- It's a bit deeper than would be expected from a standard c-wave

- It's a bit shallow for a standard third wave

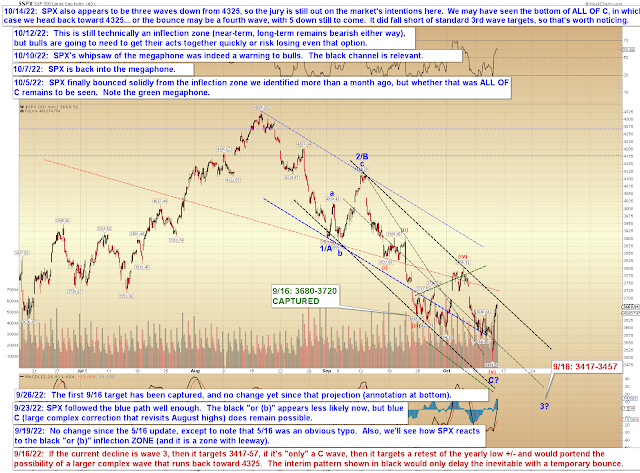

The bounce effectively came from smack between the c-wave and third wave target zones. What does that indicate? Well, if it's the c-wave, it may simply indicate the magnitude of long-term selling pressure (note that this will not stop this bounce from now turning into a vicious rally). If it's a third wave, then it probably isn't done yet. It's a bit early to say, but the charts below will help outline some zones to watch, starting with BKX:

SPX also seems to show three waves down, though it's much less clear on SPX:

Finally, the simple trend line chart helps identify the next overhead resistance zones:

In conclusion, if SPX clears resistance, I do not believe bears should be quick to short this rally until it becomes a bit more clear what the market wants to do here. If that was the bottom of the C-wave inflection we've been discussing, then the forthcoming rally is going to be so fast and brutal that it will fool many people into declaring the bear market to be "over" (it will not be over, though). It will also rally hundreds of SPX points, and nobody wants to endure that sort of drawdown, or endure the "death by a thousand cuts" of shorting/stopping out, shorting/stopping out. I recommend awaiting an impulsive decline to at least mark a zone to short against (not trading advice).

So the bottom line is, it's too early to say if this is just a short-lived dead cat bounce or the start of the larger C-wave rally -- but both options are very much on the table, so it's wise not to get tunnel vision. Trade safe.

No comments:

Post a Comment