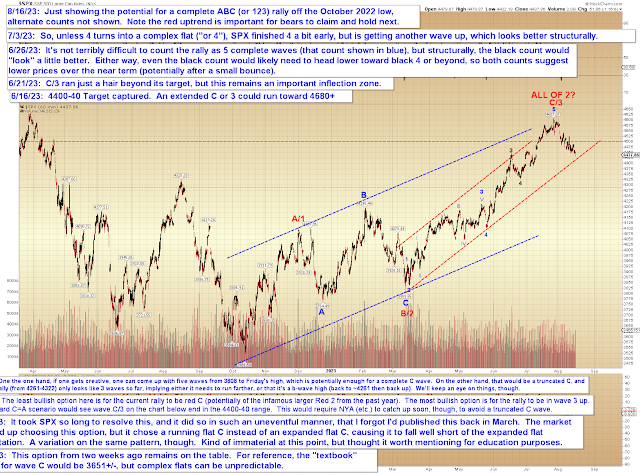

INDU broke below its key zone from last update, which implies either a snap-back rally fairly directly (which would likely revisit current levels afterwards) or an immediate follow-through decline. Immediate and meaningful bull options seem less likely, so this break seems to favor the bears for the near-term... and possibly much longer, as we'll see.

Let's take a look at SPX first to understand why:

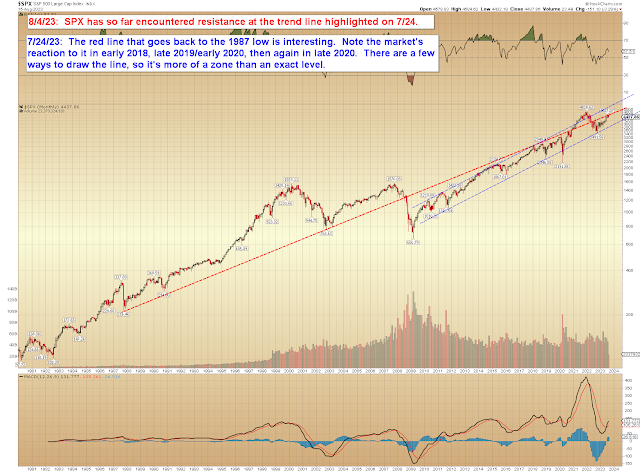

As we've known for a while, SPX hit a major long-term resistance line, and has so far been rejected. While rejections at resistance (or bounces at support) aren't necessarily the end of the world, this is, again, about the best bears can hope for at this stage. And combined with the potential for three complete rally waves (as shown above), it's definitely worth sitting up and taking notice.

No comments:

Post a Comment