For the past few updates, I shifted from my previous near-term bullish stance to a more cautious stance, and on December 5, I wrote:

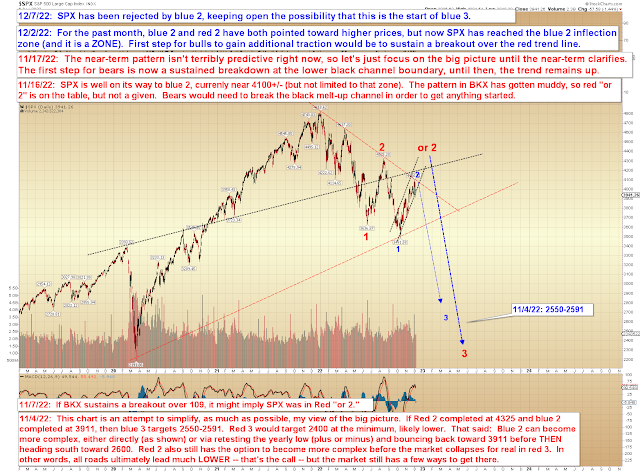

What we do have now, though, is a case where the "more upside" of the past couple updates has been achieved, the 4100 target from October has been captured, and the month-long standing blue 2 on the chart above has been reached. Thus, this is a neutral zone; people tend to finally "get it" and become bullish or bearish once targets are captured, but that's the wrong time. Once targets are captured, the market is at last truly free to go either way again.

As we know now, the last week's-worth of warnings turned out to be timely, as SPX has since been rejected literally on the button at the blue 2 inflection (which was 4100+/-: see annotation from November 16):

In conclusion, SPX has been rejected dead-on from the blue 2 inflection, but we do not yet have an impulsive decline (5 waves down). To that, I would add that the market appears reasonably likely to form one, given the structure so far, but of course that's just how a typical wave would form -- so I'm stating that it looks "reasonably likely" based on the typical wave, as opposed to it actually being there on the chart in black and white yet. We'll see how it develops from here, but do note that if we're already in blue 3 already, things can get ugly over the coming weeks. Trade safe.

No comments:

Post a Comment