Last update ended with (in part):

In conclusion, SPX captured Target 2, good for around 200 points of profit for readers. It would look a little better if it were to head at least a bit deeper into the 4970-5005 zone, but that's not required and if that's ALL OF 3/C down, a big bounce is possible any time.

SPX did indeed head a bit deeper into the target zone, and even exceeded it slightly. That's about as far as I can get us for the moment and I now have something approaching a neutral stance, at least from an analytical standpoint. A big bounce is indeed possible from here, though I have no strong opinion yet on whether it will materialize directly or if further lows are pending. I can't see around every corner, and sometimes it's best not to attempt to.

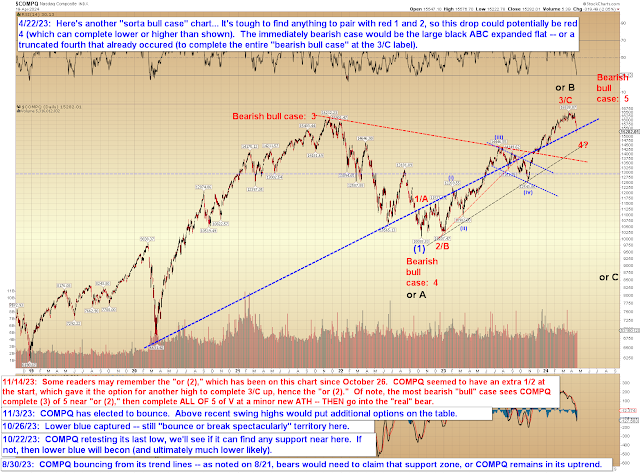

COMPQ discusses one "bullish" option -- and because we don't yet have a larger impulsive turn, bullish options remain very much alive and well for now:

Finally, BKX bounced almost immediately after I posted the red "1?" label:

In conclusion, unless/until we see a larger impulsive turn, it's worth remembering that SPX and COMPQ are still very much in the running for new highs, and there are now enough waves down for that to happen from this general area. If they do, instead, go on to form larger impulsive turns, then bears will have more leverage than they do now. Trade safe.

No comments:

Post a Comment