Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Monday, October 31, 2022

SPX Update: "Not a Fourth Wave" Confirmed

Friday, October 28, 2022

SPX and TLT: Last Monday's Update Absolutely Nailed TLT

Last update noted that COMPQ had reached intermediate resistance and that SPX had captured its next upside target, and that this could generate a reaction, which would most likely be a fourth wave. We've had the anticipated reaction, now we find out if it is indeed a fourth wave. No change to the chart below (the annotation is from 10/26), but I did add a bit more detail to the (seemingly most likely) micro wave count. Note that gray iv has some room to play around a bit if it wants:

Next, let's take a look at Monday's if/then price projection, which has played out pretty well so far:

Also, let's revisit COMPQ, which is probably responsible for the market's hesitation here:

The caveat regarding the potential micro fourth wave and how it contrasts with COMPQ is that this is intermediate resistance, so as I warned in the last update, bulls probably shouldn't get complacent just yet.

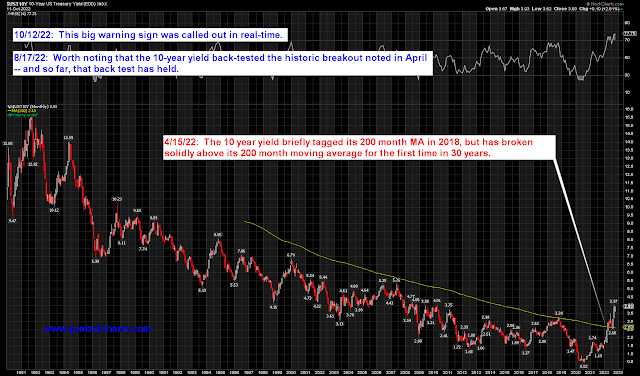

And last, a quick follow up: On Monday, for TLT, I issued the first warning I've given to bears in a long time, writing:

Finally, TLT is firmly into its target zone now, so I'm going to give my first warning for "bear caution" since I published this target back in April. As of yet, there's nothing even vaguely bullish in the chart, but my gut has started saying: "be careful, bears" -- for whatever that's worth.

That turned out to be the exact bottom, and TLT proceeded to launch the largest bounce it's had in 3 months (so far):

In conclusion, by all rights, SPX probably does still need another wave up, but we still have to remain cognizant that this is an intermediate resistance zone, because off-beat patterns do show up every now and then to keep us on our toes. As long as SPX holds above 3762, nothing gets too complicated yet. Trade safe.

Wednesday, October 26, 2022

SPX Update: Resistance vs. "The Usual Outcome"

I've outlined a couple options above -- both of them point higher for now. As I noted, bears' remaining near-term hope would be for an ending diagonal (or a b-wave high that runs down to Friday's low, but then runs back up to today's high), but even a diagonal would need to run higher before it ends.

Today, we're going to keep it simple, and just focus on the near-term uptrend line for now:

For the past few updates, I've presented the bull case, so let's take a quick look at the bear hope... but again, referring back to the "keep it simple" approach above, bears need to break the near-term uptrend in order to gain much traction. So while tagging this overhead resistance line (chart below) isn't reason in itself to be bearish, it is at least reason for bulls not to get too exuberant just yet:

In conclusion, last update opined that the market needed to run higher, and it did... and near-term, this pattern would normally need to continue to unwind higher (assuming it isn't something weird, such as a WXY, which one can never rule out). That said, COMPQ has reached a potential intermediate resistance zone, so the market may react to that -- and SPX did capture its old 3/c target. This is a moment where one might want to take a more cautious stance if already long, if nothing else. If one is inclined more bearishly, then this is an area to watch closely. Trade safe.

Monday, October 24, 2022

SPX Update: More Cause for Bear Caution

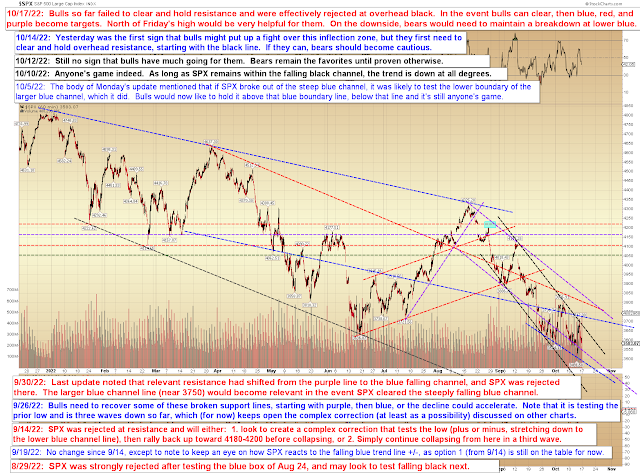

These can be terminal patterns, in which case a bounce may be imminent, but they can also be nesting patterns -- so while a minor break and whipsaw of the lower line would be perfectly fine, bulls should be cautious if there's a sustained breakdown at lower black.

Friday, October 21, 2022

SPX and TLT: TLT Captures April's Downside Target

Wednesday, October 19, 2022

SPX Update: Still Important

Monday, October 17, 2022

SPX Update: Longest Inflection Zone Ever

Friday, October 14, 2022

SPX and BKX: Careful Out There...

- It's a bit deeper than would be expected from a standard c-wave

- It's a bit shallow for a standard third wave

Wednesday, October 12, 2022

SPX Update: They Shoot Markets, Don't They?

Monday, October 10, 2022

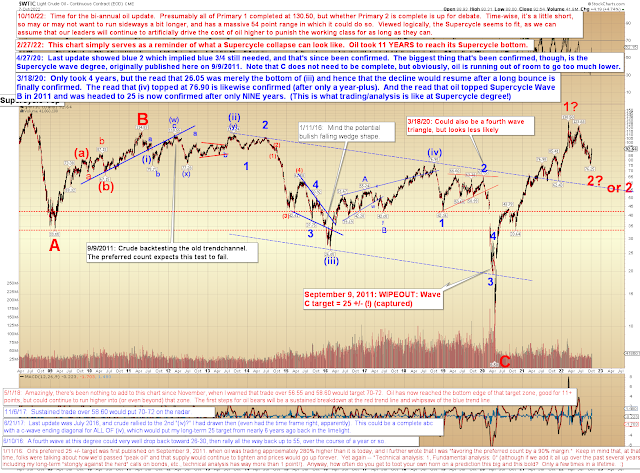

SPX and Oil Updates

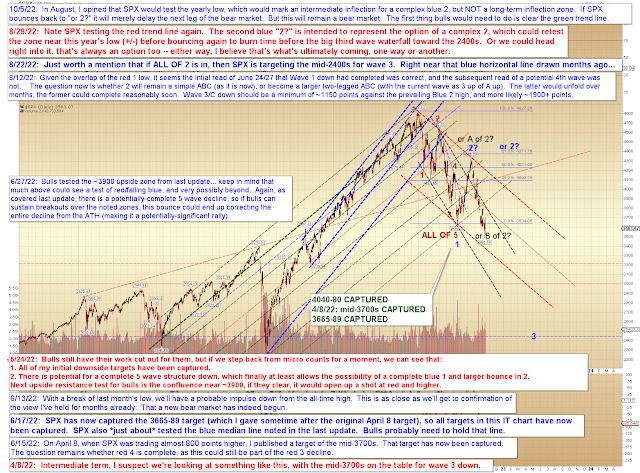

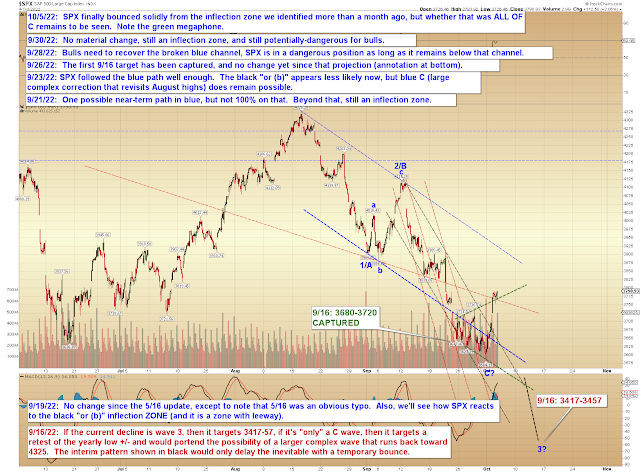

On October 5, I wrote:

[Y]esterday's violent rally could be the start of the complex blue 2 on the final chart, but I'd caution against reading too much into a "one day rally." Bulls will need to see some follow-through before getting their hopes up too much.

And last update concluded:

So far, bulls have not proven they have even the near-term ball, and it is still possible that this is all part of an intermediate bear wave.

Both of those warnings proved to be useful, and Friday's market dropped precipitously. So far, the decline from last week's high appears to be three waves, so it's in the ballpark of a near-term inflection zone, but could simply be an incomplete impulse wave (which would mean more downside to come after some small fourth wave corrective rallies).

Friday, October 7, 2022

SPX Update

Last update concluded:

[Y]esterday's violent rally could be the start of the complex blue 2 on the final chart, but I'd caution against reading too much into a "one day rally." Bulls will need to see some follow-through before getting their hopes up too much.

So far, there has been no follow-through. To the contrary, there's been a whipsaw back into the megaphone:

Same with the lower blue channel boundary:

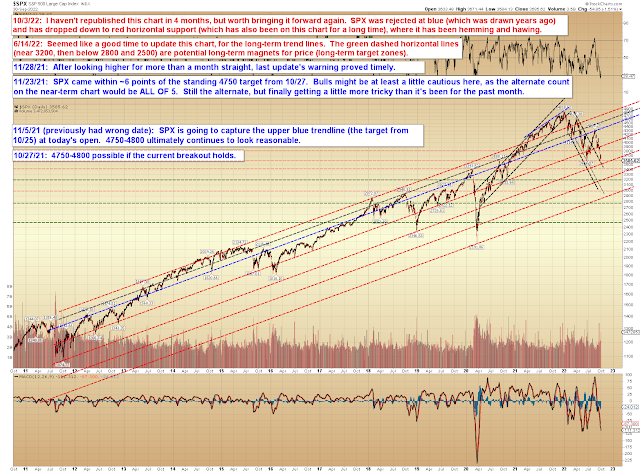

And, big picture, bulls have not hurdled the key trend line yet:

In conclusion, no real change from last update: So far, bulls have not proven they have even the near-term ball, and it is still possible that this is all part of an intermediate bear wave. Regarding the "even bigger picture," it is my belief that this is still a bear market no matter what happens here. Trade safe.