always backdated to pre-industrial temperature levels.

Temperature has reportedly already risen 1.1°C from pre-industrial levels, so the "1.5°C target" we often hear bandied about is actually only a 0.4°C increase from today. (Let's ignore the complete and utter absurdity of all this and just run with their numbers.)

Using their numbers above, we've had 1.1°C rise already, so, with a 2.7°C target, they're speculating that temperatures may increase another 1.6°C from today.

Okay, so let's assume that's all correct. What percentage of that 1.6° would come from the USA if nothing changed from our current way of life?

The USA is responsible for 14% of global emissions, so the answer is approximately 14%.

Thus: 1.6°C x 14% = 0.224°C

So, if the USA went dark tomorrow, then, according to the UN, that would stop... err... 0.224°C of "global warming" over the next century.

Silliness, right? But wait, it gets better.

According to the

U.S. EIA,

electricity generation from fossil fuels in the United States only accounts for 31% of U.S. emissions!

So we have to take 0.224°C and multiply that by 31%, which means that if the USA did all the destructive "green" energy stuff we just spoke about in order to completely eliminate fossil fuel from the power grid, then, using the UN's own alarmist figures and assumptions about CO2, it would stop the global temperature from rising by...

0.0694°C ! (add more exclamation points here as needed)

That's right, less than seven-hundredths of a degree. Not even one-tenth of one degree. THAT is what all this would accomplish.

I mean, really, stop and think about that for a few minutes.

Now, since you're not (I assume, correct me if I'm wrong) a politician who's seeking to influence votes via fear or a vested interest that stands to make a huge profit on "green" energy, ask yourself:

Does destroying the real environment in all the ways we just discussed make any sense whatsoever in order to potentially avert a hypothetical 0.0694°C temperature rise?

Does it make sense to put the USA's very sovereignty and independence into a compromised position to possibly avert the dreaded prospect of... a 0.0694°C warmer planet?

While you're wearing your "Question Authority" cap, ask yourself: Even if they're 100% right, would less than one-tenth of a degree REALLY "destroy the planet"? Would it make any difference at all to the planet? I mean, really?

I'll tell you right now:

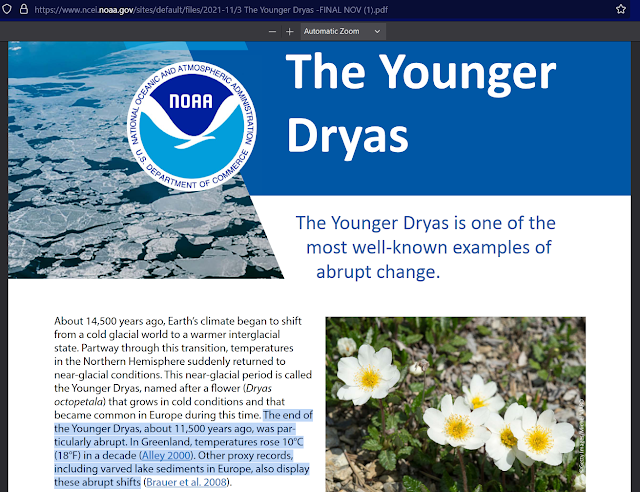

No. No, it wouldn't. I don't care how much doomsday speculation they throw at us, I'm done pretending that it would matter one iota. I know this will create cognitive dissonance in some, because we're expected to abdicate all common sense to every doomsayer who invokes the term "science," but the temperature difference between 9 a.m. and noon is considerably more significant. And, for crying out loud, this planet and every species alive on it today, including humanity itself,

already survived an 18°F (10°C) temperature increase

in the course of only a single decade!

So no, the climate isn't changing "faster" now (obviously). Things aren't somehow "worse than ever" today. Nothing happening today is even close to being "unprecedented." It's all fearmongering, anti-scientific baloney.

Sorry, helplessly watching us railroaded into this garbage upsets me sometimes, because if they succeed, it's going to cost many human lives. Mark my words.

Anyway, to sum it all up:

- on one hand, we have hard science conclusively demonstrating how devasting and destructive renewables are to the real environment, no speculation needed.

- on the other hand, we have speculative "science" running around screaming that if the United States doesn't switch to "renewables" right now, then Earth's temperature will rise 0.0694 degrees, which (if it happened) would somehow magically be worse than all the real and measurable damage that "renewables" are 100% guaranteed to do.

It's complete absurdity.

And I think we've put this issue to bed: "Renewables" are anti-environment and, at scale, nonsensical.

To be completely blunt: After more than two decades and thousands of hours of research into the "climate" topic, I've concluded that if there's a true threat to the planet (and particularly to the well-being of humanity), then that threat comes from the powerful interests who are pushing this agenda.

*****

Epilogue: I have made every effort to ensure the accuracy of the information provided, but few sources openly highlight the downsides, so it's painstaking research and I will gladly correct errors if there are any. Incidentally, unlike those who are (in my view) working against humanity's interests, I gain nothing by writing these pieces. They're very time consuming, earn me 0 dollars, and sometimes make me unpopular. I do it as a public service because people cannot make informed decisions without access to the whole truth, and neither our media nor our leaders are providing that to them. These climate pieces carry a personal cost for me; my motivation is the slim hope that if enough people are educated,

then maybe we can avert the environmental, economic, and humanitarian disaster we're being railroaded into under the false guise of "saving the planet." I cannot sit idly by and do nothing, even if it hurts me to speak up. I hope this inspires others to, to quote

Glengarry Glen Ross: "Go and do likewise, gents.

Go and do likewise."