Last update discussed that SPX and NYA had both reached support, and both markets proceeded to form sizeable bounces from that support. I want to say that puts us in trickier territory, but the reality is, this market has been stuck in a trading range for a year. So it's all tricky territory lately, and don't let any temptation toward complacency (in either direction) convince you otherwise.

Year-long trading ranges are the type of thing that could give Freddy Kruger himself nightmares.

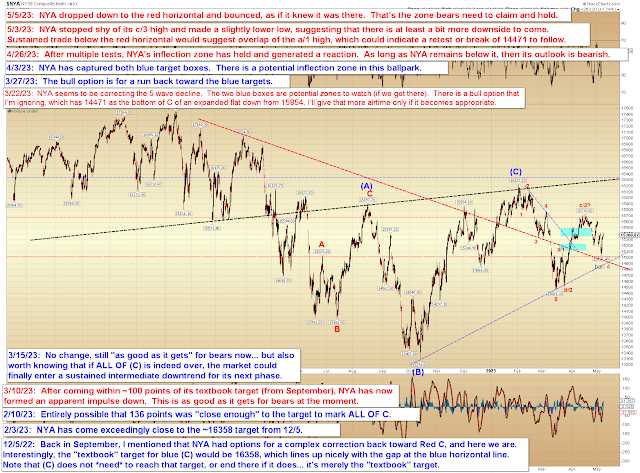

There's no change to either NYA or SPX at the intermediate level.

Near-term, I outlined a bear case (the bull case is obvious and was already discussed last update):

In conclusion, so far, the market has bounced twice at major support. As noted several times previously, bears still need to break that to get anything going. On the flip side, bulls have yet to claim the next key resistance levels, so they can't claim victory yet, either. And on another note, if you've survived this year-long trading range without blowing up your account entirely, pat yourself on the back. When the market treads water, often the best we can hope for is to do the same. Trade safe.

No comments:

Post a Comment