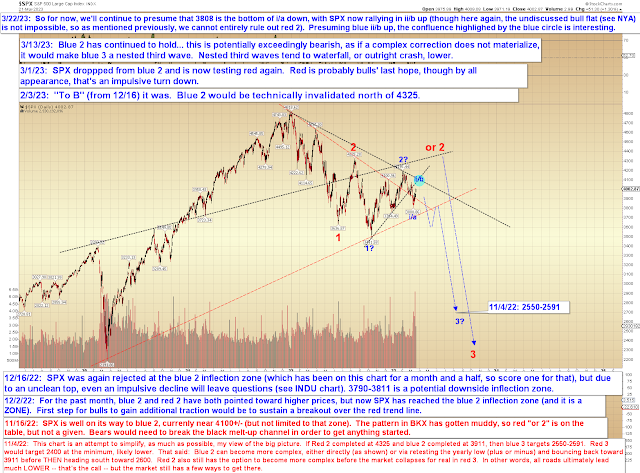

Price is still hugging the near-term channel I drew on March 17 -- for now, anyway, but bears probably need that to be a diagonal (approximated by the red and blue lines below) so it doesn't threaten a breakout. If it does break out, it may head toward the confluence shown on the third chart.

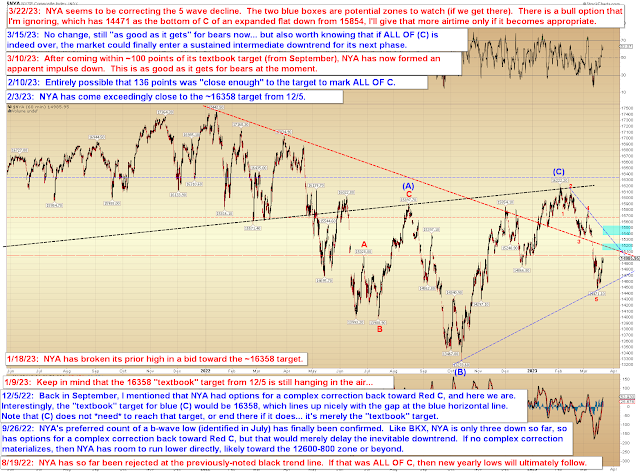

Nothing like a near-term miss to get one thinking, so the NYA chart does mention the bull option (in passing -- for now, I'm not focusing on it):

SPX is in similar shoes to NYA. In a perfect world for bears, though, SPX stops at or before the highlighted confluence:

In conclusion, we do have five clear waves down (an impulse) in NYA, which means that unless that impulse is wave C of the noted expanded flat, it will be followed by another impulse down that is equal to or greater in length than the first. We cannot entirely rule out all bull options, but if this is the start of blue 3, that next impulse down will be a nested third wave and thus fairly brutal. Today is, of course, a Fed day, so watch your back out there, and trade safe.

No comments:

Post a Comment