On October 5, I wrote:

[Y]esterday's violent rally could be the start of the complex blue 2 on the final chart, but I'd caution against reading too much into a "one day rally." Bulls will need to see some follow-through before getting their hopes up too much.

And last update concluded:

So far, bulls have not proven they have even the near-term ball, and it is still possible that this is all part of an intermediate bear wave.

Both of those warnings proved to be useful, and Friday's market dropped precipitously. So far, the decline from last week's high appears to be three waves, so it's in the ballpark of a near-term inflection zone, but could simply be an incomplete impulse wave (which would mean more downside to come after some small fourth wave corrective rallies).

The simple trend line chart has remained useful:

No change to the big picture, but bulls are running out of real estate:

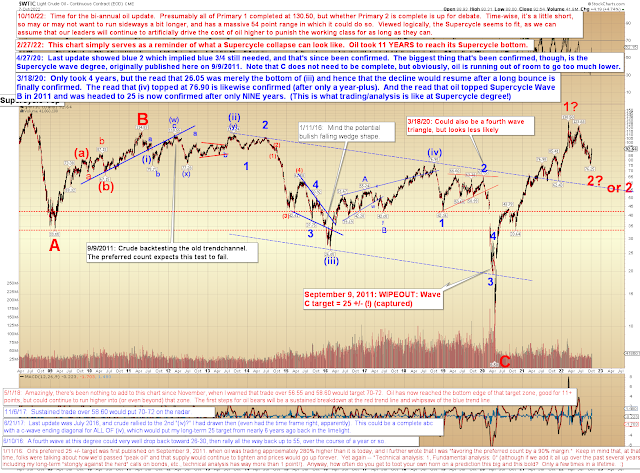

Finally, this seemed like as good a time as any to update the 11+ year-old legacy oil chart. It's possible that ALL OF 2 down is complete, but the last wave of the decline is far from clear, so it likewise wouldn't be too shocking to see 2-down stretch a bit farther.

In conclusion, by all rights, SPX looks like it probably needs to run lower still (after some small fourth waves), but this is a near-term inflection zone nested within a larger inflection zone, so that makes this a tougher call. Trade safe.

No comments:

Post a Comment