Last update predicted:

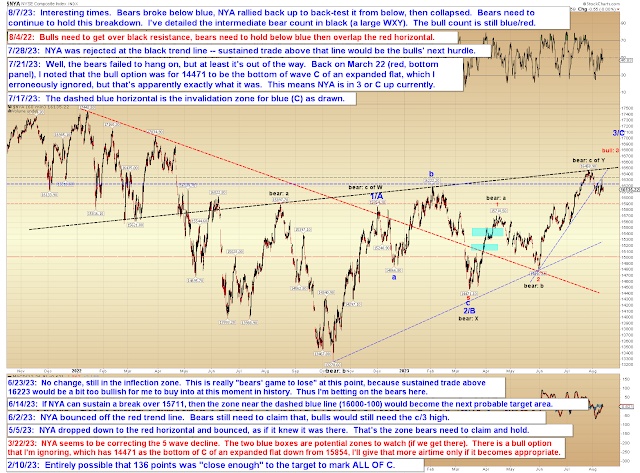

While it's always possible bulls will surge again, the fact that multiple markets are still below resistance heading into an important data point (one which could well show inflation rising again) leads me to suspect bears will manage to pull out the win over the near-term and create at least "another" 3/C down ("or 3/C" on the first INDU chart).

Headline CPI inflation is not showing as rising again (yet), but producer prices showed their largest increase since January -- and, either way, bears did pull out the win due to overhead resistance, and INDU indeed seems to have gotten "another" 3/C down exactly as shown in the last update. The real question for INDU at this point is whether it feels like it needs ANOTHER up/down sequence or not:

SPX has continued reacting to very long-term resistance:

BKX has continued reacting to the resistance zone I highlighted a month ago:

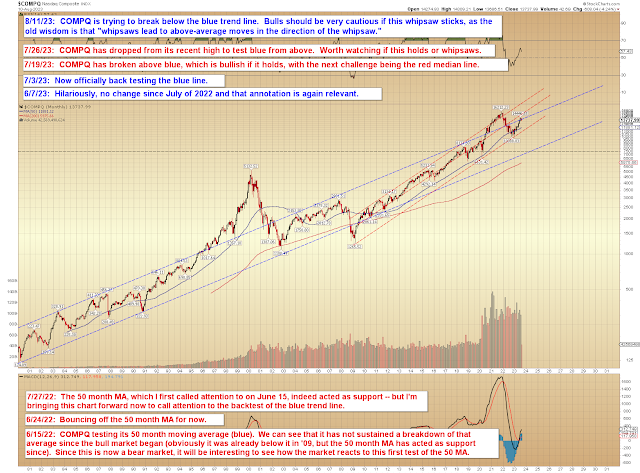

And finally, COMPQ is in the process of trying to whipsaw its last breakout:

In conclusion, the market has remained disheartened by resistance -- but the big question on everyone's mind is whether we have an impulsive decline yet. By all rights, the decline does appear to be impulsive in both NYA and SPX. There's some lingering possibility that the high was a B-wave, but I'm not leaning that way and if bears can keep pushing a bit lower, that option should be erased. Presuming the decline is not a b-wave, then the implication is that if there's another bounce from here, there should also be another leg down. The more bearish option would be to continue lower directly, without another large bounce. Trade safe.

No comments:

Post a Comment