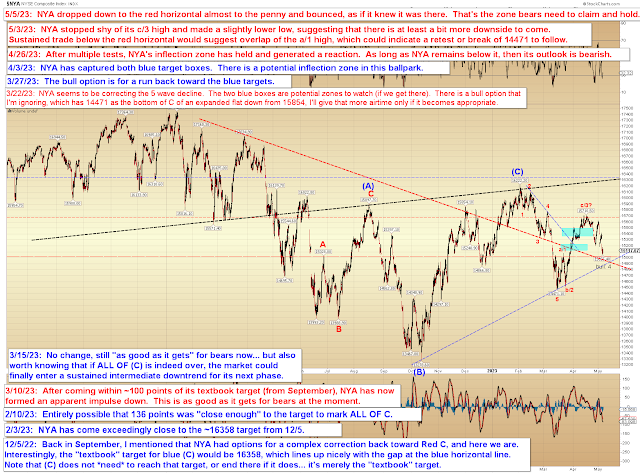

NYA is interesting, because, unlike SPX, it did not make a new high, instead making a slightly lower low. This suggests that these markets need at least a little more downside

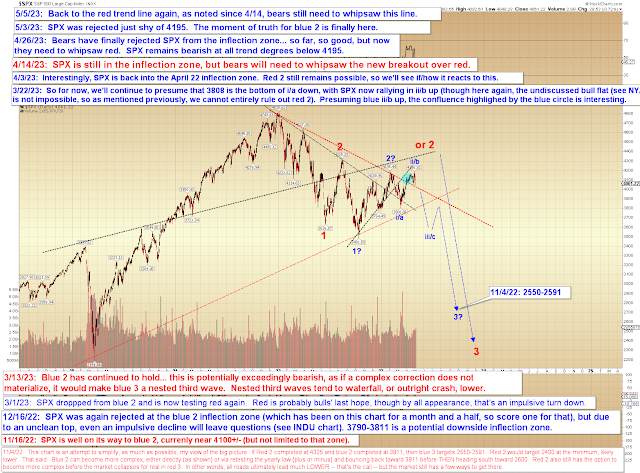

That read came through, and the markets delivered more downside -- in fact, both SPX and NYA declined right to their downside inflection zones (even though anyone not well-versed in Elliott Wave probably thought my placement of the red horizontal line seemed arbitrary!):

SPX also tested/is testing its important trend line:

These are important tests, and bears need to come through, since we can see on the near-term SPX chart that the decline has taken the form of three waves so far:

In conclusion, last update thought the pattern begged more downside and that happened -- now the market has reached support, so bears need to keep pushing and break that support. If they can't, then Red 2 (second chart) will stay on the table. Trade safe.

No comments:

Post a Comment