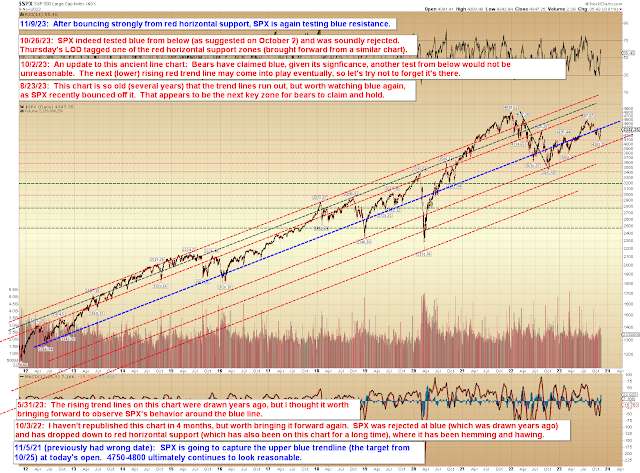

No change from the past few updates, but a few interesting charts worth looking at, starting with the very long term SPX chart:

Next, NYA rallied straight up to the price zone where I'd originally drawn red 2, though decidedly faster than drawn. If it were to become a two-legged rally, that would stretch it sideways/up and add more time to the pattern (but again, this is "easy as cake" territory, so that's not for certain either and an immediate end isn't impossible):

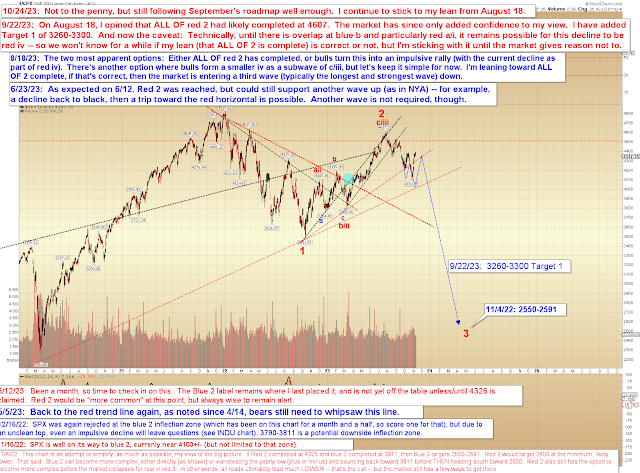

Next is the near-term SPX chart. SPX is into the lower edge of the first inflection zone for these counts, so a reversal is possible (not guaranteed) anytime in here.

IT, my broad-strokes view is unchanged for now:

Finally, oil is getting into the general ballpark of three waves down after being rejected at the ~8 month-old red b-wave label, which proved to be both a strong magnet and strong resistance. It's uncertain if the drop in oil wants to become five down or not, but if not, this is the upper edge of the general zone where a bounce could begin:

In conclusion, no change from recent updates, but the market is now flirting with the first bear inflection zone, so it will be interesting to see what happens from here. Trade safe.

p.s.- okay, I finally looked it up so you don't have to and Powell was hawkish in his speech yesterday. So, I wasn't far off in one of my guesses about his speech, though I'm still not sure which one.

No comments:

Post a Comment