Last update noted, regarding the SPX chart:

In a perfect world for bears, though, SPX stops at or before the highlighted confluence

SPX stopped at the very bottom edge of the blue zone, and shy of the confluence, so things continue to look "not particularly bullish."

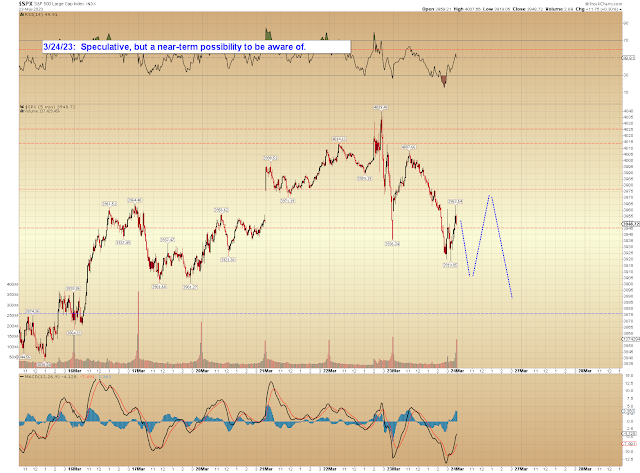

I want to call attention to one potential near-term path. The pattern isn't clear enough to call this a "hard prediction," more of a soft speculation... but the option is there, so I thought readers might want to see it:

NYA just missed its first zone and reversed. It is now coming up on the red trend line, which may or may not offer support:

TLT is at a near-term crossroads:

Last update concluded:

[W]e do have five clear waves down (an impulse) in NYA, which means that unless that impulse is wave C of the noted expanded flat, it will be followed by another impulse down that is equal to or greater in length than the first. We cannot entirely rule out all bull options, but if this is the start of blue 3, that next impulse down will be a nested third wave and thus fairly brutal.

And bulls have done nothing to help their case, so that stands for now. Trade safe.

No comments:

Post a Comment