[T]he Fed's goal is to achieve, essentially, a "negative wealth effect." Which means asset prices must fall. To the Fed's current mindset, the fall of asset prices is a feature, not a bug. The Fed is not worried with the S&P below 4000 -- the Fed wants the S&P below 4000. To achieve its goals in this environment, it needs SPX below 4000. And well below 4000.

QE and government "stimulus" spending created runaway inflation; to reverse inflation, the Fed must reverse the effects of QE and government spending. The Fed needs demand to weaken and supply to increase, and in order to do that, the Fed must drain the excess liquidity that was poured into the market and the economy.

Put simply: The Fed needs to destroy wealth to tame inflation. And, more importantly, it seems committed to that goal.

Some bulls have argued that we won't see a recession because household and business balance sheets remain strong. But bulls are stopping their analysis too soon and aren't taking this to its logical conclusion: The Fed cannot tame demand if balance sheets remain strong. Which means that in order to achieve its goals, the Fed needs balance sheets to become weak, so destroying balance sheets becomes part of the plan. "Balance sheets remain strong" is thus not an argument that "there will be no recession," it is instead an argument the Fed will continue pushing the market down.By all current appearances, it seems the Fed only reaches its goals by continuing to feed volatility and destroying wealth until the economy is in recession. Thus, the Fed is not going to reverse course when the economy starts to struggle (unless inflation has abated), because they currently view a struggling economy as necessary to tame inflation. And the Fed won't bail the market out as it heads lower, because the Fed wants the market lower.Needless to say, this is not the same environment the market faced during the 13+ year bull; it is the complete inverse. Bulls have not yet come to terms with this new reality. Just as many bears struggled back in 2012 and 2013 with accepting the reality that Bernanke's Fed was committed to reflating every bubble it could, bulls will now suffer the same fate, in reverse. With every dip, they will assume the Fed is waiting just around the corner to again bail the market out. And why wouldn't they assume that? After all, that's what happened for the past 13 years.But the Fed will not bail the market out. Not this time. At least not yet.

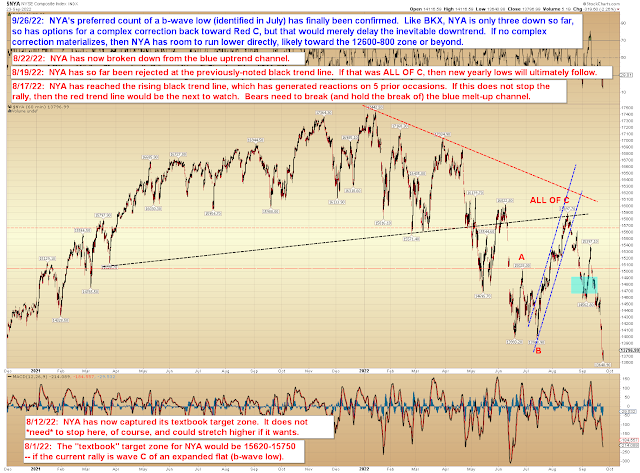

In conclusion, July's chart analysis has finally been confirmed, and May's broader environmental analysis is finally becoming apparent to everyone. The market is now in a position where it has to choose whether it wants to drag out the inevitable a bit longer with a more complex correction, or if it wants to simply continue declining rather directly. In both cases, we are, in my estimation, nowhere near the end of this bear market, and things will get a lot worse before they get better. Trade safe.

No comments:

Post a Comment