In the last update, I wrote:

Here's what we have so far:- The market has indeed encountered resistance at the resistance lines we've been watching.

- This is about the best bears could have hoped for at this point, but

- So far, the decline is not yet impulsive.

In other words, it's everything bears could want at this stage, but thus far is not enough to definitively signal they have the ball, so "just a near-term correction" is still possible. I can't sum it up much better than that.

And this is still where we are today. I do want to add, however, that the significance here probably can't be overstated: Multiple markets tagged resistance, ranging from intermediate to very-long-term, in concert, and were rejected. Bears still have their work cut out for them, but so do bulls. If bulls cannot claim those resistance zones, then lots of people could get caught standing around gawking at "the most obvious top in the world." So we should stay on our toes here.

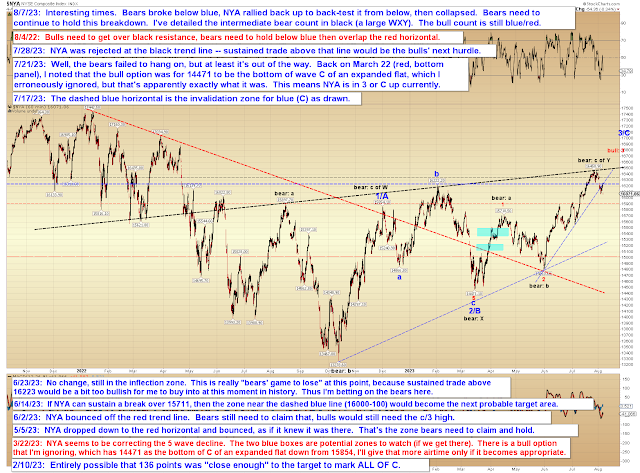

NYA's action was interesting on Friday:

And COMPQ is still testing its old trend line.

In conclusion, no change so far: Bears have hope on this reaction to resistance, but no confirmation of anything else just yet. Trade safe.

(Side note: If anyone is wondering where the title came from:)

No comments:

Post a Comment